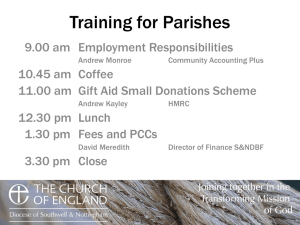

Gift Aid and GASDS Nov13

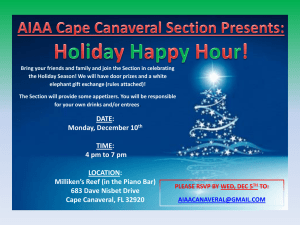

advertisement

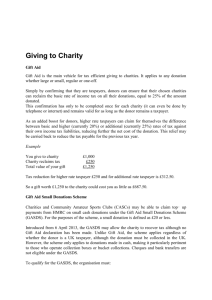

Charities Online New Gift Aid claim process Guidance available www.parishresources.org.uk/giftaid/ Quick Check….. Gift Aid declarations….. • New wording last year • Please treat as Gift Aid donations all qualifying gifts of money made from the date of this declaration and in the past four years. I confirm I have paid or will pay an amount of Income Tax and/or Capital Gains Tax for each tax year (6 April to 5 April) that is at least equal to the amount of tax that all the charities (including churches) and Community Amateur Sports Clubs that I donate to will reclaim on my gifts for that tax year. I understand that other taxes such as VAT and Council Tax do not qualify. I understand the charity will reclaim 25p of tax on every £1 that I give. • 25p instead of 28p on literature, websites, etc. Three Gift Aid reclaim options Paper ChR1 Claim Form + ChR1CS (Continuation sheet) Only available direct from HMRC Form will be handwritten, scanned and data extracted ChR1 - space for 15 Gift Aid donors + (6 Other taxed income items) + 2 Community Buildings + 5 Connected charities ChR1CS - space for 5 more extra Gift Aid donors Photocopies not acceptable Typed schedules & Covering letters not acceptable Experience thus far OK for 30 or so donors Once a year With a glass of wine! Questions around data – out of date postcode etc. Online claiming Now live: • only charities registered with HMRC can access. • must first register with Government Gateway on line • Activation PIN posted to authorised official • then need to go back to Gov’t Gateway and activate online service. NB Old systems (R68i) now withdrawn. Online claiming • Needs spreadsheet of schedule • Download Office Libre, unless Excel 2010 or later. • Can cut and paste (example offered on PR site). Online claiming • More data required e.g. address and First name/initial Online claiming • Timescales: Gift Aid on Accounting year (calendar year) • But only for interest payments. • GASDS on tax year Third Party Software route • A data file is created from a Gift Aid software package • Automatically submitted to HMRC via Government gateway • Format of data is checked (validated) and acceptance of data is acknowledged • Software solutions for the church include Donations Co-ordinator and FundFiler. Charities Online New Small Donations Scheme £1,250 extra each year for most churches Guidance available www.parishresources.org.uk/giftaid/smalldonations/ In a nutshell… Small cash donations: • small – donations of £20 or less, • cash – in coins or notes. Standing orders, cheques, text or online giving etc are not eligible, • giving/donations only. Money from raffles, tombolas, sales and other income that would not qualify for Gift Aid cannot be included in the scheme. from individuals, received in the building, and on which no Gift Aid claim has been made. Two parts to the scheme….. Core or “Top-Up” Community Buildings HRMC’s view is that PCCs are controlled by the Diocesan Bishop DBF and DBE. and are ‘connected charities’ under the scheme Two parts to the scheme….. Core or “Top-Up” Community Buildings Each community building … £5,000 limit for each Community Building, which includes churches, halls and schools. (separate guidance note) Must be used for charitable activities (e.g. worship or occasional offices) at least six times in a year, with at least ten people attending. What counts towards Community Buildings part….. Loose plate Regular giving envelopes no Gift Aid declaration received When 10 or more people in a service Two pieces of evidence needed Cash deposit slips from a bank branch in the UK showing at least the amount claimed under GASDS. Vestry forms which provides evidence of the donations that are eligible. Envelope register will split into Gift Aided donations and ones eligible for GASDS. 1. Vestry Record 2. Envelope record Claim using Gift Aid claim More info to follow John Preston National Stewardship Officer Church of England Guidance available www.parishresources.org.uk Encouraging generosity…… • • • • Holistic generosity – time, hospitality, money Reflecting God’s generosity and grace Within a context of discipleship Expressing the values of the church community Why preach and teach stewardship? Resourcing Mission & Ministry Vital for discipleship – the application of faith. Good corporate stewardship helps churches develop Overflowing generosity is transformational. Faithraising not Fundraising To answer the question….. Motivations for giving….. Love Motivations for giving….. Thanksgiving Motivations for giving….. For a Purpose Church Giving Why do people give to Church? Breadth of audience Incredibly diverse range of motives for giving, for coming to church; & wide range of understanding of the church’s mission and needs. Particular need is to help parishes link generous giving with mission & ministry outcomes and the parish’s vision Need to communicate The outcomes of giving to the Church. The vision and purpose of our churches. The costs and financial situation of our churches. Communication to our givers…. Say “Thank You” annually Giving Programmes – a common aim That those willing to support the Church’s work, • after prayerful reflection and • informed by the Church’s vision, mission and finances will review their giving, (and provide a pledge of what the church can expect to receive). Common Elements of Giving Programmes…. Preach & Teach Generosity Element of Thanksgiving Link Giving with Mission Outcomes and explanation of Costs. Prayer and Reflection A word on legacies….. • A part of stewardship • Some will want to give in this way, others will not. • Timing varies – as people are considering making or reviewing their will. • An option on a pledge form to ask for more details. Legacy promotion guide…..