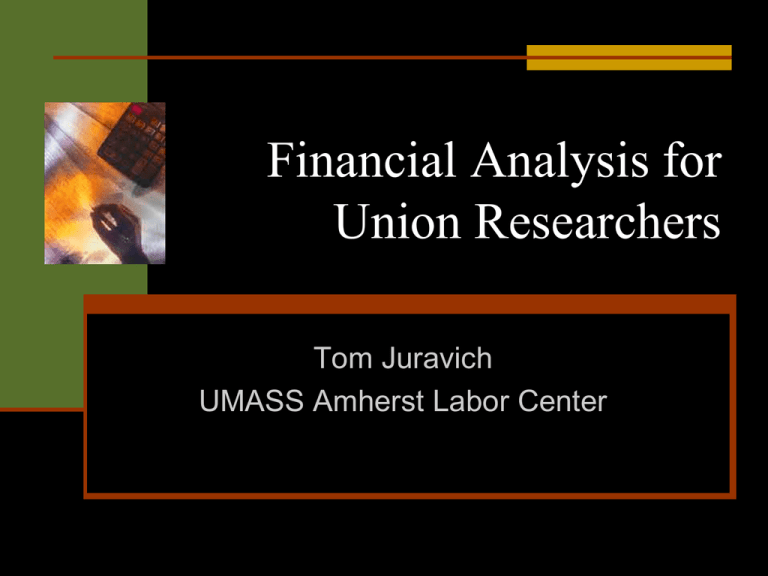

Financial Analysis for Union Researchers

advertisement

Financial Analysis for Union Researchers Tom Juravich UMASS Amherst Labor Center Why Do Strategic Researchers Avoid Financial Analysis ? Tom Juravich 2 How Corporate Finance Typically Used in Labor Movement The CEO is making $1.25 million, so you can afford giving us a raise Your revenue is up 15%, so you can afford to give us a raise Your stock price has gone up by 10%, so you can afford to give us a raise Tom Juravich 3 Goals for this Session Demonstrate how all these uses of financial analysis are incorrect Provide introduction to basic financial analysis In process demystify corporate finance Begin process of self-study Tom Juravich 4 Our Approach Learn by doing No extensive hypotheticals Work through a real example (Verizon) using information available to anyone online Model a method to use on your own case Tom Juravich 5 Three Basic Financial Skills Understanding basic financial statements Income Statement Balance Sheet Statement of Cash Flow Working with key financial ratios Stock analysis Tom Juravich 6 What We Can Accomplish Assessment of overall financial condition How the company generates profit The relative importance of various segments An understanding of financial change over time Comparison with other firms and the industry Tom Juravich 7 What We Won’t Accomplish Not provide the basics of accountancy Not conduct a full blown financial analysis Tom Juravich 8 A Few Reminders Look at the forest not the trees Don’t get fixated on any one detail, especially one you don’t understand Use your knowledge of the firm to understand the numbers Tom Juravich 9 Finding Financial Information Readily available for publicly held firms In 10-K reports Many Secondary sources Yahoo Finance – basic Mergent – more detailed We will use Yahoo for financial statements We will use Mergent for financial ratios, segments Tom Juravich 10 Concepts and a Vocabulary Each financial statement contains specific concepts and vocabulary Will focus on key concepts for each statement Get familiar with concepts before we get to the numbers Key concepts will be bolded in the text Tom Juravich 11 Income Statement – What Is It? Also referred to as a profit and loss statement (P&L) Shows the performance of a firm over a period of time (year/quarter) Provides insights into the operation of a firm A moving picture of a firm Tom Juravich 12 Income Statement – Basic Formula Revenue – Expense = Income What is Revenue? Sales Inflow of Resources What are Expenses Expenditures Outflow of Resources Tom Juravich 13 Income Statement – Gross Profit Revenue – Cost of Goods Sold (COGS) = Gross Profit What makes up COGS? Materials Labor Costs Anything directly involved in production COGS does not include all costs of doing business That’s why is call Gross Profit Tom Juravich 14 Income Statement – Operating Income Gross Profit – (Sales, general, and administrative + depreciation) = Operating Income What is SG&A Sales costs Administrative costs Management costs What is Depreciation Cost due to wear and tear on equipment Operating Income a more fine-tuned measure Tom Juravich 15 Income Statement – Net Income Operating Income – Taxes = Net Income Everybody knows what taxes are Net Income is the bottom line of the Income Statement A common financial measure Tom Juravich 16 Income Statement– Simple Example I just bought some studio equipment to produce a CD. What would an Income Statement look like? Revenue CD Sales COGS Studio Supplies Studio Musicians Manufacture of CDs Gross Profit SG&A Administrative Staff Person CD Give-aways Depreciation Studio Equipment Operating Income Tom Juravich Income Tax Net Income 17 Income Statement – Real Example Actual Income Statements are much more detailed Categories are broken into sub-categories Additional adjustments are made Begin by looking for key concepts Tom Juravich 18 Tom Juravich 19 Tom Juravich 20 Income Statement – Limitations Includes one kind of financial information What it doesn’t include: Anything about debt Anything about buildings or equipment Anything about stockholders To get this information –Balance Sheet Tom Juravich 21 Balance Sheet – What Is It? A snapshot of a firm at one point in time Based on double entry accounting By definition a balance sheet must balance Tom Juravich 22 Balance Sheet – Basic Formula Assets = Liabilities + Shareholder’s Equity Shareholder’s Equity is treated as