GOVT.ACCOUNTS

advertisement

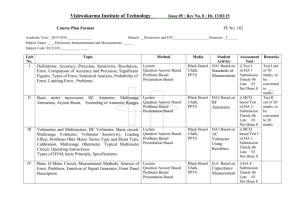

Welcome To The Session of the workshop On ‘Role of DDOs & TOs in maintenance of Govt. Accounts’. Time: 10.00 AM to 11.00 AM Dated 20th January’2015 GOVT.ACCOUNTS TOPICS: TIMELY SUBMISSION OF ACCOUNT DEFECTIVE ACCOUNTS DIFFERENCE IN CASH BALANCE VERFICATION & RECONCILIATION UTILISATION CERTIFICATE AGAINST GIA DETATAILED CONTINGENT CHARGES(DCC) TREATMENTS IN TREASURY, PW & FOREST ACCOUNTS TIMELY SUBMISSION OF ACCOUNTS TREASURIES WORKS DEPARTMENTS FOREST DEPARTMENT COUNCIL ACCOUNTS UNDER SIX SCHEDULE AREAS ACCOUNTANT GENERAL BY 10th OF THE FOLLOWING MONTH TO WHICH THE ACCOUNTS RELATES TIMELY SUBMISSION OF ACCOUNTS The monthly accounts from ARUs should invariably reach the AG within 10th of the following month of the accounts to which it relates. Timely submission of accounts enables the PAG to submit Monthly Civil Accounts to the state in time i.e. within 25th of the following month of the accounts to which it relates covering all the transactions made effecting RBI account of the state. MEASURES FOR TIMELY SUBMISSION OF ACCOUNTS ARUs should maintain target date Repetition of work should be avoided. Pending of work should be avoided. Entry in payment & receipt schedules should be as per cash book. Payee’s signature on the body of the bill should be obtained beforehand. Payment certificate on the body of the voucher should be timely ensured. Consolidation of all Head wise transactions should be completed on or before 5th of the following month to which accounts relate. DEFECTIVE ACCOUNTS Misclassification causes artificial Excess/Saving Diversion of fund to ‘8443-101-R.D’. or to another scheme/work is irregular. Excess over allotment should be avoided. Payment without obtaining Financial sanction should not be made. Transfer of fund to DDO’s Bank Account is not permissible. Prescribed form of bill should be used. Mis-booking in accounts. Difference in cash balance Reconciliation of cash balance VERFICATION & RECONCILIATION DDO’s verification & reconciliation with treasury. DDO’s Reconciled Receipt & Expenditure Statement CCO/CO’s DDO-wise Receipt & Expenditure Broadsheet against FOC/Budget Allotment Verification & Reconciliation Statement up to detail head with columns 1) H/A up to detail 2) Departmental figure as per BS 3)AG’s figure 4) Difference 5)Remark with proposal for TE UTILISATION CERTIFICATE AGAINST GIA GIA against scheme/project • Implementing agencies should ensure. Timely payment of bills. Timely submission of accounts to payer. Timely Audit of the account. Return of surplus DCC BILLS AGAINST AC BILLS Submission of DCC bill within one month from the date of drawl of AC bill Certificate of submission of DCC bill on next A.C. bill drawn with supporting document Refund of unspent AC bill amount Sub-vouchers with DCC bill Reference of AC bill with TV No., Date & Amount of bill in DCC bill submitted. TREASURY ACCOUNT: UNCOMPILED ACCOUNT: CHALLAN VOUCHERS LOP VDMS PLUS-MINUS OF DEPOSIT WORKS ACCOUNT: MONTHLY ACCOUNTS CLASSIFIED ABSTRACT SCHEDULE OF REVENUE RECEIPT SCHEDULE OF CREDIT TO REMITTANCE SCHEDULE OF DEBIT TO REMITTANCE STOCK ACCOUNT SCHEDULE OF MPWA SCHEDULE OF DEPOSIT WORKS ACCOUNT: SCHEDULE OF WORK EXPENDITURE SCHEDULE OF DEPOSIT WORK EXPENDITURE SCHEDULE DOCKET FOR PERCENTAGE RECOVERY SCHEDULE DOCKET FOR WORK EXPENDITURE WORK & SUPPLY VOUCHERS CHALLANS FOR DEPOSIT & REMITTANCE TRANSFER ENTRY & HAND RECEIPT