Unit Cost Problems

advertisement

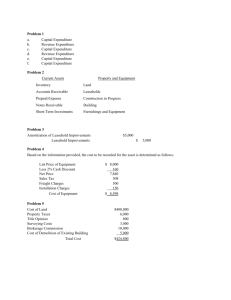

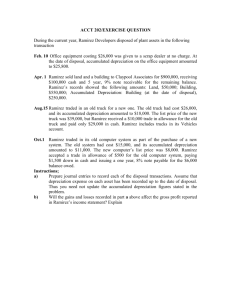

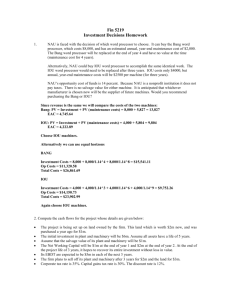

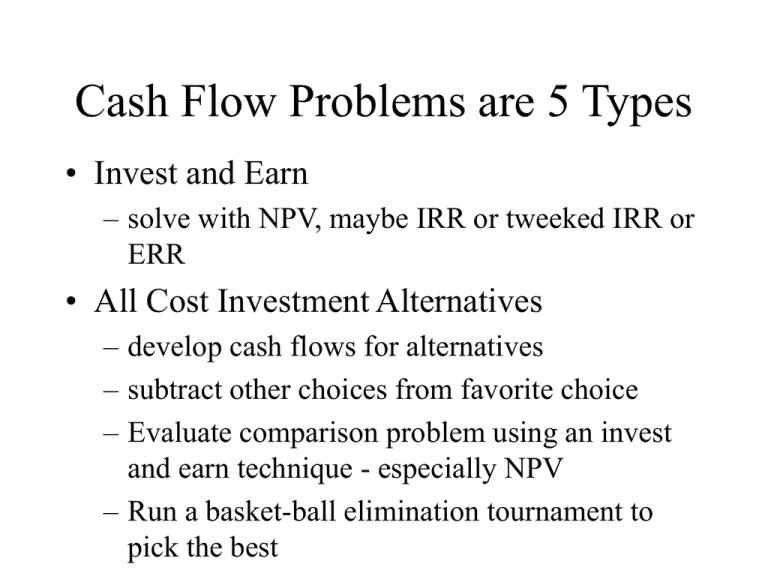

Cash Flow Problems are 5 Types • Invest and Earn – solve with NPV, maybe IRR or tweeked IRR or ERR • All Cost Investment Alternatives – develop cash flows for alternatives – subtract other choices from favorite choice – Evaluate comparison problem using an invest and earn technique - especially NPV – Run a basket-ball elimination tournament to pick the best Five Types of Cash Flow Problems • Incremental Investment Problem – Write cash flow for basic investment – Write cash flow with the add on being evaluated – Subtract the basic cash flow from the one with the add on - get a cash flow for value of the add on – Do an NPV or IRR/ERR/Tweeked IRR on the new cash flow Five Types of Cash Flow Problems • Competing Investments Problem – Is no one right answer – Have to choose what strategy you are using to pursue wealth and then choose your analysis technique • Last Type of Problem is the Unit Cost Problem Unit Cost Problems • It costs a certain amount to produce a unit of something your business handles • Cost to get equipment to produce something is divided into two types of costs – Ownership costs (have to buy the equipment) – Operating costs (have to run it) • These costs are put on an annual basis and divided by units produced to get a cost/unit Example • Earnest does mine planning for Crader Mining • Operating Costs – – – – – Each Truck uses $60,000 in diesel fuel $10,000 in lubricants $20,000 in repairs $10,000 in tires $40,000 for operator Unit Cost Problem • Total Operating Cost/Year – $60,000+$10,000+$20,000+$10,000+$40,000 = $140,000 / Year – Annual tonnage produced is 700,000 tons – Operating Cost/Unit is $140,000/700,000 = $0.2/ton • Ownership consists of – Purchase – Taxes and Insurance – Tax Benefits Purchase Cost • In order to get cost per ton, ownership costs must be put on an annual basis so it can be divided by annual production • Earnest’s trucks cost $700,000 each – Can make it a series of annual payments – Maybe in life it is - Maybe the share holders paid – Break it up as if it were annual payments at interest rate for loan of shareholders rate Need the Life of Equipment or Loan • Mining trucks are often 7 years • Assume shareholders pay and want 15% rate of return • A/P0.15,7 = 0.2404 • $700,000 * 0.2404 = $168,280 / Year Depreciation • Truck is used up by working it in production – Already said life was 7 years • Simple Way to Depreciate is called “Straight Line” – – – – Truck was worth $700,000 Is used up over 7 years $700,000 / 7 = $100,000 per year used up Per unit cost analysis uses straight line More Depreciation • In practice things depreciate faster at first – New car dropping $2000 when drive it off the lot • Other Depreciation Methods such as Sum of Years Digits – Income tax has schedule IRS developed called ACRS (Accelerated Cost Recovery Schedule) – Not going to cover right now Depreciation and Tax Advantage • Earnest’s trucks can be depreciated on Federal and State Income Tax – Government taxes business income just like yours – Government allows you to deduct from your income • If self employed you can deduct business expenses • Only pay tax on what you actually cleared – Crader Mining has to buy trucks - it’s a business expense taken by depreciation The Tax Advantage • Straight Line Depreciation give $100,000/year • Crader will deduct $100,000 from their reported earnings – Saves them money on taxes - should be considered in per unit cost • some analysis are done before taxes • some are done after taxes – Large businesses pay was about 36% Federal and 3% state - now 32% Federal 3% State Calculating Tax Advantage • $100,000 deduction – 35% tax rate – $100,000 * 0.35 = $35,000 – $35,000 in income tax that don’t have to pay Property Tax and Insurance • Property Tax is about 2%, Insurance is about 2% • Problem is 2% of what? • Insurance and Property Tax are on the value of the property - which is changing • We need an annual cost but its different every year • Use what is called “Average Annual Investment” Depreciation and Average Annual Investment Initial Value for Tax and Insurance $700,000 $600,000 in Year 2 Note that average value is not middle value of $350,000 which occurs at time 3.5 years (taxes and insurance are based on value at the beginning of the year) $500,000 in Year 3 ($700,000 + 600,000 + $500,000 + $400,000 + $300,000+ $200,000 + 100,000)/7 = $400,000 General Formula (n+1)/2n * Initial Value = Average Annual Investment $100,000 in Year 7 0 1 2 3 4 5 6 7 Apply (7 + 1)/ (2*7) * $700,000 = $400,000 Average Annual Investment Taxes Are 2% of Average Annual Investment $400,000 * 0.02 = $8,000 Insurance is 2% of Average Annual Investment $400,000 * 0.02 = $8,000 Summing Annual Ownership Cost • • • • • $168,400 / year from purchase $16,000 /year in taxes and insurance -$35,000 / year in tax savings $149,400 / year in Ownership Cost $149,400 / 700,000 tons / year = $0.2134 Finishing the Problem • Ownership Cost/ton = 21.34 cents • Operating Cost/ton = 20.00 cents • Total Cost per ton to move rock with the haul truck is 41.34 cents/ton • Most Engineering Applications can do a per unit cost the same way – Often an analysis of choice in trying to justify or explain new equipment purchases