if it were a loan Tom Juravich 23 Shareholders Equity More Than it Seems Also includes Retained Earnings Funds a firm carries over to next year Net Income - dividends paid to stockholders Can be negative (loss) One of the reasons the balance sheet balances Conceptually distinct from shareholders equity – yet included in this section of balance sheet Tom Juravich 24 Balance Sheet – Detailed Assets Current Assets Cash Accounts Receivable Inventory Non current (Fixed) Buildings Equipment Liabilities Current Liabilities Accounts Payable Short-term Notes (less than 1 year) Non-Current Long term debt (more than 1 year) Tom Juravich 25 Balance Sheet – Simple Example Let’s go back to my music example Assets Current Assets Cash -- Checking account balance Accounts Receivable – What I’m owed for CDs Inventory – Unsold CDs Non current (Fixed) Buildings – My barn studio Equipment – Recording gear, instruments Liabilities Current Liabilities Accounts Payable -- What I owe recording studio Short-term Notes – Credit card balance Non-Current Tom Juravich Long term debt – Home equity loan 26 Tom Juravich 27 Tom Juravich 28 Cash Flow –What Is It? Tracks the generation and use of cash in three basic areas Investing Financing Operations The least useful annual financial statement Quarterly statements more helpful Tom Juravich 29 Tom Juravich 30 Tom Juravich 31 Why Financial Ratios Limits to eyeballing financial statements Ratios combine one or more pieces of data In essence “normalize” data Useful in comparing across companies Tom Juravich 32 Key Financial Ratios No need to calculate by hand Many different sources Stick with one source – methods may vary Many different classifications and definitions Tom Juravich 33 Key Financial Ratio –Types Although there are many classifications, we will explore ratios in four areas Liquidity Profitability Debt Management Asset Management Tom Juravich 34 Liquidity Ratio Current Ratio Current Ratio = Current Assets Current Liabilities Accepted Standard: Varies by industry Low Ratio: May be unable to meet obligations High Ratio: Too conservative growth plan Loan rates often tied to maintaining a certain current ratio Tom Juravich 35 Profitability Ratio Return on Assets (ROA) ROA = Income Before Taxes (Operating Income) Assets Accepted Standard: Varies by industry and amount of fixed assets Low Ratio: Poor use of assets High Ratio: Strong performer Tom Juravich 36 Debt Management Ratio Debt/Equity Debt/Equity = Debt Equity Accepted Standard: Less than .8 Low Ratio: Too fiscally conservative High Rates: Too risky Tom Juravich 37 Asset Management Ratio Interest Coverage Interest Coverage = Operating Income Interest Obligation Accepted Standard: Varies by industry Low Ratio: Too heavily burdened with debt High Ratio: Too conservative in borrowing Tom Juravich 38 Financial Ratio Summary Current Ratio – High good to a point > Return on Assets (ROA) – Higher the better > Debt to Equity – Lower good to a point < Interest Coverage – Higher good to a point > Tom Juravich 39 Tom Juravich 40 Tom Juravich 41 Key Ratios – Competitors VZ Current Ratio ROA Debt/Equity Interest Coverage 0.78 1.70 1.50 4.63 Tom Juravich T 0.66 4.69 0.71 6.36 S 1.27 (4.29) 1.16 na 42 Why A Segment Analysis? Digs deeper into company operations Identifies where revenues and income are generated Key in developing points of leverage Tom Juravich 43 Verizon Segment Analysis Tom Juravich 44 Verizon Segment Analysis Tom Juravich 45 Verizon Segment Analysis Tom Juravich 46 AT & T Segment Analysis Tom Juravich 47 AT & T Segment Analysis Tom Juravich 48 AT & T Segment Analysis Tom Juravich 49 Stock Analysis Often ignored in financial analysis Huge amount of materials available for self study Both data and analysts’ reports are readily available Tom Juravich 50 What are Analysts Saying? On a scale of 1-5, 1 = buy, 5 = sell VZ = 4 T= 3 S= 3 Tom Juravich 51 What We Learned About Verizon? 1 2 3 4 5 6 7 Tom Juravich 52 Materials for Assignment Already done the computer work and are providing you with the following: Hoover’s Financial Statements Mergent Financial Ratios (historical) Mergent Financial Ratios on competitors Segment Analysis (when available) Tom Juravich 53 Your Assignment Prepare a financial analysis presentation for your company. Overview of basic financial statements, including historical analysis Comparison with competitors Segment analysis Overall summary Remember it’s about the forest not the trees!!! Tom Juravich 54