Document

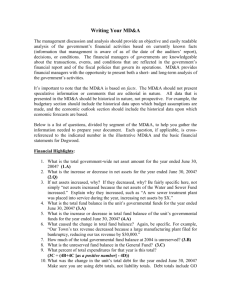

advertisement

AGA Montgomery Chapter CGFM Exam Review Presented By Steven H. Emerson, CPA, CGFM, CGAP, CFE, CITP Added a new level of reporting for state and local governments – the government-wide level. The previous model focused on funds. The government-wide level does not focus on funds – the focus is on the activities of the government – governmental and business-type. Established an additional reporting requirement – management’s discussion and analysis (MD&A) The major impact of GASB Statement 34 is the requirement for reporting about the government as an economic entity. There was no presentation that focused on the government as a whole in the previous reporting model. The focus was on funds. The total column on the Combined Balance Sheet titled “Memorandum Only” cautioned users that the numbers may not be useful for financial reporting. Two reasons for this caution were: The measurement focus and basis of accounting was not the same for all fund types. There were no interfund eliminations. Even GAAP operating statements that used the same measurement focus and basis of accounting, had the “Memorandum Only” caption because there were no interfund eliminations. The central focus of the government-wide statements is the primary government. They are not fund based. Government-wide statements distinguish between governmental activities and business-type activities. Governmental Activities Activities primarily associated with governmental funds Business-Type Activities Primarily associated with enterprise funds Internal Service funds are generally included with governmental activities, but with substantial eliminations for interfund activities. Virtually all interfund transactions are eliminated, thus providing a complete picture of the government as a whole. Discrete component units are presented separately to complete the financial picture of the reporting entity. A total for the primary government is required. A total for the reporting entity including the component units is optional. Fiduciary funds are not presented in the governmentwide statements. As stated earlier, internal service funds are usually reported with governmental activities, however if the primary customers of the internal service funds are enterprise funds, then they would be reported with business-type activities. The change in net assets for internal service funds is eliminated so that the funds “break even” for the fiscal year. The two required statements for government-wide reporting are the statement of net assets and the statement of activities. Presented before the basic financial statements Required Supplementary Information (RSI) Easily readable analysis of the financial activities of the government Discuss current year compared with the prior year Distinguish between the primary government and its component units Primary emphasis is the primary government Brief discussion of the basic financial statements, how the government-wide statements are related and how they are different from the fund-level financial statements Condensed financial information with comparisons to the prior year. The following elements should be included: Capital assets, other assets and total assets Long-term, other and total liabilities Total net assets, distinguished by its components Program revenues by major source General revenues by major source Total revenues Program expenses by function Total expenses Results of operation before contribution, special & extraordinary items Contributions to capital Special and extraordinary items Transfers Change in net assets Ending net assets Practical Example: State of Alabama Comprehensive Annual Financial Report For the Fiscal Year Ended September 30, 2010 Government-Wide Financial Statements are prepared using the economic resources measurement focus and the accrual basis of accounting Business-type activities require no adjustments since enterprise funds use the same MFBA as the businesstype activities Governmental activities require adjustments from the current financial resources measurement focus and modified accrual basis of accounting used by governmental funds to the Government- Wide MFBA (see examples in the text) The first of the two required government-wide statements Assets – Liabilities = Net Assets The traditional balance sheet may be used instead Net Assets instead of Fund Balances or Equity Assets and Liabilities should be presented in order of their relative liquidty The classified statement of net assets may be used – i.e. City/County of San Francisco 2006 and 2010 CAFRs Net assets should be displayed in three components Invested in capital assets, net of related debt Only debt attributable to the acquisition, construction or improvement of the capital assets Unspent proceeds should not be included Restricted net assets (Restricted assets used in the text) Constraints placed on net asset use, either externally imposed by creditors, grantors, contributors, or laws or regulations of other governments or imposed by law through enabling legislation or constitutions Unrestricted net assets (Unrestricted assets used in the text) All other net assets Format Prepared using a columnar format Assets, liabilities and net assets of the primary government are reported in two columns – governmental activities and business-type activities A total column for the primary government should be presented A final column is for discretely presented component units if present A total column for the reporting entity is optional Comparative data for the prior year is also optional Modified approach for Infrastructure In lieu of depreciation for infrastructure, conditional assessments can be made on the ongoing maintenance of the infrastructure assets. Certain requirements need to be met such as keeping and up to date inventory of the infrastructure, condition assessments using a measurement scale and the conditional level at which the infrastructure is to be kept must be disclosed. Failure