Session 3 E & O - Federation of Mutual Fund Dealers

advertisement

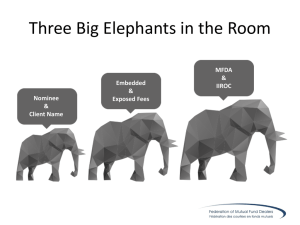

E&O INSURANCE: THINK YOU KNOW IT ALL? THING AGAIN…. © 2011 The Magnes Group Inc. Key Discussion Items: Financial advisor/client relationship Financial advisor/regulators E&O Insurance Coverage Structure – Definition of Professional Services Outside Business Activities Claims Arena – Common Allegations Risk Management Tools What To Do If…. Questions © 2011 The Magnes Group Inc. Financial Advisor/Client Relationship Financial advisors are increasingly the target of E&O claims, particularly in the wake of the financial crisis Fiduciary Relationship There are more complex transactions and there is more reliance on the advisor as the professional in the relationship There is also more willingness to sue © 2011 The Magnes Group Inc. Financial Advisor/Regulators Not only can clients commence a civil matter against an advisor/agency/dealer alleging negligence, they can also file a complaint with the regulatory body, ie. FSCO, MFDA, OSC If the regulatory body commences an investigation, this can be a very time consuming and expensive process for the advisor/agency/dealer © 2011 The Magnes Group Inc. What is Errors & Omissions Insurance? ▪ Transfer of Risk Mechanism ▪ Contract of Indemnity (called an Insurance Policy) ▪ Parties of the contract: Insurer and Policyholder (also known as Insured) ▪ Subject to the terms and conditions of the contract: ◦ Insurer will defend the policyholder ◦ Pay compensatory damages on behalf of the policyholder for: financial loss incurred by a third party as a result of an error or omission made by the policyholder in the rendering of PROFESSIONAL SERVICES. © 2011 The Magnes Group Inc. What is Errors & Omissions Insurance? ▪ Can also provide regulatory investigation coverage to advisor/agency/dealer ◦ First Party Coverage ◦ Sublimit of insurance may apply ▪ Advisor E&O policies – Vicarious Liability extension to the Agency and/or Dealer Extended Reporting Period Coverage (Tail Coverage) Referral Arrangements © 2011 The Magnes Group Inc. Why Is E&O Insurance Purchased? ▪ Mandatory Requirement of Licensing ▪ Mandatory Requirement by Insurers, Agencies, and/or Dealers ▪ Transfer of Risk Mechanism – protect your business and your assets ▪ Sleep Insurance © 2011 The Magnes Group Inc. Definition of Professional Services in an E&O Insurance Policy Definition in Financial Advisor E&O Insurance Programs Defined by licenses and/or registrations held, ie. Life/Accident & Sickness Insurance Agent Mutual Fund Registered Representative Exempt Market Dealer Representative IIROC Registered Representative Product Defined or Practice Defined? Other licenses held by advisors, such as but not limited to: RIBO License Mortgage Broker License Non Medical Travel Insurance License Outside Business Activities © 2011 The Magnes Group Inc. Definition of Professional Services in an E&O Insurance Policy ▪ Definition in a Corporate E&O Policy Individually customized based on operations Can cover all operations, or one aspect of operations ▪ Sample Definition: Professional Services: means those services performed by any of the Insureds solely in the conduct of the Policyholder’s business as described in Item 7 of the Declarations Declarations: Item 7: © 2011 The Magnes Group Inc. Managing General Agency Mutual Fund Dealer Claims Arena – Common Client Allegations Allegations commonly heard are: Failure to assess the client’s true risk tolerance and failure to adequately explain the risks Failure to determine and understand the client’s personal circumstances and objectives Unsuitability of product or investment Breach of fiduciary duty - advisor putting own interests ahead of those of the client Misrepresentation of how a life insurance/investment product works causing a financial loss to the client © 2011 The Magnes Group Inc. Client Allegations (cont’d) Certain allegations are fairly easy to deal with – advisor made an error, causing the client a financial loss. Much more common and complex are claims where a client alleges misrepresentation, but on investigation: either there was no such misrepresentation made, there was a misunderstanding, or the determination as to whether there was or was not a misrepresentation is unclear, usually because the advisor and the client have differing versions of what happened and what was discussed © 2011 The Magnes Group Inc. Client Allegations (cont’d) For example, our claims department often hears clients say that they were conservative investors when they complain about their investments going down in value, yet their KYC documentation reveals they were 100% high risk investors On the life side, we hear that clients have disclosed their full medical histories to their agent, and then there is a surprise when the claim is denied by the insurer In hearing both sides, sometimes it is hard to understand that the advisor and the client were at the same meeting because their recollections vary so much © 2011 The Magnes Group Inc. Risk Management Tools 1. Follow Standard Practices 2. Document Everything 3. Retain Documentation 4. Know Your Products 5. Know Your Clients 6. Manage Expectations © 2011 The Magnes Group Inc. What To Do If… • You have an uncomfortable feeling about a transaction/conversation with a client • You detect an error has been made even if unbeknownst to the client • Your client complains about the services you have rendered or the way the investment has been performing • Your client states something to the effect of “I am going to seek legal advice / contact my lawyer” • You are in receipt of a letter from a lawyer or you have been served with a statement of claim… Contact your insurance broker immediately © 2011 The Magnes Group Inc. Why Report to Insurer ASAP? The issue is fresh in your mind Any witnesses can be interviewed A repair or fix might be possible It is a requirement of your insurance policy to report any incident, allegation, or claim upon knowledge of same Liability and damages can be assessed and controlled You want to do nothing to prejudice your insurer and in turn prejudice your coverage Make no admissions Make certain your file is well documented © 2011 The Magnes Group Inc. Questions © 2011 The Magnes Group Inc.