Taxes 101 for Non-residents - Washington and Lee University

advertisement

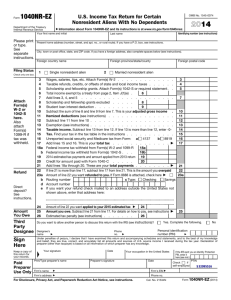

Taxes 101 for Non-residents • All J-1 and F-1 students are required to file some sort of tax form, whether you have earned any income or not. • International students - up to 5 years in the US • Research scholars or faculty in J-1 status – up to 2 years in US • File as a non-resident and use the non-resident tax software. • International students who have exceeded the number of days of presence in the US to qualify as a non-resident must file as a ‘resident’ and will not be able to use the non-resident tax program Glacier Tax Prep that we subscribe to. These individuals will need to use Turbotax or Taxact. US citizens may go to the Tax Clinic that the law students have during the tax season. * Federal tax returns are due April 15, 2015 and State tax returns are due May 1. If you are taking Spring Option or going on a spring term abroad program, make sure you complete and submit your tax forms BEFORE you leave!!!! Form 1040NR EZ • NR stands for ‘non-resident’ – format differs from regular 1040 tax return • Allows for tax treaties between different countries • Tax Computations different for nonresidents Form 8843 • ALL F-1 and J-1s, and their dependents, must file Form 8843 regardless of whether they have any income in the U.S. or are required to file a tax return. • When the program asks for you to give the name, address and telephone number of your academic institution and the name, address and telephone number of the director of your academic program. Actually, it is not as complicated as it looks. If you were a student at Washington & Lee University during 2013, here is what you would write for questions 9& 10: Address of Institution: Washington and Lee University 204 West Washington Street Lexington, VA 24450 Director of Academic Institution: Ken Ruscio President Washington and Lee University Lexington, VA 24450 Phone: 540-458-8700 • • • • • • • • State of Virginia tax forms • Students with less than $11,950 of income (including taxable financial aid) are not required to fill out a VA tax form. You will know once you complete the Federal tax return how much taxable income you have accumulated. • VA tax is not normally taken out of work/study or financial aid, so if you have crossed the above threshhold, you will likely owe VA taxes. Most students use the money they get back from Federal tax returns to pay for State taxes. • VA tax forms are due May 1, 2015. • The Lexington Commissioner of the Revenue at City Hall can help you complete these forms if you take them copies of your Federal tax return, W-2 and 1042-S. Make sure you keep a copy for your own records. Forms W-2 and 1042-S • The W-2 form I – employment earnings only. You will get one from each institution where you were employed. • Form 1042-S is used to report certain amounts paid to a non-resident regardless of whether the payment is taxable. The form has a number of purposes. It can be used to report wages exempt under a tax treaty, wages earned as an independent contractor, royalties, and scholarship or fellowship grants. Many international students received both form 1042-S and form W-2, some students will receive only form W-2. Consequences of Not Filing Tax Forms • Applicants for US permanent residency or H1-B visas may be asked to show evidence of completed tax forms for years you have previously been resident in the US. • If you do not file a return with the State of Virginia, they will eventually send you a letter and you will be required to either justify why you were exempt from paying taxes or you will have to pay penalties on the amount due. . No Social Security Number? • If you have no income and are only completing an 8843, you do not need a SSN or ITIN. • If you worked or have taxable financial aid, you must have a SSN or ITIN to complete a 1040NR form. • Sprintax allows you to apply for an ITIN for an extra fee and documentation from me. SprintaxTax Prep TAX SOFTWARE PROGRAM • • The Sprintax Tax Prep software program is an on-line program that most international students here use to complete their 1040-NR EZ and 8843 tax forms. You may purchase a password to get into the program for $10. You simply answer the questions that are asked of you and it will then print out the completed forms, sign, copy, and mail. Sprintax Tax Prep also has a support center and a Frequently Asked Questions section where you can get your questions answered. Assembling and Mailing Income Tax Forms • If you are filing a federal form 1040NR-EZ or 1040NR with a form 8843, you should first staple the Copy B of any W-2 forms and/or 1042-S forms to the lower FRONT of the 1040NR-EZ or 1040NR. If you are also required to submit any special schedules or additional forms, staple those behind the 1040NR-EZ or 1040NR. The last form behind the 1040NR-EZ or 1040NR should be form 8843. • Make checkpayable to US Department of Treasury. In the memo or “for” line on the check, write “Income Tax 2014” and your social security number. Do not staple or tape your check to your tax forms; I usually use a clip to attach it to the forms in the same envelope. • Before mailing anything, MAKE ONE COPY FOR YOUR RECORD • Mail forms 8843 and 1040NR-EZ (or 1040NR) and the appropriate attachments to the address indicated in the Sprintax Tax Prep instructions. • For State of Virginia taxes, you can have them prepared by the tax ladies at City Hall, Washington Street, Lexington, VA or mail to PO Box 922, Lexington, VA 24450. You may also pay it at the ‘tax ladies’ at City Hall.