THE NEW BRAZIL

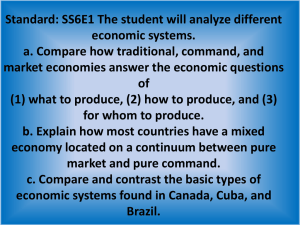

advertisement

THE NEW BRAZIL: ACHIEVEMENTS AND CHALLENGES Edmar Bacha Brazil Seminar. Columbia University September 10th, 2014 BRAZIL’S ACHIEVEMENTS SINCE MID 1990s • • • • • 2 Inflation stabilization Income gains of poor families Declining unemployment rates Lower real interest rates From external debtor to external creditor 8/21/2014 INFLATION BEFORE AND AFTER THE REAL PLAN, 1979-94 AND 1994-2009 3 8/21/2014 3 INCOME DISTRIBUTION IMPROVED AFTER STABILIZATION, 1995-2012 Cumulative Yearly 4 8/21/2014 UNEMPLOYMENT IS THE LOWEST IN THE SERIES, 2002-2014 5 8/21/2014 REAL INTEREST RATES ARE LOWER THAN IN THE PAST, 1996-2014 6 8/21/2014 BRAZIL: A NET CREDITOR TO ABROAD (GROSS AND NET EXTERNAL DEBT AS A RATIO TO EXPORTS, 1970-2014) 7 8/21/2014 STRUCTURAL CHALLENGES • • • • • • • • • 8 Low growth syndrome Unfavorable growth-inflation mix Too high prices Heavy tax burden Very expensive social security Low investment rate Insufficient infrastructure Poor education Closed economy 8/21/2014 LOW GDP GROWTH RATES SINCE THE EARLY 1980s 9 8/21/2014 INFLATION-GROWTH MIX IS UNFAVORABLE (2011-14*) 10 8/21/2014 THE MOST EXPENSIVE COUNTRY AMONG THE BRICS 11 8/21/2014 TAX BURDEN IS HEAVY (OECD AND EMERGING MARKETS, 2013) 12 8/21/2014 SOCIAL SECURITY IS A BIG PROBLEM (OECD data for 2005) 13 8/21/2014 INVESTMENT RATE IS LOW AND BNDES OFFERS LITTLE HELP 14 8/21/2014 INFRASTRUCTURE LAGS 15 8/21/2014 EDUCATIONAL LEVELS ARE POOR (PISA 2012 RANKINGS & GRADES, SELECTED COUNTRIES) 16 8/21/2014 ONE OF THE MOST CLOSED COUNTRIES IN THE WORLD • Big economies, big exporters: – US (1/2), China (2/1), Japan (3/5), Germany (4/3), France (5/6), UK (6/4) • Ratio imports/GDP Brazil: 13% – Lowest value among the 176 countries considered by the World Bank. • Brazil: 7th largest economy in the world, but only the 22nd largest exporter • Paradox: Brazil the 4th most preferred destination for foreign direct investment • Brazil’s GDP, 3.3% of world. Brazil’s exports, 1.3% of world. • Open capital account, closed current account: 17 8/21/2014 recipe for impoverishing growth CURRENT INDUSTRIAL POLICY: MORE PROTECTIONISM • Response to deindustrialization and external deficits: – Discriminatory manipulation of taxes and import tariffs – Overambitious local content policy – Indiscriminate Buy Brazilian act with 25% preference margin – Inadequate ‘national champions’ policy by BNDES Result is less competitiveness and lower productivity 18 8/21/2014 ALTERNATIVE INDUSTRIAL POLICY: INTEGRATION TO INTERNATIONAL PRODUCTIVE CHAINS Three Pillars 19 1 • Reduction of ‘Brazil cost’ (tax, bureaucracy, logistics) 2 • International trade agreements 3 • Replacing high tariffs by a more devalued exchange rate 8/21/2014 CONCLUSIONS Brazil has come a long a way since the mid-1990s But it needs more savings and investment, better education, and a reduction in the “Brazil cost” of doing business Opening up to the world would work as a catalyst for the adoption of the reforms that Brazil needs to raise its GDP growth rates 20 8/21/2014 THANK YOU 21 8/21/2014 SOURCES FOR THE SLIDES • • • • • • • • • • 22 S3: Miriam Leitão, Saga Brasileira: A Longa Luta de um Povo por sua Moeda. Record, 2011: 260261. S4: Secretaria de Assuntos Estratégicos (SAE). S5-S7: MacroEconomic Research Banco Itaú BBA. S9: Edmar Bacha and Regis Bonelli, “Accounting for the rise and fall of Brazil’s Post-WW-II GDP growth”, July 2012. Available at: www.iepecdg.com.br. Updated in July 2014 by Regis Bonelli. S10: The Economist. S11: IMF apud José Roberto Afonso and Kleber Castro. S12: Paulo Tafner and Fabio Giambiagi, “Previdência social: uma agenda de reformas”. PPT. October 2010. S13: Armando Castelar, ”Desempenho Recente e Perspectivas de Crescimento da Economia Brasileira”. Presentation to the Seminar: Whither Latin America? Rio de Janeiro: Vargas Foundation, August 9-10, 2012. Updated in July 2014 by Luísa de Azevedo Senra Soares. S14: World Economic Forum, apud Financial Times. S15: OECD, PISA. 8/21/2014