Time and Effort Reporting - Yosemite Community College District

advertisement

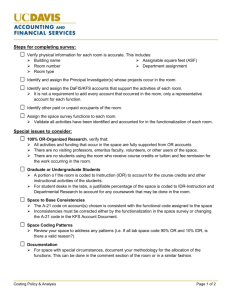

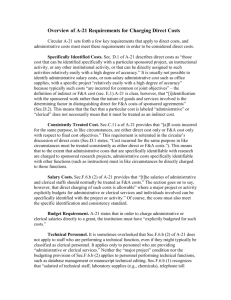

Time and Effort Reporting Grants Office 4/13/2015 4/13/2015 Know The Basics 4/13/2015 When is Time and Effort Required? Time and Effort reporting is required when any part of an employee’s salary is: 4/13/2015 Charged to a Federal program Used as match for a Federal program Paid with non-Federal funds (State) Where are the Requirements? 4/13/2015 Time and Effort reporting is required under 2 CFR Section 225 (formerly Federal Office of Management and Budget’s Circular A-21, Cost Principles for Educational Institutions) Who is considered an employee? Salaries, wages and benefits are charged under object codes 1, 2, and 3 An employee is NOT a vendor or independent consultant Time and Effort isn’t needed for non-employees Time and Effort isn’t needed for employees using time sheets or honorariums 4/13/2015 What is Effort? Total effort is defined as whatever amount of time a person devotes to fulfilling his/her program-related responsibilities OMB Circular No. A-21, J10c(2)(a)-(f) 4/13/2015 Effort Reporting is… A way for an employee to certify that… 1. Effort supported (paid) by a grant sponsored project has been performed as promised 4/13/2015 Effort Reporting… 4/13/2015 Is required by Federal regulation and District policy for all individuals working on grant funded sponsored projects Makes salary sources for the period congruent with effort spent for the period Why Does Time & Effort Continue to be an Audit Problem? 4/13/2015 Large % of Federal Education Funds Used for Staffing Staff Turnover Decentralized responsibilities Communication Complexity of applying requirements to variety of situations People don’t like it! Why should We Care? 1. 2. Signed effort reports are considered legal documents in which an individual attests to the accuracy of the effort spent on sponsored projects Erroneously certifying effort reports can be viewed as fraud We are obliged by Federal regulations to exercise good stewardship of those funds Effort is a part of that stewardship Personnel costs are the majority of program costs False Claims Act, 31, U.S.C., sections 3729 & 3721 4/13/2015 What type of reporting is needed? 4/13/2015 Single cost objective →Semi annual certification Multiple cost objectives →Monthly time reports or Personnel Activity Reports (PARs) What is a “cost objective”? A particular set of work activities for which cost data is accumulated A-21 Definition: Compensation for personal services covers all amounts paid currently or accrued by the institution for services of employees rendered during the period of performance under sponsored agreements. P. 255 EDGAR 4/13/2015 What are some typical examples of single cost objectives? Example 1: An employee funded 100% by the grant who provides services only to the special population identified in the grant Example 2: An office assistant who works 100% of the time for a sponsored program and is funded partially with local funds. Example 3: An early childhood education teacher funded 80% with “pass-through” and 20% with district funds if there isn’t a difference in activities performed. Since there is no difference in the activities Semi-Annual certification is only needed. 4/13/2015 What are some typical examples of multiple cost objectives? Example 1: An employee provides counseling services to TRIO student 60% of the time and college counseling services to the general student population 40% of the time. The counseling objectives are different for the TRIO students and must be documented for verification and continuation of the program. Since the counseling is intended for different purposes, PAR is required monthly. 4/13/2015 Another example of multiple cost objectives Example 2: An accountant manages several categorical budgets as well as the college’s Work Force Training Center budget. Although the budgets within the Center deals with multiple categorically-funded grants, the categorical programs are intended for different purposes, multiple cost objectives are reported. Time and Effort reporting is required monthly. 4/13/2015 What is a semi-annual certification? 4/13/2015 A statement that individual(s) worked solely on activities related to single cost objective Completed at least every six months Signed and dated by employee and supervisor with first-hand knowledge of work performed 4/13/2015 What is a monthly time report? (PAR) 4/13/2015 Accounts for total time / activity Prepared & signed at least monthly Signed and dated by employee and supervisor Reflects actual work performed (not budgeted) Agrees to supporting documentation 4/13/2015 What type of supporting documentation is needed? Requires a judgment call Examples include, but are not limited to: Grant activities and goals Number of students served Number of reports generated Calendars or work logs 4/13/2015 Contact the Grants Office for advice Ext. 6948 When is an accounting adjustment required? If the difference is 10% or more: Payroll charges must be adjusted at the time of the comparison AND: The following quarter’s estimates must be adjusted to more closely reflect actual activity If the difference is less than 10%: 4/13/2015 No action required until the end of the year BUT: At year-end any payroll charges to federal awards that exceed actual time and effort must be reconciled Who should sign the reports? 4/13/2015 Monthly reports (PARs) must be signed by the employee Semi annual certifications must be signed by employee and supervisor having first-hand knowledge of work performed Internal controls through the District requires the employee & supervisor to sign both forms 4/13/2015 Time and Effort: Tracking / Calculation Employee Name: Position/Title: Track Hours Worked FUNDING SOURCE July Restricted Program Account Hrs. Subtotal August Effort % 0 Hrs. September Effort % Hrs. Effort % October Hrs. Effort % November Hrs. Effort % December Hrs. Effort % 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0 0% 0 0% 0 0% 0 0% 0 0% Unrestricted Program Subtotal 0 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0 0% 0 0% 0 0% 0 0% 0 0% Match Fund To Program Subtotal 0 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0 0% 0 0% 0 0% 0 0% 0 0% Other Leave Sick/Vac/Holiday Other Subtotal Total Hours/Month Total Actual Work Hours 4/13/2015 Total Distribution of Efforts 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0% 0% 0% 0% 0% 0% Caution: Beware of Re-organization! 4/13/2015 Administrators: Changes can affect program activities President, Vice Presidents, Deans usually not allowable charges to federal program Requires good documentation to support Could be a supplanting issue 4/13/2015 Other Requirements for Charging Compensation to Federal Programs 4/13/2015 Reasonable and necessary Compensation consistent with nonfederal activities of the District Leave buy-out at termination is an indirect charge or may be charged to the Division Other leave (vacation/sick) is subject to OMB Circular A-21, J 10 and Appendix A, Part 225 Tips…… Know the Basics Train employees on the mechanics of filing out forms (new employees) Identify which program cost objectives they are working on Communicate: 4/13/2015 Who needs to communicate what changes (budget/personnel changes) Be ready to redirect work of employees or adjust grant salary Ask the Grants Office for help if needed Discussion 4/13/2015 Missing Time and Effort report documentation is one of the most frequent and costly audit findings in the state. How can your department ensure that every employee required to report time and effort does so? For Additional Information See OMB Circular A-21 Examples Sample forms Time and Effort FAQs 4/13/2015 Questions? ? ? ? ? ? ? 4/13/2015