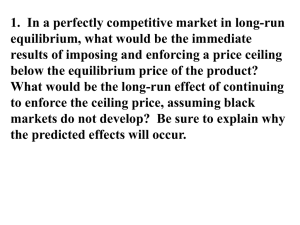

2. The Problem

advertisement

Insurance for Financial Crisis? Michael Faure and Klaus Heine METRO, Maastricht University PO Box 616, 6200 MD Maastricht, The Netherlands RILE, Erasmus University Rotterdam PO Box 1738, 3000 DR Rotterdam, The Netherlands Structure 1 Introduction 2 The Problem 3 Insurance for Catastrophes 4 Export Insurance 5 Proposal 6 Concluding Remarks Faculty of Law 2 1. Introduction • After financial crisis: bail-out of financial institutions • Debated by economists because perverse incentives • Financial intervention by government not new (Natcats, export insurance) • Example for financial crisis? Faculty of Law 3 2. The Problem 2.1 Bail-out flawed • Bailing-out ex post • Ad hoc • Random compensation • Moral hazard: wrong incentives etc. Faculty of Law 4 2. The Problem 2.2 … but intervention unavoidable? • Financial crises are systemic risks • Some government intervention unavoidable • Why not better solutions • Like insurance? Faculty of Law 5 2. The Problem 2.3 Why not insurance for financial crisis? • Theoretically insurance could protect (financial) institutions • Insurance not only taken for risk aversion, but also reduction of transaction costs • Potential problems: • Predictability of risk (reliable statistics lacking etc.) Faculty of Law 6 2. The Problem • Endogenously: business failure really due to crisis? Business risk uninsurable! • Moral hazard • Adverse selection (enterprise risk caused by financial crisis or by mismanagement?) • Damage uninsurable; lacking capacity Faculty of Law 7 2. The Problem 2.4 A conditional support • Problems serious, but not incurable • Today, many interdependencies between insurance and financial markets • Predictability: lacking statistics, not necessarily uninsurable: adding risk premium Faculty of Law 8 2. The Problem • Moral hazard curable through adequate information: risk differentiation and classification • Enterprise risk is now also insurable Faculty of Law 9 2. The Problem Faculty of Law 10 2. The Problem • Capacity problem: government as reinsurer of last resort? Examples exist! Faculty of Law 11 3. Insurance for Catastrophes 3.1 Theory • Insurance solutions favoured (Kunreuther 1968) • Reinsurance by state necessary to support development of insurance coverage (Schwarze/Wagner 2004) • Government capacity to diversify risks over population and over generations Faculty of Law 12 3. Insurance for Catastrophes • Government better placed to reduce risks? 3.2 Examples • Many! E.g. • CCR (France) for Natcats • NHT (Netherlands) for terrorism etc. Faculty of Law 13 3. Insurance for Catastrophes 3.3 Lessons • Of course, Natcats/terrorism vs. financial crisis different (economic impact, interrelatedness of banks, predictability etc.) but: • Also in case of Natcats charity hazard (Weck Hanneman) Faculty of Law 14 3. Insurance for Catastrophes • Also preference for structural solutions vs. ad hoc-ism • Also preference for multi-layered approach (using insurance to full extent; government only in last resort) Faculty of Law 15 4. Export Insurance 4.1 Theory • Political risk in export difficult to insure • Government better able to bundle claims and recover obligations Faculty of Law 16 4. Export Insurance 4.2 Example • Euler Hermes KreditversicherungsAG • Only coverage for political risk; not commercial risk • Exists in many countries Faculty of Law 17 4. Export Insurance 4.3 Lesson • State considered better insurer of political risks • Distinction between commercial and political risks possible Faculty of Law 18 5. Proposal • Ex ante structural approach instead of ad hoc and ex post solutions • Idea: Establishing private insurance markets to deal (at least partly) with financial crises Faculty of Law 19 5. Proposal • Advantages: 1. Employing market incentives to evaluate financial risks correctly; 2. Sharing the burden of compensation between the private and the public sector; 3. Triggering a pre-emptive effect against crises Faculty of Law 20 5. Proposal 5.1 Multi-layered insurance approach • Lesson learned from natcats: Self-insurance by victims (1st layer); Private insurance and reinsurance (2nd layer); Public as reinsurer of last resort (3rd layer) Faculty of Law 21 Self-insurance by victims (1. layer) • Incentive for firms to not engage in moral hazard (taking too high financial risks) • May also help to overcome adverse selection. Firms may hold higher rates of equity for self-insurance. Reliable