M20--Pricing and Related Decisions

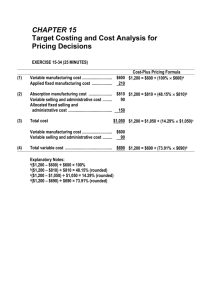

advertisement

Module 20 Pricing and Related Decisions The Value Chain The set of value-producing activities that stretches from basic raw materials to the final consumer Each product or service has a separate value chain All entities along the value chain depend on the final customer’s perception of the value and cost of a product or service Three Levels of the Value Chain The value chain for the paperboard cartons used to package beverages shows three levels with each successive level showing more detail. Who does what activities best? Value Chain Perspective Core competencies: Where do we fit in the chain & what are we best at? Relationships with suppliers & customers becomes an integrated partnership (data & vision) Considers the full cost, including customer use… Meet together to improve product value, processes and reduce costs Fewer suppliers Some shared management Supplier-Buyer Partnership Example Ford Motor Co. partners with selected suppliers who meet quality tests. They share production data, engineering design, and some training. Must meet delivery of quality, time, and cost. Industrial Molding Corp. (Lubbock) provides plastic components for Ford (and 20 other companies). Source: Hirsch, Steve. E-Management - Suppliers Become Closer Partners © International Trade Centre, International Trade Forum, Issue 3/2005. The Pricing Decision Important and complex decision for management Directly affects the salability and profitability of individual products or services Two pricing theories Economic approaches Cost-based approaches Economic Approaches to Pricing Based on cost and revenue functions Marginal revenue The varying increment in total revenue derived from the sale of an additional unit Marginal cost The varying increment in total cost required to produce and sell an additional unit of product Expand production until marginal revenue = marginal cost For 1 company Expand to MC = Price http://upload.wikimedia.org/wikipedia/commons/1/17/Profit_max_marginal_small.svg Entire market clears when production expands and price decreases to MC http://upload.wikimedia.org/wikipedia/commons/7/7a/Supply-and-demand.svg Marginal revenues often unknown—just a guess. Cost-Based Approaches to Pricing Cost has traditionally been the most important consideration in pricing because Cost data are available. Cost-based prices are defensible. Feasible for setting prices in a short period of time Managers can argue prices represent a fair profit Revenues must exceeds costs if the firm is to remain in business. Long run selling prices must exceed the full costs Cost-Based Pricing in Single-Product Companies Known data are entered into a profit formula Example Lawn Chopper mows lawns and has an annual facilities cost totaling $30,000. Each lawn mowed costs $10. Management desires to achieve an annual profit of $40,000 at an annual volume of 5,000 lawns. Profit = Total revenues – Total costs $40,000 = (Price × 5,000) – ($30,000 + [$10 × 5,000]) Price = $24 per lawn Then, will the customers pay $24 per week to have their lawns mowed? Cost-Based Pricing in Multiple-Product Companies Desired profits are obtained for entire company Standard procedures are established for determining initial selling prices of each product Typically include Cost assigned to the product or services Plus a markup to cover unassigned costs and to provide a profit Pricing Bases in Multiple-Product Companies Possible cost bases for markups: Variable production costs Variable production, selling, and administrative costs Full manufacturing costs Markup on Cost Base General approach to developing a markup is to recognize that the markup must be large enough to provide for costs not included in the base, plus a profit Markup on cost base = Costs not included in the base + Desired profit Costs included in the base Variable Cost Basis Example Lawn Chopper has total assets of $320,000. Management desires an annual return of 12.5% on total assets. Fixed costs and expenses total $30,000, and variable costs and expenses total $50,000. Estimated variable costs per unit equals $10. Desired annual profit = 12.5% × $320,000 = $40,000 Markup on Variable Costs $30,000 + $40,000 $50,000 = 140% of VC Selling price = $10 + ($10 × 1.40) = $24.00 Full Production Cost Basis Example Lawn Chopper’s fixed costs and expenses total $30,000, of which $10,000 are selling and administrative costs. Total variable costs and expenses total $50,000, with $5,000 of this amount selling and administrative costs. Estimated variable costs per unit equal $10 (with $1 of this selling and administrative costs). Full production cost = $20,000 + $45,000 = $65,000 or $13 for each of the 5,000 units. Desired profit is still $40,000. Markup on Full Production Cost $10,000 + $5,000 + $40,000 $20,000 + $45,000 = 84.6% Selling price = $13 + ($13 × 84.6%) = $24.00 Critique of Cost-Based Pricing If cost-based pricing does not have accurate cost assignments, some products could be priced too high and others too low. Cost-based pricing assumes goods or services are relatively scarce and, generally, customers who want a product are willing to pay the price. Target Costing & Product Starts with determining what customers are willing to pay for a product or service Then subtracts a desired profit on sales to determine the allowable cost of the product or service Team must design a product that meets customer price, function, and quality requirements while providing the desired profit Save cost by designing the target product that will eventually be in the market after competitors have responded. Target Costing Requirements Requires cost information Detailed information on the cost of alternatives activities is needed Allows decision makers to select design and production alternatives that are fast & cost effective Requires coordination with all involved Need a basic understanding of the overall processes required to bring a product to market Should appreciate cost consequences Must respect, cooperate, and communicate with other team members Pros and Cons of Target Costing Product Life Cycles Products with a relatively long life go through 4 stages during their life cycle Sales Revenue Maturity Sales are low. Often selling prices are high. Customers are affluent trendsetters. Time Sales level off. Price pressure increases. Price reductions could be needed. Sales increase as product gains acceptance. Selling prices often remain high. Customers are loyal. Low competition. Sales decline as product becomes obsolete. Significant price cuts needed to sell inventories. Life Cycle Costs Life cycle costs include all costs associated with a product or service ranging from Cost incurred with initial conception Design Pre-production Production After production support Cost management aided by target costing Commitment and Expenditures Commitments and expenditures of organizations for high-technology products with relatively short product lives Kaizen Costing A costing approach focused on continuous improvement Calls for establishing cost reduction targets for products or services Begins where target costing leaves off Often found in companies that have adopted a lean production philosophy Successful companies often use Kaizen to avoid complacency. Benchmarking A systematic approach to identifying best practices to help an organization take action to improve performance Typically deals with Target costs for a product, service or operation Customer satisfaction Quality Inventory levels Inventory turnover Cycle time Productivity