Industrial Metals Monitor Base metals prices are struggling

advertisement

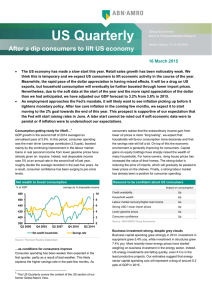

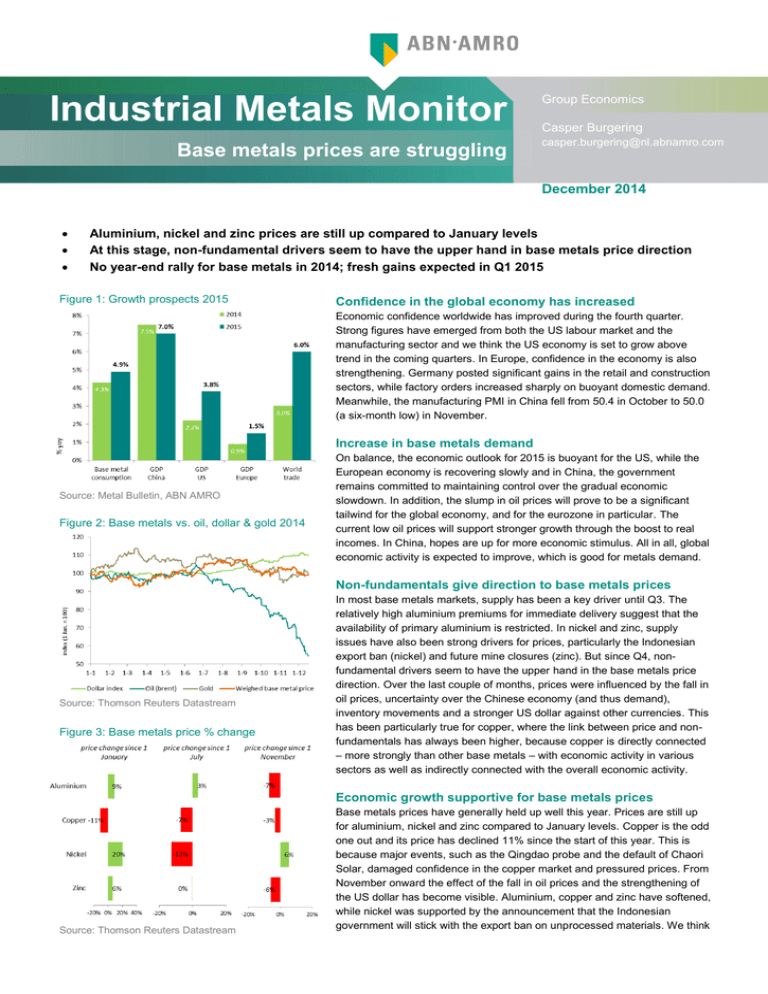

Industrial Metals Monitor Base metals prices are struggling Group Economics Casper Burgering casper.burgering@nl.abnamro.com December 2014 Aluminium, nickel and zinc prices are still up compared to January levels At this stage, non-fundamental drivers seem to have the upper hand in base metals price direction No year-end rally for base metals in 2014; fresh gains expected in Q1 2015 Figure 1: Growth prospects 2015 Confidence in the global economy has increased Economic confidence worldwide has improved during the fourth quarter. Strong figures have emerged from both the US labour market and the manufacturing sector and we think the US economy is set to grow above trend in the coming quarters. In Europe, confidence in the economy is also strengthening. Germany posted significant gains in the retail and construction sectors, while factory orders increased sharply on buoyant domestic demand. Meanwhile, the manufacturing PMI in China fell from 50.4 in October to 50.0 (a six-month low) in November. Increase in base metals demand Source: Metal Bulletin, ABN AMRO Figure 2: Base metals vs. oil, dollar & gold 2014 On balance, the economic outlook for 2015 is buoyant for the US, while the European economy is recovering slowly and in China, the government remains committed to maintaining control over the gradual economic slowdown. In addition, the slump in oil prices will prove to be a significant tailwind for the global economy, and for the eurozone in particular. The current low oil prices will support stronger growth through the boost to real incomes. In China, hopes are up for more economic stimulus. All in all, global economic activity is expected to improve, which is good for metals demand. Non-fundamentals give direction to base metals prices Source: Thomson Reuters Datastream Figure 3: Base metals price % change In most base metals markets, supply has been a key driver until Q3. The relatively high aluminium premiums for immediate delivery suggest that the availability of primary aluminium is restricted. In nickel and zinc, supply issues have also been strong drivers for prices, particularly the Indonesian export ban (nickel) and future mine closures (zinc). But since Q4, nonfundamental drivers seem to have the upper hand in the base metals price direction. Over the last couple of months, prices were influenced by the fall in oil prices, uncertainty over the Chinese economy (and thus demand), inventory movements and a stronger US dollar against other currencies. This has been particularly true for copper, where the link between price and nonfundamentals has always been higher, because copper is directly connected – more strongly than other base metals – with economic activity in various sectors as well as indirectly connected with the overall economic activity. Economic growth supportive for base metals prices Source: Thomson Reuters Datastream Base metals prices have generally held up well this year. Prices are still up for aluminium, nickel and zinc compared to January levels. Copper is the odd one out and its price has declined 11% since the start of this year. This is because major events, such as the Qingdao probe and the default of Chaori Solar, damaged confidence in the copper market and pressured prices. From November onward the effect of the fall in oil prices and the strengthening of the US dollar has become visible. Aluminium, copper and zinc have softened, while nickel was supported by the announcement that the Indonesian government will stick with the export ban on unprocessed materials. We think 2 Industrial Metals Monitor - Base metals prices are struggling - December 2014 Figure 4: Aluminium stocks remain relatively high most base metals prices will be able to finish this year with gains compared to 1 January, with the exception of copper. Still, we will have to be patient for a revival in base metal prices. Investor demand could remain relatively soft, which will have a dampening effect on prices. In 2015, we expect base metals prices to regain some strength during Q1 and to finish higher on a yearly basis, driven by increases in economic activity and metal demand. ‘Aluminium, aluminium everywhere, nor any lot to use…’ Source: Thomson Reuters Datastream Figure 5: Copper LME stocks plummeted Since our previous monitor (25 November), aluminium prices have decreased by 7%, in part due to the strong drop in oil prices. The prospect of lower energy prices in future could trigger a ramp-up of idled capacity in China, which will