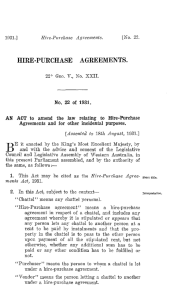

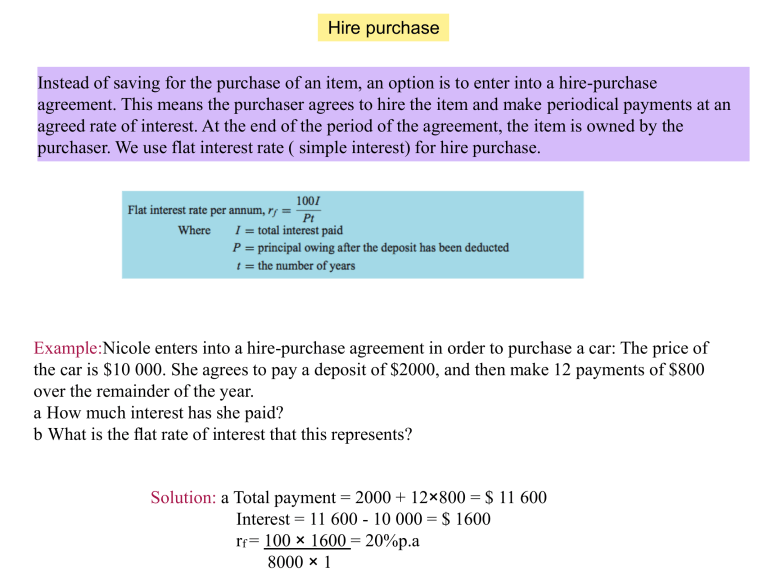

rate ( simple interest) for hire purchase

Hire purchase

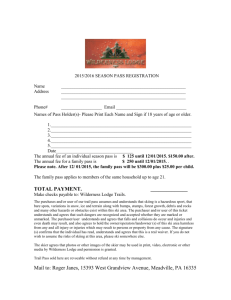

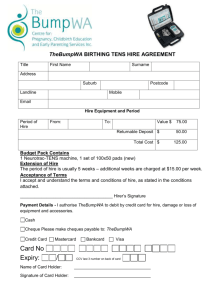

Instead of saving for the purchase of an item, an option is to enter into a hire-purchase agreement. This means the purchaser agrees to hire the item and make periodical payments at an agreed rate of interest. At the end of the period of the agreement, the item is owned by the purchaser. We use flat interest rate ( simple interest) for hire purchase.

Example:

Nicole enters into a hire-purchase agreement in order to purchase a car: The price of the car is $10 000. She agrees to pay a deposit of $2000, and then make 12 payments of $800 over the remainder of the year.

a How much interest has she paid?

b What is the flat rate of interest that this represents?

Solution:

a Total payment = 2000 + 12

×

800 = $ 11 600

Interest = 11 600 - 10 000 = $ 1600 r f

= 100

×

1600 = 20%p.a

8000

×

1

Effective interest rate

When we pay with flat rate of interest ( simple interest) we are actually paying alot more interest than compound interest.The

effective interest rate

is the actual interest rate that we pay with the flat rate of interest.

Example:

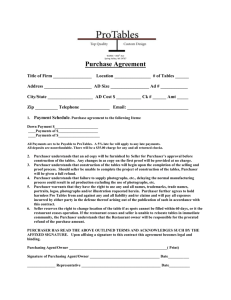

Monique arranges to purchase a stereo costing $1690. She agrees to pay a deposit of $150, and 18 equal monthly payments of $95. Find: a the flat rate of interest per annum b the effective rate of interest per annum that she is paying on this contract.

Solution:

a Interest = 150 + 18

×

95 - 1690 = 1860 - 1690 = $170 r f

= 100

×

170 = 7.36% p.a.

1540

×

1.5

r e

= r f

×

2

×

18 = 7.36

×

32 = 13.94%p.a.

18 + 1 19