The Earned Income Tax Credit (EITC)

advertisement

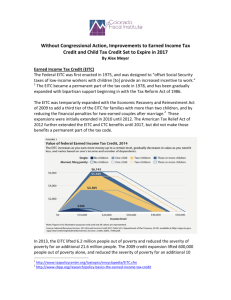

The Earned Income Tax Credit (EITC) “A tax credit for people who work, but don’t earn high incomes” 1 EITC is a Refundable Tax Credit • It was enacted in 1975 to offset families’ Social Security payroll tax withholding • Workers who don’t earn enough to owe income tax can still get a refund • Today it supplements the earnings of workers with lower wages • Available to families and individuals who work but earn low to moderate income 2 Who May Qualify? All taxpayers claiming the EITC: • Must have a valid social security number • Must not file as “married filing separately” • Must not file form 2555 or 2555-EZ • Must meet the investment income limitation 3 Who May Qualify (Cont’d) All taxpayers claiming the EITC: • Must have earned income • Cannot be the qualifying child of another person • Generally, must be a U.S citizen or resident alien for the entire year 4 Definition of Qualifying Child Relationship: • Son, daughter, grandchild, stepchild, adopted child, brother, sister, stepbrother, stepsister, (or their descendents) or foster child placed by a government or private agency Residence: • Must live with worker in the U.S. for more than half the year Age: • Under 19 or 24 if full time student or any age if totally and permanently disabled 5 How Much is the EITC Worth? • $6,044-Workers raising three or more qualifying children who earned less than $46,227 ($51,567 married filing jointly) • $5,372-Workers raising two qualifying children who earned less than $43,038 ($48,378 married filing jointly) 6 How Much is EITC Worth? (cont’d) • $3,250- Workers raising one qualifying child who earned less than $37,870 ($43,210 married filing jointly) • $487-Workers with no qualifying children who earned less than $14,340 (19,680 married filing joint) with no qualifying children • 2013 Investment income must be less than $3,300 7 Claiming the EITC Eligible taxpayers must: • File a tax return • Complete and attach Schedule EIC (if claiming a qualifying child) to the return • Complete a worksheet to figure the credit 8 Common EITC filing errors • Claiming a child who is not an EITC qualifying child • Incorrect filing status • Incorrect amounts • Incorrect Social Security Number 9 Disallowed EITC claims Taxpayers filing misleading claims: • Must recertify • May be disallowed from taking the credit 10 EITC Assistance & Products for Taxpayers • Form 1040,1040A,1040EZ instructions • www.irs.gov/eitc all services including the EITC tax trails, EITC assistant and electronic qualification check list • Publication 17, Individual Income Guide • Publication 596, Earned Income Tax Credit • Publication 3311M, EITC Q & A’s • 1-800-839-1040 for tax questions • 1-800-839-3676 for tax products (forms request for taxpayers) • 1-800-839-4477 for pre-recorded information 11 EITC Assistance and Resources Internal Revenue Service (IRS) • 1-800-839-1040 • www.irs.gov/eitc • www.irs.gov • www.aarp.org New Jersey Community Resource New Jersey Division of Taxation • 1-888-895-9179 • www.njtaxation.org New Jersey Helps • www.njhelps.org 12 Free Tax Preparation is Available Volunteer Income Tax Assistance (VITA) and AARP sites throughout the state • Community volunteers are trained and IRS certified. • Sites are sponsored by community groups, churches, banks, and nonprofits. • Free electronic filing available. 13 Questions ? 14