HOLT Chapter 12 Paying for Government

advertisement

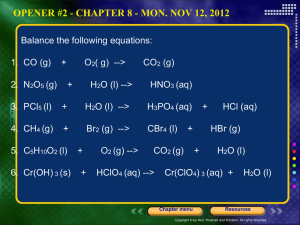

CIVICS IN PRACTICE HOLT Chapter 12 Paying for Government Section 1: Raising Money Section 2: Types of Taxes Section 3: Managing the Country’s Money ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 1: Raising Money The Main Idea Each year the local, state, and federal government provide Americans with services such as police, schools, highway construction, and defense. These services cost huge amounts of money. The government pays for these services with taxes collected from citizens. Reading Focus Why is the cost of government so high? What guidelines do governments use when taxing citizens? Other than taxes, what are two ways to pay for government? ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 1: Raising Money The cost of government is high due to: A population of more than 310 million people The rising cost of living More government programs and services like defense spending and payments to the elderly, disabled, or impoverished The national debt ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 1: Raising Money Deciding how to spend the government’s money: Officials establish government’s priorities. Priority is given based on urgency and need. Debate over the country’s priorities is common. ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 1: Raising Money Principles of taxation: Ability to pay—based on earned incomes; poor do not pay income tax Equal application—tax applied at the same rate for similar taxable items Scheduled payment—taxes due by April 15 Fees, fines, and payments for special services also raise government funds. ‹#› HOLT, RINEHART AND WINSTON SECTION 1 CIVICS IN PRACTICE HOLT Question: What guidelines do governments use when taxing citizens? ability to pay Principles of Taxation equal application ‹#› scheduled payments HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 2: Types of Taxes The Main Idea Taxes are the main source of revenue for the local, state, and federal governments. The types of taxes each level of government uses to raise money vary. Reading Focus What are the two main kinds of income taxes? What are the other major types of taxes? ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 2: Types of Taxes Different types of taxes: Individual income tax—the largest source of tax revenue; most citizens pay federal, state, and local income taxes Sales and excise tax—sales taxes are collected by state or local governments; excise taxes (on “luxury” items) are collected by the federal government Property taxes—chief income for most local governments; funds public education ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 2: Types of Taxes Different types of taxes: (continued) Estate, inheritance, and gift tax—estates of the deceased, value of inheritances, and monetary gifts above $10,000 are taxable by the federal government Import tax—tariffs on imported products used to regulate trade ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 2: Types of Taxes Progressive and Regressive Taxes Progressive taxes take a larger percentage of income from high-income groups. Example: individual income tax Regressive taxes take a larger percentage of income from low-income groups. Example: sales taxes ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 2: Types of Taxes Tariffs and the U.S. Economy Tariffs are taxes placed on goods imported from foreign countries. Tariffs can help the U.S. economy by: Regulating trade Retaliating against tariffs placed by foreign countries on U.S. goods Protecting American industries against foreign competition Raising prices on foreign goods ‹#› HOLT, RINEHART AND WINSTON SECTION 2 CIVICS IN PRACTICE HOLT Question: What are the differences between progressive and regressive taxes? PROGRESSIVE TAX takes a larger percentage of income from higher-income groups. ‹#› takes a larger percentage of income from lower-income groups. REGRESSIVE TAX HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 3: Managing the Country’s Money The Main Idea The federal, state and local governments collect and spend many billions of dollars each year. Each level of government has systems to manage public funds. Reading Focus How do governments collect public money? What steps are involved in spending public money? How do governments account for your money? ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 3: Managing the Country’s Money How governments collect public money: Internal Revenue Service—collects federal taxes U.S. Customs Service—collects taxes on imported goods State and local governments collect taxes through their own collection agencies. ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 3: Managing the Country’s Money Steps in creating the federal budget: Office of Management and Budget and the president ‹#› prepare the budget. The prepared budget is published and sent to Congress for study. Congress debates the budget and makes changes. Both houses must approve the budget. The budget is passed with 13 appropriations bills. Bills are sent to the president for approval or veto. HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Section 3: Managing the Country’s Money The National Debt 1970–1997—The government spent more than it ‹#› collected. Money was borrowed to make up the difference. Interest on the borrowed money increases the debt. Government bonds used to borrow money are being bought by foreign investors. Clinton plan for balanced budget in 2002 was thwarted by recession and terrorism. HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE SECTION 3 HOLT Question: How do governments collect public money? Government Collection of Public Money Government Collection of Public Money Federal “collection agency” Internal Revenue Service Role of the “collection agency” collects individual income taxes, corporate income taxes, Social Security taxes, excise taxes, estate taxes, and gift taxes State and local “collection agencies” collects state income and inheritance taxes as well as local property taxes ‹#› HOLT, RINEHART AND WINSTON CIVICS IN PRACTICE HOLT Chapter 12 Wrap-Up 1. Identify six reasons for the high cost of government. 2. Identify and explain the principles the government uses to try to make taxation fair. 3. Why must governments borrow money? How do they borrow money? 4. How is individual income tax calculated, and how do citizens pay individual income taxes? 5. What is the difference between a progressive tax and a regressive tax, and what is an example of each? 6. What is the difference between a surplus and a deficit? 7. What is the national debt, and how might it be harmful to the country? ‹#› HOLT, RINEHART AND WINSTON