Percent Applications

advertisement

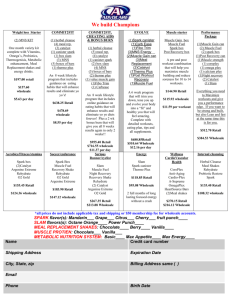

Percent Applications Lesson 7.6 OBJ: To find markups, discounts, sales tax, and tips Markup • An increase from the wholesale price of an item to the retail price. • Retail Price = wholesale + markup • Retail = wholesale x (100% + Markup percent) • Example – What is the retail price of a bracelet that has a wholesale cost of $7 if the markup percent is 120%? Discounts • A decrease from the original price of an item to the sale price. • Sale Price = Original price – Discount • Sale Price = Original Price x (100% Discount Percent) • Example - A pair of jeans that originally costs $42 is 25% off. Find the sale price. Using Sales Tax and Tips • Sales Tax – A tax based on the amount paid for goods bought, usually added to the price. It is calculated using percents. • Tip – An amount of money given based on the percentage of bill and service. It is calculated using percents. • Example – The bill for your restaurant meal is $23. You leave a 15% tip. The sales tax is 5%. What is the total cost of the meal? • ** The tip is based on the food bill only. Do not include the sales tax when finding a tip. Finding an Original Amount • Retail Price = Whole Price x (100% + Markup percent) • Example – A store marks up the wholesale price of a printer by 80%. The retail price is $120. What is the wholesale price of the printer? Examples 1. Find the retail price of a collectible figurine with a wholesale cost of $12 that is marked up 75%. 2. Mason buys a suit that is on sale for 20% off the original price of $180. What is the sale price? Examples 3. The bill for a family’s meal at a restaurant is $68. They leave a 15% tip. The sales tax is 6%. What is the total cost of their meal? 4. A dress shop marks up the wholesale price of a prim dress by 115%. The retail price is $180. What is the wholesale price of the dress? Assignments • Class work – Guided Practice P. 359 1-7. • Homework – Text p. 360-361, #’s 826 evens