3.1 Measuring National Income

advertisement

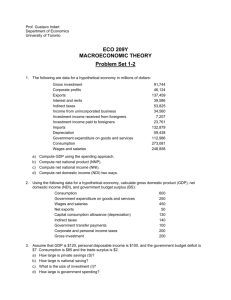

3.1 Measuring National Income Circular Flow of Income National income Sum of all final goods and services produced in an economy during a given time period. (1yr) E=O=Y Simple Two-Sector Model Leakages? Injections? What is missing? Total injections= Total Leakages Transfer Payments How are welfare, education, social programs accounted for? Rule: Only expenditure flows which have a corresponding output are counted. Methods of Measurement Factor Income: Total payments for FOP Employment Rental Income Profits Interest Subtract stock appreciation =GDP at factor cost Expenditure Method: Total Expenditure Consumtion (C) Investments (I) Government Expend. (G) Exports (X) Subtract Imports (M) Add subsidies =GDP(same as factor cost) Output Method Value-added at each level of output (to avoid double counting) National and Domestic Product GDP=output created using Domestic FOP How do you deal with foreign owned companies within economy? Domestic assets held abroad? GNP (Gross National Product) = GDP+Net property income from abroad LDC= GDP>GNP Why? They have few companies abroad that are repatriating income. MDC=GNP>GDP Many companies abroad Gross and Net National Product NNP= GNP-Depreciation Nominal vs. Real Nominal= face value Real= adjusted for inflation GDPr= GDPnom/CPI X 100 Consumer Price Index (CPI) Base Line= 100 CPI of 106 = 6% increase in prices GDP Deflator CPI: only consumer goods GDP Deflator: All goods in GDP GDPreal = GDP nom / Deflator X 100 Total and Per Capita Income per capita = GDP/population Real Income per capita: adjusted for inflation Which countries do you think are in the top ten by GDP per capita? GDP by Country USA 32.9% 4.65% Japan 13.4% 2.09% Germany 6.0% 1.36% Britain 4.6% 0.99% France 4.2% 0.97% China 3.7% 20.84% Italy 3.5% 0.95% Canada 2.3% 0.51% Mexico 2.0% 1.62% Spain 1.9% 0.65%