signal for insurers that a firm strives for a proper management Faculty of Law 22 Private insurance and reinsurance (2. layer) • Risk adjusted insurance premiums for covering (at least a part of) the risk of becoming illiquid (market prices) • Insurers will undertake risk evaluations of firms on a regular base (due diligence, stress tests). Uncovering of a firm’s performance and financial stability Faculty of Law 23 Private insurance and reinsurance (2. layer) • Permanent monitoring by insurance companies triggers a pre-emptive effect against crises • Availability of data in case of a financial crisis Faculty of Law 24 The public as reinsurer of last resort (3. layer) • Covering of remaining losses • Speedy decision making on financial help based on the information provided by insurers • Cross-time diversification of risks to future tax-payers (not available on private insurance markets) Faculty of Law 25 5. Proposal 5.2 Addressing some general problems 1. Proposal applicable to all firms. Here focus on financial intermediaries 2. When is it a financial crisis? The government has to declare it (referring to the information provided by insurers). See the example of France for declaring a natural catastrophe Faculty of Law 26 5. Proposal 3. State subsidies of the third layer may trigger severe inefficiencies. However, state provided reinsurance must not be costless and can be designed to reflect actual risk as close as possible. See the example of Dutch insurance against terrorism Faculty of Law 27 5. Proposal 4. Should the private insurance at the second layer be mandatory or voluntary? Example of natcats suggests a mandatory insurance (behavioral arguments). However, in case of financial crises the issue is more complicated… Preventing a systemic risk may incur a pooling equilibrium… Faculty of Law 28 5. Proposal 5.3 Addressing some special problems 1. Implementation of a separating equilibrium 2. Problem of state intervention 3. Coordination of compensation Faculty of Law 29 1. Implementation of a separating equilibrium • • • Differentiation between firms which are a victim of the crisis and those which are in trouble anyway If insurance is voluntary, good risks may insure, while bad risks will not. An insured firm will then be monitored by the insurer. A separating equilibrium can be attained However, if insurance is voluntary firms may speculate on a bailing out because of the need to prevent a systemic crisis Faculty of Law 30 1. Implementation of a separating equilibrium • • Mandatory insurance may yield enough money for compensations at the second layer. However, a pooling equilibrium may occur, which does not allow for risk differentiation Yet, it is not obvious, whether additional signalling and screening mechanisms will be sufficient for attaining a separating equilibrium (small differences of premiums may be leveraged by decisions of investors on capital markets, if premium differences are made public) Faculty of Law 31 2. Problem of state intervention • • • • The state may impinge on insurance premiums of the second layer. Making premiums no longer risk adjusted Firms as well as insurers may have an interest for state interference (rent seeking) Equalization of premiums fosters a pooling equilibrium State intervention is a serious problem, but not exclusive to our proposal Faculty of Law 32 3. Coordination of compensation • • The proposed model suggests that the third layer pays, if the second layer ascertains a loss because of a financial crisis and if the money of the second layer is not sufficient However, the different layers may try to shift the burden of compensation. Therefore, strategic behavior has to be prevented Faculty of Law 33 3. Coordination of compensation • Need of a clear and reliable legal framework, which comprises two components: 1) Automatism which triggers the mechanism; 2) Independent committee which has to confirm the event of a financial crisis Faculty of Law 34 6. Concluding Remarks • The technique and experience of insuring natcats provide interesting suggestions for insuring a firm’s risk in the event of a financial crisis • General idea: Making use of market solutions as far as possible Faculty of Law 35 6. Concluding Remarks • Proposal: A three layers model of insurance, comprising (1) self-insurance, (2) insurance by insurance companies and (3) the public as lender of last resort • The implied problems seem not to be insurmountable Faculty of Law 36