Credit Management Overview

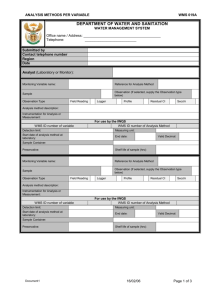

advertisement

Credit Management Overview of Current Settings What we will cover…… Credit Control Areas Sales Documents Delivery Documents Item Categories Processes Risk Category Definitions Risk Category Settings Immediate Recommendations 2 Credit Control Areas F/S = Sales Areas: 1000/20/10 Fender Squier Sales (Domestic, National Accts., Canada) 1000/20/12 1000/20/13 1020/20/10 1030/20/13 Pro Audio Sales Customer Service (parts) International Sales FMI Wholesale (SPA) SPEC = Sales Area: 1000/20/11 Specialty Sales Sales Documents in Production Not Checked: IN Inquiry QT Quotation AS Service Quotation CR Credit Memo Request KA Samples Pick-up (rtn from DSM) KB Samples Fill-up (to DSM) RAS Repairs / Service RE Return Authorization ZDF Replacement Order ZDS Drop Ship Order ZEXP Expense Type Order ZRE Return Authorization ZWAR Warranty Replacement ZWCR Warr. Credit Request Checked: BV Cash Sale KE Samples Issue KR Samples Returns DR Debit Memo Request PV Item Proposal RK Invoice Correct. Req SO Rush Order OR Standard Order TAV Standard Order (VMI) Delivery Documents in Production Not Checked: BV Cash Sale EL Inbound Deliv. LR Returns Deliv. ZF Outbound NCC Checked: DIG Inbound deliv. Gds mvmnt DOG Outb. Deliv.gds mvmnt DTR Central Posting Change EG Rough GR HID Inbnd dlv. HU mvmnt HOD Outb. Deliv. GI mvmnt HTP Deliv. For post. chge JF Outbound delivery IN LB Delivery for subcon. LD Outbound del. decentr LF Outbound Delivery LFKO Correction Delivery LO Delivery w/o Ref. LP Delivery from proj. NCR Ret. StTranspOrd CC NK Replen.Del.Consignmt NKR Replen.Ret.Consignmt NL Replenishment Dlv. NLCC Replen. Cross-company NLR Ret.stock Trans. ord RL Returns (pur.ord) RLL Return del. to vendor UL Del. for stock trans. WID WMS Inbound Delivery WIG Other WMS Inb. Dely WMPP WM-PP delivery WNL Replenishment WMS WOD WMS Outbound Dely WOG Other WMS Outb. Dely WRD Cust. Returns WMS WTR Decentr. Pstng chnge Item Categories in Production Not Checked: BVN-Cash sales G2N-Credit Request G2W-Warranty Claim Labor REN-Standard Item TAC-Config.at Mat.Level Z2N-Request ZG2N-Warranty Rqst -parts ZG2W-Warranty Rqst labor Checked: All Others Processes Sales orders perform a dynamic credit checked at time of entry. A nightly batch job will re-check all credit blocked sales orders and update the status appropriately. A second nightly batch job will check sales orders that fall within the credit horizon. Risk Category Definitions A - Document Controlling B – Released documents are still unchecked if order value changes by 10% a new check is carried out if an order is changed and it has been 10 days since the last credit check, a new check is performed. C – Credit Limit Seasonal Factor special routine; 901 = Order with Credit Card, 902 = Delivery with Credit Card Percentage allowed to exceed the established credit limit. D – Checks in financial accounting/old A/R summary Check current payer – not all payers assigned to the sold to customer. A B C D Risk Category Definitions E – Checks – (active only if checked) Static - Takes into account open order and/or delivery/billing document values. Dynamic – Takes into account only open or partially shipped sales order documents if relevant for shipping within the horizon. The system ignores all open orders that are due for delivery beyond the horizon specified. Current setting is 1 Day. Document Value - Indicates that the system carries out a credit check based on a maximum document value. The sales order or delivery value may not exceed the maximum value that you specify in the adjacent field. Critical Fields - The indicator controls the critical field check. If the field is selected, the system checks whether critical fields have been changed. Next Review Date - Indicates whether the system carries out a credit check based on the date of the next credit review. E Risk Category Definitions E – Checks – (active only if checked) Open Items - Specifies whether the system carries out a credit check based on open items. This type of credit check works in conjunction with two values that you specify in the adjacent fields: Maximum % of overdue items in open items Number of days which the open items are overdue Oldest Open Item - Indicates whether the system carries out a credit check based on the age of the oldest open item. The oldest open item must not be older than the number of days specified. High Dunn Level - Indicates whether the system carries out a credit check based on the highest dunning level. User 1, 2 and 3 - This field is inactive in the standard system, but can be used for a credit check you define yourself. E Risk Category Settings Risk Category Settings Immediate Recommendations: Turn on Static check for deliveries only - they are not included as part of the Dynamic check. Increase Dynamic check horizon to more than 1 day.