IFC - PMAESA

advertisement

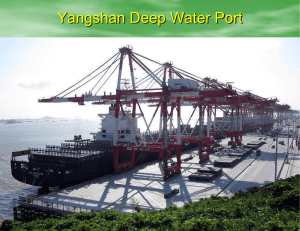

African Ports and Maritime Conference – IFC Port Presentation •November 28-30, 2011 •Méhita F. Sylla •IFC Infrastructure Advisory Services Agenda Overview of IFC’s Advisory Services Private Sector Participation in the Port Sector IFC Approach to PPP Transactions IFC Experience in Port Transactions 2 IFC is a Member of the World Bank Group •Role: •Clients: •Products: •IBRD •IDA •IFC •MIGA •International Bank for Reconstruction and Development •International Development •International Finance Corporation •Multilateral Investment and Guarantee Agency •Association •Est. 1945 •Est. 1960 •To promote institutional, legal and regulatory reform •To promote institutional, legal and regulatory reform •Governments of member countries with per capita income between $1,025 and $6,055. •Governments of poorest countries with per capita income of less than $1,025 •- Technical assistance •- Technical assistance •- Loans •- Interest Free Loans •- Long-term Loans •- Policy Advice •- Policy Advice •- Risk Management •Est. 1988 •Est. 1956 •To promote private sector development •Private companies and Governments in 179 member countries •- Equity / Quasi-Equity •To reduce political investment risk •Foreign investors in member countries •- Political Risk Insurance •- Advisory Services •Shared Mission: To Promote Economic Development and Reduce Poverty 3 IFC’s Role Advisory Services and Financing IFC also provides advice to governments and businesses Enterprise Assistance Advisory services to governments and businesses Public-Private Partnerships Environment & Business World’s largest multilateral provider Social Sustainability Environment of financing for private enterprises $38+ billion in investment commitments Access to Finance IFC’s Infrastructure Advisory Services • Public-Private Partnerships (PPPs) IFC helps governments to increase the quality and availability of public services and infrastructure using the PPP model IFC has global experience in PPPs for transport (roads, airports, rail, ports, etc.), water and sanitation, health and education, power, mining, and many other areas • Governments rely on IFC to structure PPPs that cost-effectively meet public needs with well-qualified private partners. • Private partners trust IFC to construct a balanced and bankable project Successful Mandates in Africa Benin Port Cameroon: power Kenya Airways Kenya Safaricom Kenya Telecoms Kenya Uganda Railways Lesotho Hospital Madagascar Tamatave Port Mauritania Telecoms Mozambique Moatize South African National Parks Sierra Leone Hotel Uganda Telecom Agenda Overview of IFC’s Advisory Services Private Sector Participation in the Port Sector IFC Approach to PPP Transactions IFC Experience in Port Transactions 6 Private Sector Participation Overview • Key factors defining type of private participation include: • Port Ownership • Role of Port Authorities • Relationship between the public and private sectors and their respective roles • Most port “privatizations” have tended towards transferring selected port services and/or assets to private or mixed economy companies by means of restrictive leasing, licensing or concessionary contracts. 7 Role of Port Authority after PSP – retains abilities to control property rights, planning & efficiency • A modern Port Authority, acting in close cooperation with private sector companies, typically concentrates its efforts on the efficient performance of a number of fundamental functions, including: • Landlord and performance monitoring function • Policy-making, planning and development function • Traffic control, regulatory and surveillance function • Marketing, public relations and promotion function • Governments (and port authorities) also retain the responsibility for formulating a policy and/or regulatory reform agenda to serve as an effective basis for private sector involvement, which have often included difficult and transforming legislative, institutional and procedural changes. 8 Governments benefit from Private Sector Participation • Potential for new revenue streams for governments • Access to private sector financing freeing Government budgets for social sectors • Introduction of Experienced Management and International Trade Benefits • Higher Efficiency through the involvement of the private sector • Platform for Government Trade Strategies: Establishing a supportive environment and platform for an export-focused economy, and lowering the artificial costs of imported raw materials. 