Chapter_32_Section_32.2

advertisement

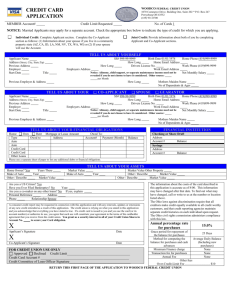

Marketing Essentials n Chapter 32 Extended Product Features Section 32.2 Credit Chapter 32 n Extended Product Features 1 SECTION 32.2 Credit What You'll Learn The importance of credit The five sources of consumer credit The four types of credit accounts extended to consumers How businesses use trade credit Important credit legislation Chapter 32 n Extended Product Features 2 SECTION 32.2 Credit Why It's Important Extending credit to customers or accepting credit cards for purchases is an important part of product planning. The wise use of credit can be a great benefit to a business and its customers. Chapter 32 n Extended Product Features 3 SECTION 32.2 Credit Key Terms credit regular, or 30-day, charge accounts installment accounts revolving accounts budget accounts Chapter 32 n Extended Product Features 4 SECTION 32.2 Credit Credit and Its Importance Credit allows businesses or individuals to obtain products or money in exchange for a promise to pay later. The use of credit is essential to our economy. In 2000 there were over 500 million credit cards in circulation. Slide 1 of 2 Chapter 32 n Extended Product Features 5 SECTION 32.2 Credit Credit and Its Importance Credit is important because income often does not match buying needs when they occur. Example: It is often difficult to save enough to buy a car. Credit allows you to buy a car and pay for it over a period of time. Extending credit gives consumers an incentive to purchase, which increases businesses' sales and profits. Slide 2 of 2 Chapter 32 n Extended Product Features 6 SECTION 32.2 Credit Consumer Credit Companies that offer credit to consumers typically issue credit cards. There are several kinds of consumer credit: bank credit cards store and gasoline credit cards travel and entertainment cards rebate cards affinity cards debit cards special customer cards secured and unsecured loans Slide 1 of 6 Chapter 32 n Extended Product Features 7 SECTION 32.2 Credit Consumer Credit Bank Credit Cards Sponsored by companies such as VISA and MasterCard, bank credit cards are issued by banks. Banks charge businesses fees for each transaction, and charge customers finance charges and annual fees. Store and Gasoline Credit Cards Some businesses, such as Sears and Target, offer their own proprietary credit cards. The companies receive income from finance charges. Slide 2 of 6 Chapter 32 n Extended Product Features 8 SECTION 32.2 Credit Consumer Credit Travel and Entertainment Cards American Express, Discover, and Diners Club require that payments be made in full each month. They receive income from retailer transaction fees, and customer annual fees and service charges. Rebate Cards Companies offer a reward or incentive, such as airline miles, cash, or long distance telephone service, for using the card. Slide 3 of 6 Chapter 32 n Extended Product Features 9 SECTION 32.2 Credit Consumer Credit Affinity Cards These credit cards are issued by banks to show loyalties to a sports team, university, charity, or other organization. A small percentage of interest is given to the organization. Slide 4 of 6 Chapter 32 n Extended Product Features 10 SECTION 32.2 Credit Consumer Credit Debit Cards Not actually a credit card, a debit card allows purchase amounts to be automatically deducted from a customer’s bank account. Special Customer Cards Also not a credit card, these are offered to frequent shoppers to allow them to receive reduced prices on some items or discounts on future purchases. Businesses get valuable marketing research information about customers. Slide 5 of 6 Chapter 32 n Extended Product Features 11 SECTION 32.2 Credit Consumer Credit Secured and Unsecured Loans In secured loans, something of value, such as property, motor vehicles, machinery, or merchandise, is pledged as collateral to ensure that a loan is repaid. Unsecured loans represent a written promise to repay a loan. Slide 6 of 6 Chapter 32 n Extended Product Features 12 SECTION 32.2 Credit Types of Accounts There are four major consumer credit plans in use today: regular, or 30-day accounts installment accounts revolving accounts budget accounts Slide 1 of 5 Chapter 32 n Extended Product Features 13 SECTION 32.2 Credit Types of Accounts Regular charge accounts, or 30-day accounts, allow customers to charge purchases and pay in full within 30 days after they are billed without incurring a finance charge. Slide 2 of 5 Chapter 32 n Extended Product Features 14 SECTION 32.2 Credit Types of Accounts Installment accounts, or time payment plans, allow for payment at a specific interest rate over a set period of time. They are normally used for large purchases, such as travel, appliances, and furniture. Slide 3 of 5 Chapter 32 n Extended Product Features 15 SECTION 32.2 Credit Types of Accounts Revolving accounts are accounts in which the issuer determines the credit limit, payment due date, and minimum payment. The customer can choose to pay more than the minimum payment to reduce the balance owed and finance charges. Interest is charged on the unpaid balance. Slide 4 of 5 Chapter 32 n Extended Product Features 16 SECTION 32.2 Credit Types of Accounts Budget accounts allow for the payment of a purchased item over a certain time period (usually 90 days to one year) without a finance charge. This is common for purchases such as appliances, furniture, and electronics. Slide 5 of 5 Chapter 32 n Extended Product Features 17 SECTION 32.2 Credit Business Credit Business credit, or trade credit, is similar to consumer credit in that money is lent for goods and services. Trade credit involves credit memorandums, letters of credit, and credit drafts instead of credit cards. Chapter 32 n Extended Product Features 18 SECTION 32.2 Credit Legislation Affecting Credit There are many regulations that protect consumers and their credit standing while providing information on the proper use of credit. The Truth in Lending Act of 1968 requires that lenders disclose information about annual percentage rates, the issuer, and the amount financed. Slide 1 of 3 Chapter 32 n Extended Product Features 19 SECTION 32.2 Credit Legislation Affecting Credit The Fair Credit Reporting Act of 1971 requires that a lender report the name and address of the credit bureau that was used when consumer credit was denied. The Equal Credit Opportunity Acts of 1975 and 1977 set guidelines for the review of credit applications and prohibit discrimination. Slide 2 of 3 Chapter 32 n Extended Product Features 20 SECTION 32.2 Credit Legislation Affecting Credit The Fair Debt Collection Act of 1980 prevents businesses from harassing or abusing bad-debt customers. The Credit and Charge Card Disclosure Act of 1988 requires credit card issuers to provide information about card costs. Slide 3 of 3 Chapter 32 n Extended Product Features 21 32.2 ASSESSMENT Reviewing Key Terms and Concepts 1. Why is credit important to our economy? 2. List the types of consumer credit. 3. Identify the four major credit plans extended to consumers. 4. How do businesses use trade credit? 5. Why do federal and state governments pass legislation regulating credit? Chapter 32 n Extended Product Features 22 32.2 ASSESSMENT Thinking Critically More and more banks are issuing credit cards that offer low interest six-month "teaser" rates. What are some possible disadvantages of accepting these offers? Chapter 32 n Extended Product Features 23 Marketing Essentials End of Section 32.2 Chapter 32 n Extended Product Features 24