Risk Management and Types of Risks

advertisement

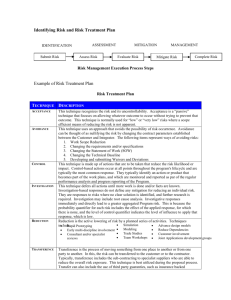

Lesson Objectives Define Risk and Risk Management List and Describe 3 Types of Risks Know and Understand 4 Basic Ways to Handle and Control these Risks List 3 types of Ways to Transfer Risks Know the Difference Between Risk Avoidance and Risk Acceptance What is Risk Management? Risk - The possibility of financial loss Management - The business function used to plan, organize, and control all available resources to reach company goals Risk Management - The systematic process of managing an organization’s risk exposure to achieve objectives in a manner consistent with public interest, human safety, environmental factors, and the law. Kinds of Risks 3 Types Economic Natural Human Economic Risks These risks occur from changes in overall business conditions. This can include: amount or type of competitor(s) changing consumer lifestyle population changes government regulations inflation Recession Unemployment Natural Risks Natural risks are result from natural disasters or disruptions floods tornadoes hurricanes fires droughts lightning earthquakes even sudden abnormal weather conditions Indiana State Fair Cowboys Practice Field Human Risks These are caused by human mistakes and errors, as well as the unpredictability of customers, employees, or the work environment This could include: Theft Injury on the job Employee error Negligence Incompetence Etc. Lance Armstrong Ways to Handle Business Risks There are 4 principle ways to handle risks Risk Prevention and Control (Loss Prevention) Risk Transfer Risk Acceptance Risk Avoidance Risk Prevention and Control Screening and Training Employees Providing Safe Conditions Providing Safety Instruction Preventing External Theft Deterring Employee Theft This is often called “Loss Prevention” in the business world Risk Transfer 3 Common Risk Transfers insurance product/service warranties transference through business ownership Insurance that covers a business Insurance policy - contract with a specific type of insurance reducing risks Business liability - insurance protects a business against damages for which it may be held legally liable. Personal liability - covers damages by customer and/or employees Product liability - protects from personal injury caused by product manufactured or sold by the business http://youtube.com/Y_FuLW2-EWA Product/Service Warranties Warranties are simply promises made by the seller or manufacturer with respect to the performance and quality of a product and protection against loss Transference Through Ownership The total amount of risk the business must handle depends in part on the type of business ownership For example, a entrepreneur who owns a soleproprietorship assumes all the risk as where a stockholder in a corporation assumes only his percentage of the risk. Risk Acceptance When the business assumes the loss responsibility into the upkeep of the company Most companies pull out a certain percentage of their revenue for damages, loss to theft, and unsold items. Risk Avoidance Risks can be avoided by advance anticipation Following market research can assist a business in making the decision on whether or not to invest in a product. To determine whether the product is a low risk you must weigh the potential benefits against the potential risks Risk Management Plan Develop an overall Risk Management Plan for the business Develop a specific Risk Management Plan for specific events that occur within the business Revisit the plan regularly to update What We Have Learned The three types of risks: economic, natural, human The terms important to Risk Management: risk - the possibility of financial loss risk management - the process of how a business controls the risk of financial loss while staying consistent with the public’s interest, safety, environmental factors, and the law There are more ways than one to handle risks effectively. Loss prevention risk transfer - insurance, warranties, and transferring ownership risk acceptance - assume responsibility of loss risk avoidance - anticipating product failure and not investing in product/service