Purchase of Assets in UK

advertisement

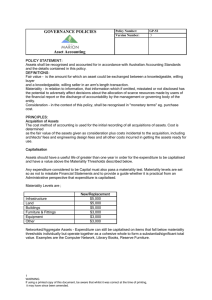

Purchase of Assets in UK Assets and Expenses What is an asset ? An asset is usually defined as premises, machinery or equipment that is owned by the business, used for the purpose of carrying out the business, and likely to remain in use by the business for a period of time. Assets are recorded in an asset register. Assets are depreciated according a straight line method or a reducing balance method. The materiality concept should be used to decide if an item represents capital or revenue expenditure. In an office, a computer would be regarded as an asset, but a stapler or paper bin would probably be regarded as revenue expenditure. Capital and Revenue Expenditure The purchase of an asset is capital expenditure. The purchase of smaller items is treated as revenue expenditure. For example: A computer and printer are purchased by a small business. These are treated as capital expenditure. Any delivery cost and installation cost (such as connecting to a network) are treated as capital expenditure. The cost of printer ink, paper and computer discs would be treated as revenue expenditure. Purchase of a vehicle The following are capital expenditure: Net cost of vehicle Number plates Delivery costs The following are revenue expenditure. Fuel Vehicle excise duty / road fund licence Insurance Servicing