Module 2 - Jim Casey Youth Opportunities Initiative

advertisement

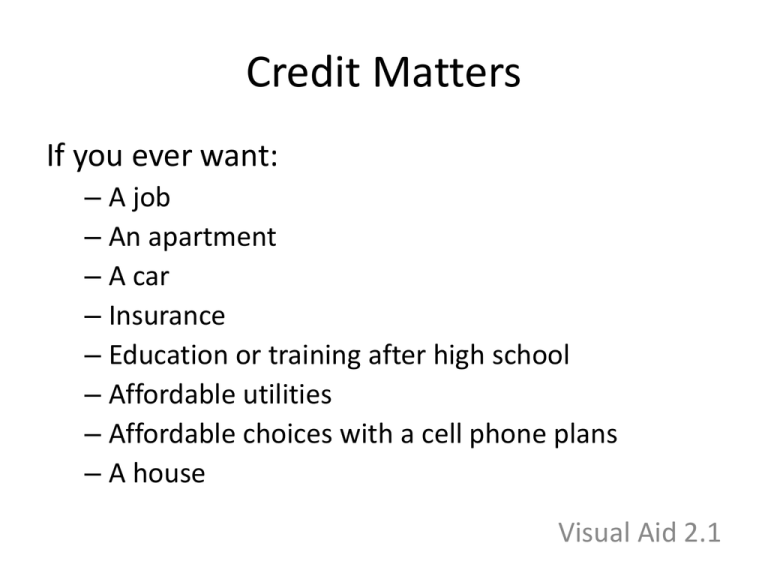

Credit Matters If you ever want: – A job – An apartment – A car – Insurance – Education or training after high school – Affordable utilities – Affordable choices with a cell phone plans – A house Visual Aid 2.1 Credit is. . . • Do you have good credit? = Do you have a good credit history as reported on your credit report? • Did you pay for this care using credit? = Did you borrow money to buy this car? • Does your credit qualify you for a good price on this loan? = Are your credit scores high enough to get the lowest interest rate on this loan? • Did the bank credit your account? = Did the bank add money back into your account? • Did you get credit for this great idea? = Did you get recognition or acknowledgement for this idea? Visual Aid 2.2 2 Types of Credit • Installment versus – Approved for a specific amount. – Monthly loan payment calculated when you take out the loan. • Secured versus – Asset pledged against the loan. – This pledged asset is called collateral. • Revolving – Borrow as much as you want up to a credit limit. – Make minimum payment depending on balance. • Unsecured – No asset pledged against the loan Visual Aid 2.3 How Credit Works • Lender (creditor) loans money to borrower (debtor) with certain terms (rules) • The amount the borrower borrows = Principal • Rent for using the money until it is paid back = Interest (and fees although most fees are paid one time unless they are penalty-type fees such as late payment) Visual Aid 2.44 Key Terms 1 • APR—Includes interest and the fees that everyone who gets the loan has to pay. It’s a percentage and allows you to compare loan to loan. Required by Truth in Lending Act. • Terms — what you agree to follow when taking out a loan. Includes: interest rate, kind of interest rate, length of the loan, where payments are due, when payments are due and more Visual Aid 2.5 Key Terms 2 • Fixed Rate—The interest rate does not change during the term of the loan. • Variable Rate—The interest rate changes as market rates change. • Amortized—Accounting term that means the interest has been calculated over the life of the loan so you pay the same amount each month. Visual Aid 2.6 Answers to KEY ACTIVITY— Amortized versus Revolving Credit • How much total interest is paid for the installment loan? – $54.99 • How much interest is paid for the revolving credit? – $45.07 so far. • How much principal is owed on the installment loan after 12 months? – $0 • How much principal is owed for the revolving credit 12 months? – There is still a balance of 600.07 left. • Which kind of loan seems like it would easier to manage in your budget? Why? – The installment loans. The payments are predictable and consistent and have an end date. • If the person with revolving credit continues to make payments at this level, how much interest do you think the person will pay? – $144.78 • How long do you think it will take to pay off the loan in years? – 5 years Visual Aid 2.7 Credit versus Debt • Credit • Debt • The ability to borrow money. • The result of using credit. Owing an individual or business money. • This is a liability. Visual Aid 2.8 How Credit May Help You • • • • • • Avoid a financial crisis Get a job Start a business Own a home Provide for your own family Achieve your own goals and realize your vision But credit must be used wisely. Visual Aid 2.9 When You Owe Money • You obligate your future income. • In other words, you tie up money you have not yet earned. • This could decrease your options in the future. Visual Aid 2.10 Debt to Income Ratio Monthly debt payment Divided by Monthly gross income Equals Debt to Income Ratio Visual Aid 2.11 Gross Income What you earn before deductions. Deductions may be taken for: Federal income tax Social security Medicare State tax Local tax Insurance Visual Aid 2.12 Debt to Income Limits 20% or less with no mortgage (home loan) – This means that monthly credit card payments, student loan payments, auto loan payments and other debts should take up 20% or less of your gross income. 