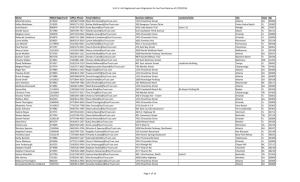

Self-Funded Trusts D4

advertisement

Personal Support Trust Sponsored by The Arc of Northern Virginia and SunTrust Bank What Is A Special Needs Trust? It is a trust designed to: provide benefit to and protect the assets of a person with a disability and still allow the individual to be qualified for and receive government benefits such as Medicaid and Supplemental Security Income. It can also be used to help individuals with disabilities who cannot manage their money. Why Do I Need A Special Needs Trust? In the Commonwealth of Virginia, many public services you or your loved one receive or one day will need are tied to Medicaid and Social Security Eligibility. Medicaid and Social Security have limits on what the individual with disabilities can earn each month and save in a savings or checking account. If you go over these limits, services can stop. What’s the Purpose of a Special Needs Trust? Provides a manager to meet the needs of the Beneficiary which may arise and cannot otherwise be met by the beneficiary's personal resources or benefits. Promote the dignity, comfort and happiness by providing supplemental care, treatment not otherwise covered. Who is Eligible For A Special Needs Trust? Anyone with a physical, mental or intellectual disability as defined by the Social Security Act; Elderly; Receiving Medicaid or Disability Income. What is the difference between a revocable and irrevocable trust? A revocable trust is one that you can change during your lifetime. In other words, you can regain control of the trust assets or request other changes in the trust agreement. An irrevocable trust, once established, transfers all control of the trust assets to the trustee and cannot be changed. An irrevocable trust may be more advantageous from a tax standpoint. What Can I Use The Trust For? Dental Care Costs Trips – visiting siblings; going to the beach Renting a tux for a cousin’s wedding Pre-need Burial Expenses Anything not covered by Medicaid or SSI The Trust cannot be used for the Following: Recipients of SSI cannot use the trust to pay for food and shelter; including electricity, gas and water bills, property taxes, homeowners insurance and condo association fees. For Self-funded account holders, the trust cannot pay for burial or funeral expenses for the beneficiary once they pass away. The Trust cannot hold loans. The Trust cannot pay cash to the beneficiary. The trust cannot make gifts or use funds for anyone other than the beneficiary. Types of Special Needs Trusts Self-Funded Trusts D4 (a) - Private D4(c) - Pooled Third Party Trusts funded unfunded Self-Funded Trusts – d 4 (a) Private 1. Established by the parent, guardian 2. Funded by the individual 3. For the sole benefit of the individual 4. Created by a private attorney or institution Self-Funded Trusts – d 4 (c) Pooled 1. Established by the parent, guardian or the individual; 2. Funded by the individual 3. For the sole benefit of the individual 4. Established with a Pooled Trust Program by utilizing a Master Trust Document and Joinder Agreement Self-Funded Trusts Most Self-funded accounts are established due to: A personal injury settlement An inheritance Any other money that threatens benefits Self-Funded Trusts Upon the beneficiary’s death; remaining funds in the account are subject to a Medicaid Payback Provision. Third Party Trusts – Unfunded or Funded May be setup by parents, grandparents, siblings, aunts and uncles or friends. Used frequently by parents to plan for the Future: Set up as part of your estate planning process to protect assets and services that your loved one is receiving. Avoid probate to have funds available immediately. Ensure your loved one has a way to obtain the items, services or the extra’s you want to make sure they have. These can be funded during your lifetime or left unfunded until your passing. Third Party Trusts – Unfunded or Funded May be established by a private attorney or institution. May be established as part of a pooled trust program What Is A Pooled Special Needs Trust (a.k.a. d4c) Managed by a Non – Profit organization Funds from individual participants are pooled for fee and investment purposes Fees are calculated based on the total amount of pooled funds Why Choose A Pooled Trust? Pooled trusts are administered by non-profit agencies - professional staff, greater sensitivity and individualized services. Pooled trusts offer professional investment management by a bank. There are no minimum or maximum funding requirements They are more affordable for families or individuals How Does a Pooled Trust Work? Beneficiary Grantor Primary Representatives The Arc of Northern Virginia - Trust Manager SunTrust Bank - Trustee Why Choose SunTrust and The Arc of Northern Virginia? The Arc of Northern Virginia: a leading advocate for individuals and families with disabilities for over 50 years; knowledge, expertise, and sensitivity to meet your needs. Pooled Trust Program has been in existence for over 10 years; Pooled Assets currently managed: ca. $5.6 million with $3 million in future dollars; Experts available with whom we consult about changes in regulations; Our service is in partnership with SunTrust Bank, a leader in the financial services industry. The Arc of Northern Virginia and SunTrust Partnership Program Design Two levels of management Flexible Funding Alternatives (stocks, property, living wills, life insurance) Ability to work directly with SunTrust Private Wealth Management Team Efficiency in transactions Reduced fees SunTrust’s Team Approach to Managing the Trust Program Private Wealth Management Team – Team of specialists dedicated to serve each individual relationship Specialists include: Personal Asset Management Advisor Fiduciary Specialist Client Advisor Insurance Specialist Credit Advisory Estate Administration Team Approach to Money Management Investment Committee What Are The Trustee’s Roles? Account Reporting Asset Management Tax Reporting Account Administration Check Disbursements Asset Allocation Models Preservation of Capital Maximum Taxable Income with Growth Primary Taxable Income with Growth Primary Growth with Taxable Income Balanced Growth with Taxable Income Balanced Growth with Tax Exempt Income Maximum Growth Management of Individual’s Accounts Each account is assigned a separate Tax Id number Individual Account and Tax Reporting Each subaccount has an individualized portfolio allocation Individual monthly review meetings available Assist clients with estate planning issues How Do I Access the Funds Once they are in the Trust? Easily. You complete a simple disbursement request form stating the purpose of the request, amount of the request and to whom to send the check. In many cases, supporting documentation is needed, such as a receipt or bill. Then send the request form to The Arc. The Arc then forwards info to SunTrust. We understand that everyone is different and we can be creative in accessing funds in other ways as well; such as direct bills. How Much Does it Cost? The establishment fee for the Special Needs Trust with The Arc of Northern Virginia is $1050.00. The annual fee for an unfunded account is $65.00 until the account becomes funded. The Foundation of The Arc of Northern Virginia bills 75 basis points annually of the individuals account. (. 75%) (subject to change) SunTrust Bank bills 90 basis points annually. (. 90%) (subject to change) How Do I Get Started? Call Tia Marsili at The Arc of Northern Virginia 703-532-3214 ext 115 tmarsili@thearcofnova.org To read more, visit our website at www.thearcofnova.org Trust Why Do I Need To Plan? Creating a plan for your loved one’s future will provide you with peace of mind.