result in more Chinese aluminium material on the global markets. This was reason enough for investors to pull out. The aluminium stock level at LME warehouses has been in a downtrend since May 2014 and has already lost 19%. However, from an historic perspective, LME stocks are relatively high and have just arrived at the level of 2009. And because a major share of this material is locked up in financing deals, the physical availability of aluminium is limited. As a result, premiums in China and in the US are still high and increased in 2014 by more than 35% on average. Going forward, we expect aluminium prices to strengthen further on increased physical demand. But the capacity overhang will limit strong gains. ‘Dr. Copper & Mr. Slide…’ Source: Thomson Reuters Datastream Figure 6: Nickel LME stocks soar Currently, macro-economics are in the driving seat for copper prices, but from a long-term perspective, fundamentals (especially global demand for copper) will continuously play an important role in its price formation. For now, three major trends in particular are giving direction to the copper price: the oil price, the US dollar and inventory levels. Of all the base metals, copper is the only one that has decreased since the start of this year. From a fundamental perspective, however, the copper market looks fundamentally sound: LME stocks plummeted during 2014 and the surplus is very small, representing only 0.3% of consumption. According to the ICSG and Metal Bulletin for 2015, the copper market will continue to be in surplus, although this surplus will also be relatively small. If the macro economy develops according to plan, copper price should at least stay stable. At the moment the Chinese economy continuous to disappoint, prices will soften further. ‘A nickel for every time Indonesia is mentioned…’ Source: Thomson Reuters Datastream Figure 7: Zinc stocks in downtrend since 2013 The Indonesian export ban and the strong increases in LME stocks shaped nickel prices for most of 2014. The export ban was a particular game-changer and resulted in strong increases in Chinese imports ahead of the ban as well as higher prices. Nickel pig iron (NPI) producers bought substantial volumes of nickel ore (laterites) for stockpiling. A similar policy move by the Philippines is still a possibility and could immediately trigger a new price rally if rumours continue to increase. So far, buying activity in the nickel market has been generally cautious. However, reports show that NPI inventories in China are falling steadily, which suggests that buying activity could return when stocks are depleted. ‘Zinc: in surplus or not in surplus, that’s the question…’ Source: Thomson Reuters Datastream ILZSG expects that global demand for refined zinc will outpace supply in 2015. But other sources suggest that the balance in 2015 will be on the positive side. Whatever the outcome may be, the surplus or deficit is expected to be relatively limited. From a fundamental perspective, the zinc market is sound. So far this year, demand for zinc has been holding up relatively well in most parts of the world. And going forward, major end-use sectors in most regions will show increased activity, especially construction sectors. The outlook for the global automotive sector is also expected to remain positive. But China will remain the centre of gravity for the zinc market, with a 40%+ share of both supply and demand. 3 Industrial Metals Monitor - Base metals prices are struggling - December 2014 ABN AMRO Group Economics Casper Burgering Senior sector economist – Manufacturing Sector & Industrial Metals Phone: +31 20 383 26 93 casper.burgering@nl.abnamro.com All publications of ABN AMRO on macro-economics and sector developments can be found on: insights.abnamro.nl/en. Follow Group Economics on Twitter: https://twitter.com/sectoreconomen Disclaimer Last editing of this publication on 17 December 2014. Copyright 2014 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO"). This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on the energy market. The information in this document is strictly proprietary and is being supplied to you solely for your information. It may not (in whole or in part) be reproduced distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such information. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document after the date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks and any possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personal advisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee for future returns. ABN AMRO reserves the right to make amendments to this material.