28% or less for just the mortgage (home loan) – This means that monthly principal, interest, taxes and insurance (called PITI) should take of 28% or less of your gross income. 36% to 43% and below for all debts – This means that all debts (including the mortgage) should be between 36% and 43% or less of gross income. Visual Aid 2.13 How to Use the Debt to Income Ratio • Figure out whether to take on new debt. – Should I buy a new car or stick with the old one a little bit longer? • Make a goal for debt levels. – Can I get my debt-to-income ratio down to 25% by the end of the year? • Keep track of how you are doing paying down debt. – How much has my debt-to-income ratio dropped in the last months? Am I making improvements? • Like financial blood pressure--it tells you how much pressure your debt is putting on your income or on your budget. Visual Aid 2.14 Why Credit Reports ARE Important Many individuals and businesses use them to make decisions about you! • A bank or credit union may use them to decide whether to give you a loan. • A credit card company may use them to decide whether to give you a credit card. • A landlord may use them to determine whether to rent an apartment to you. • A potential employer may use them to determine whether you will get a job. • An insurance company may use them to determine whether to give you insurance coverage and the rates you will pay for coverage. • A utility company may use them to figure out how much deposit you must pay before they will turn on your electric or gas. • A cell phone provider may use them to determine what plans you may be eligible for and the rates you will pay. • Credit scores are completely based on information in your credit reports. Visual Aid 2.15 The Credit Reporting Agencies • Equifax • Experian • TransUnion May have different information. Must check all 3. – If over 18, order from website, call them or write to them. – Use www.annualcreditreport.com for annual free report. – May not be useable if you have been the victim of identity theft. Visual Aid 2.16 Can You Have a Credit Report if You are Under 18? • You cannot have credit report if you are under 18 unless: – You are an emancipated minor – You are an authorized user on someone’s credit card – You have student loans – You live in a state where you can be younger than 18 to enter into a financial contract – Your identity has been stolen and used by someone else to get credit or services Visual Aid 2.17 Instruction for Teach Back • Prepare a commercial highlighting the key points of your group’s assignment. • Use a poster/billboard, a rap or jingle or some other way to creatively and memorably convey the information quickly to the rest of the group. • You will have 10 minutes to prepare. • Be ready to share or perform. – Group 1, Repairing Credit – Group 2, Building Credit – Group 3, Maintaining Good Credit Visual Aid 2.18 Credit Building and Opportunity Passport™ • Because good credit is such an important productive asset, you can use your Opportunity Passport™ Matched Savings to repair or build credit. • Repair your credit history and improve your scores by using your Opportunity Passport™ Matched Savings to pay for: – – – – accounts you may be late on debts in collections accounts you risk becoming late on or dealing with legal or other issues resulting from identity theft OR • Build your credit history and improve your scores by using your Opportunity Passport™ Matched Savings to: – secure a credit builder loan to build credit – secure a credit card to build credit Visual Aid 2.19 FICO Score Distribution Types of Credit Used, 10% New Credit, 15% Payment History, 35% Length of Credit History, 15% Amounts Owed & Credit Utilization Rate, 30% Visual Aid 2.20