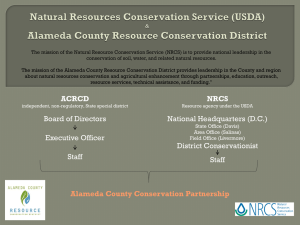

Easement Programs

advertisement

Easement Programs • Voluntary Programs – Willing buyer & willing seller NRCS Easement Programs • WRP – Wetland Reserve Program • GRP – Grassland Reserve Program • FRPP – Farm and Ranch Lands Protection Program Wetland Reserve Program • Overview – Achieve the greatest wetland functions and values, along with optimizing wildlife habitat, on every enrolled acre – NRCS holds CE deed – Restrictive-use easement deed – 50 CEs in Wyoming Grassland Reserve Program • Overview – Assist landowners in protecting grazing uses and related conservation values through rental contracts and easements • Wyoming – Four Easements • Permissible Activities – Grazing plan required – Common grazing activities – Haying, mowing or harvesting for seed production • Nesting season restrictions Grassland Reserve Program • Eligible entity may hold the easement – Entity must provide a share of the purchase price equal to U.S. share – U.S. maintains contingent rights Farm and Ranch Lands Protection Program FRPP CE Holders – Rocky Mountain Elk Foundation – Wyoming Game & Fish – Wyoming Stock Growers Agricultural Land Trust – – – – Wyoming Land Trust The Nature Conservancy The Conservation Fund Sheridan Community Land Trust Farm and Ranch Lands Protection Program • Voluntary program to help farmers and ranchers preserve their ag. Land – Entire operations/watershed scale • Provides matching funds (up to 50% fair market value of the easement) to “eligible entity” – State, or local government and non-government organizations, i.e. Land Trusts • Existing farm and ranch land protection programs to purchase easements FRPP • Eligible Landowners – FRPP participants to be in compliance with highly erodible lands (HEL) and wetland conservation (WC) provisions of the Farm Bill prior to receiving FRPP funding. NRCS will confirm compliance with the highly erodible lands (HEL) and wetland conservation (WC) provisions before obligating funding in the cooperative agreement. FRPP • Adjusted gross income – Landowners with an average adjusted gross income limitation exceeding $1.0 million for the three tax years immediately preceding the year the cooperative agreement is signed are not eligible to receive program benefits or payments. However, an exemption is provided in cases where 2/3 of the adjusted gross income limitation is derived from farming, ranching, or forestry operations. Process 1. Financial Assistance Allocation 1. varies 2. 3. 4. 5. 6. Request for Proposals Ranking of Proposals Notification of Funding Supporting Documentation Cooperative Agreement – Funds obligation mechanism Process • Dollars are obligated – now what? Fiscal Year of Fund Obligation Closing Deadline Payment Request Deadline 2011 March 31, 2013 August 31, 2013 2012 March 31, 2014 August 31, 2014 2013 March 31, 2015 August 31, 2015 Funding Match