by a government to meet the modified approach requirements would require depreciation on the infrastructure to be reported. Practical Examples: State of Alabama 2010 CAFR City/County of San Francisco, CA 2006 CAFR City of Cape Canaveral, FL 2010 CAFR Town of Priceville, AL 2010 Audit Report Net cost format To identify the extent to which a particular function requires financial support from the taxpayers Which revenues are program revenues Which revenues are general revenues To determine the operating results for the fiscal year including the economic cost and net cost of services Governmental activities should be detailed by function at the same level used for the fund financial statements All expenses are to be reported by function Indirect expenses are not required to be allocated to the functions If a government allocates the indirect expenses they may do so in a separate column The separate column is necessary to enhance comparability among governments Depreciation expenses specifically identified with a function should be included in direct expenses of the function If a separate line is used for shared capital assets, it should clearly indicate that it excludes direct depreciation of the various functions Interest on long-term liabilities should be considered an indirect expense and reported as a separate line Interest that can be attributed to a function should be reported as an expense of that function Business-type activities are presented for each significant enterprise Component units are displayed for major component units, with minor component units totaled Revenues Program revenues are reported in three categories Charges for services Exchange or exchange-like transactions Licenses and permits Assessments for street cleaning Water and sewer fees Refuse collection fees Recreation fees Fines and forfeitures Program-specific operating grants and contributions Program-specific capital grants and contributions Entire grant needs to be restricted for capital purposes A grant that allows spending for operating and capital would be reported as an operating grant Revenues – continued General revenues All other revenues All taxes are reported as general revenues Unrestricted grants and earnings from investments Gain and loss from sale of assets Special and extraordinary items Special items – significant transactions or events within the control of management and are either unusual in nature or infrequent in occurrence Reported separately after general revenues Sale of a major capital asset Settlement of a major lawsuit Special and extraordinary items – continued Extraordinary items – transactions that are both unusual in nature and infrequent in occurrence Reported separately after special items Damage from a tornado or hurricane A “near special item” is either unusual in nature or infrequent in occurrence but not in the control of management Reported separately in the appropriate revenue or expense category or disclosed in the notes to the financial statements Alternate Reporting Formats Two-page approach Pages 7-208 and 7-209 in GASB Comprehensive Implementation Guide Displaying functions in columns Page 7-211 in GASB Comprehensive Implementation Guide Single-column format Page 7-214 in GASB Comprehensive Implementation Guide Combined fund and government-wide format Page 7-217 in GASB Comprehensive Implementation Guide Practical Examples: State of Alabama 2010 CAFR City/County of San Francisco, CA 2006 CAFR City of Cape Canaveral, FL 2010 CAFR Town of Priceville, AL 2010 Audit Report Interfund Receivables and Payables All interfund receivables and payables should be eliminated in the governmental and business-type activities column of the statement of net assets Due to/froms among governmental funds Due to/froms among enterprise funds Only residual amounts of interfund payables/receivables between governmental and business-type activities should be presented as internal balances Internal balances would be eliminated in the total column for the primary government Amounts due to or from fiduciary funds should be included as a receivable from or payable to an external party Charges for Services Charges levied for services by governmental activities or internal service funds to business-type activities should not be eliminated nor should charges by business-type activities to governmental activities Transfers Would be reported in the same manner as interfund payables and receivables Transfers among governmental activities or among enterprise activities are eliminated Only residual transfers between governmental and businesstype activities are reported on the statement of activities to net to zero Internal Service Funds Designed to break even. If net revenue is positive, the internal service fund overcharged. If negative, the internal service fund undercharged. The overcharge or undercharge should be charged or credited back to the functions that incurred the user charges Investment income or interest expense should be reclassified as governmental activities Blended component units are reported along with other activities of the government either as governmental or business-type activities Discretely presented component units are reported only at the government-wide level Major component units can be reported in one of three ways In a separate column of the statement of net assets and statement of activities Providing combining statements in the basic financial statements after the fund financial statements Presenting condensed financial statements in the notes to the financial statements State of Alabama 2010 CAFR http://comptroller.alabama.gov/pdfs/cafr.2010.pdf City/County of San Francisco, CA 2006 CAFR http://www.sfcontroller.org/ftp/uploadedfiles/controller/reports/CAFR/0 6/CAFR_2006.pdf City of Cape Canaveral, FL 2010 CAFR http://www.cityofcapecanaveral.org/vertical/Sites/%7BCEAB0943-1F374E48-833E-AFC3D9CA4058%7D/uploads/%7BA3264716-7E4F-4E599460-186AD559BD9D%7D.PDF Town of Priceville, AL 2010 Audit Report Email me at steve@shecpa.com