9 Agenda Overview of IFC’s Advisory Services Private Sector Participation in the Port Sector IFC Approach to PPP Transactions IFC Experience in Port Transactions 10 Full package of advisory services Development of Privatisation Strategy Define Project Scope Project Coordination Implementation & Closure of Strat. Inv. Market Opportunity Lead Advisor Develop Structuring Plan st ecialiEnvironmental, sp Tech, aLegal, Financial & Regulatory Review Financial Analysis Develop Strategic Options 11 OurApproach Phase I: Preparation Step 1 Mandate Design Mandate TORs Work Plan Trust Funds Consultants Kick-off Scope Phase II: Implementation Step 2 Step 3 Diagnostic Enabling Reforms Legal (new laws) Regulatory (agency) Fiscal reforms Triage Retrenchment Inst. Reinforcement Communication Financing Legal due diligence Technical diagnosis Market conditions Demand projections Capital investment Regulatory framework Potential investors Strategic options Options Framework 12 Step 4 Transaction Pre-qualification Info Memo Data Room Due diligence Draft Contracts Negotiations Call for tender Award Closing Transaction Agenda Overview of IFC’s Advisory Services Private Sector Participation in the Port Sector IFC Approach to PPP Transactions IFC Experience in Port Transactions 13 Case Study # 1 Concession of a Container Terminal Port of toamasina, Madagascar 14 Toamasina – Map and Location 15 Transaction Structure (Cont’d) • Expected returns to Madagascar over the 20 years of the concession: efficiency gains, international best practices, investments • Estimated financial returns to Madagascar: US$ 300 million in investments and concession fees. • Tariff reduction: 20% (handling) and 10% for reception & delivery • Obligation to keep 350 employees for 5 years • Operator’s Obligations backed up by Performance Bond over the lifetime of the concession • June 2005: ICTSI Wins Madagascar Port Bidding • October 2005: Contract signing ceremony • Upfront payment (including asset acquisition): €10 million • US$36 million invested in container handling equipment 16 Toamasina – After Concession 17 Case Study #2 Concession of a Container Terminal Port of Cotonou, Benin 18 Port of Cotonou - Benin • Benin located to west of Nigeria. • Small seacoast but road links to landlocked Mali, Niger, Burkina Faso • Current throughput of 300,000 teu /6.05 million tons. 19 Port of Cotonou – PPP Timetable • Nov 4, 2008 - IFC signed mandate with Government of Benin US$169 million grant by US Millennium Challenge Corp for port infrastructure required private operator for container terminal MCC grant included 550 meter wharf for 540,000 teu container terminal • Nov 2008 - May 2009 - Market & technical studies, concession design • May- June-July 2009 – Prequalification- Bid Preparation. Bid criteria published: Highest NPV for upfront payment and guaranteed annual throughput charges. • August 2009 - Groupement Bollere awarded 25-year concession. • September 2009 - Concession contract signed. Terms included: Upfront payment of US$33 million, $29/teu throughput charge Investments first 5 years: US$42 million civil works/US$70 million equipment Minimum volume guarantees (400,304 Year 1 to 723,056 Year 8) Minimal tariff regulation. Flexible labor policies. Government obligation to deepen and dredge channel 20 IFC Infrastructure Advisory Services – Port Projects Completed mandates On Going Mandates and • 2009- Cotonou Port • 2011- Nouakchott PortMauritania • 2008 – Durres Port - Albania • 2006- Toasmasina Port Madagascar • 2010- Vinzhijam Port, kerala – India • 2008- Port Louis- Ile Maurice • Potential mandates • Bulk Terminal- India • 2001 – Suape Port - Brazil • Bar Port- Montenegro • Central America - 2 Ports • Caribbean 21 TO CONTACT US: •Afrique Sub-Saharienne 14 Fricker Road Illovo 2196 Johannesburg South Africa Tel: (27-11) 731-3000 Fax: (27-11) 325-0582 •Siège 2121 Pennsylvania Avenue, N.W. Washington, D.C. 20433 USA Tel: (202) 473-3800 Fax: (202) 974-4384 •Emmanuel Nyirinkindi Manager Sub-Saharan Africa, Telephone: (27) 11 731 3068 E-mail: ENyirinkindi@ifc.org •Méhita Sylla Fanny Senior Investment Officer Telephone: (27) 11 731 3180 E-mail: msylla@ifc.org •Ramatou Magagi Senior Investment Officer Telephone: +1 202 473 3954 E-mail: rmagagi@ifc.org THANK YOU!!!