High-level Overview of UK Regime

advertisement

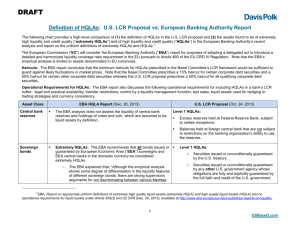

Liquidity Risk – Regulatory Update Damian Harland, Banking Policy, UK FSA. Summary Build up to the Crisis Regulatory Response: so far… Finalising International Standards Impact Study Results Pre-Implementation Period Other Regulatory Initiatives Build up to the crisis Customer funding gap of major UK banks (a) Sterling liquid assets relative to total asset holdings of UK banking sector Response to the crisis, so far… Enhanced Policy Requirements: - Systems and Controls Stress Testing, Contingency Planning “Self-assessment” of Liquidity Risk (ILAA (UK)) Cross-Border Management Quantitative Liquidity Standards Enhanced Supervision: - In-depth Supervisory Reviews - Data Collection, Peer Analysis & Monitoring Branches operating in London EEA or non-EEA bank London Branch FSA Regulatory perimeter FSA branch supervision Premodification High quality buffer No branch liquidity standards* Local systems and controls assessment No local liquid assets requirement* No recognition of head office support less than 3 months Weekly Branch level reporting (monthly if B/S <£5bn) Supervision of branch is delegated to home supervisor No local systems and controls requirements* Postmodification FSA monitors infrequent whole-firm return * All rules are waived, except for the “overall liquidity adequacy rule”, which is modified to recognise liquidity support from head office Near-term next steps Ongoing implementation of domestic liquidity policies: - Continue roll-out of supervisory reviews - Develop transparent and consistent methodologies for idiosyncratic risks - Identification of thematic risks - Contingency planning Finalising International Standards GHOS endorsed Basel Committee finalising the LCR: - Ensure liquidity pool can be used in a stress - Address limited areas of over- and under- calibration - Study whether the LCR could hinder or conflict with central bank policies - Investigate market-based criteria for allocation to Level 1 and Level 2 assets to replace ratings-based approach Target: “By the end of 2012” Impact Study – story so far Basel Committee and EBA have conducted a series of Impact Studies • Data quality improving, albeit still areas of inconsistency • Wide dispersion of results, particularly amongst smaller banks • Liquid asset shortfall around 3%-4% of total assets • Small number of banks impacted by cap on Level 2 assets or inflows Impact Studies – story so far Pre-Implementation period – EBA role CRD IV will require all institutions to report to the EBA the LCR components to assess whether it would have a “material detrimental impact” Moreover, the EBA will assess the definition of liquid assets based on market criteria Further guidelines and technical standards are required by the Regulation European Commission will then introduce legislation taking into account EBA work and international standards Pre-implementation period – EBA role To be submitted by 1 January 2013: •ITS on uniform reporting formats for LCR and NSFR, additional liquidity monitoring metrics and IT solutions for reporting (art. 403 (3) (a) – (c)), •ITS listing currencies which meet the requirement of central bank eligibility criteria for liquid assets (art. 404 (4)), •ITS on currencies with constraint availability of liquid assets (art. 407 (4)), •RTS on exceptions for such currencies (art. 407 (5)), •ITS on retail deposits subject to higher outflows (art. 409 (3)), •RTS on additional outflows corresponding to collateral needs (art. 411 (3)). Pre-Implementation period – EBA role To be submitted by 31 December 2013: •Report on the impact of the LCR (art. 481 (1)), •Report on appropriate uniform definitions of high and extremely high liquid assets (art. 481 (2)). To be submitted by 30 June 2014: •RTS on outflows for other services and products (art. 408 (3)). To be submitted by 31 December 2015: •Report on the impact of the NSFR (art. 481 (3)). PLUS: A number of BTS in the area of joint-decisions and liquidity risk management. Pre-implementation period – Industry role Contribute effectively to coherent policy-making: - Incorporating lessons learned - Evidence-based, grounded in data & analysis - Highlighting industry best practice - Capable of consistent implementation - Submission of good quality data in monitoring period Other Regulatory Initiatives Directed at banks: • Macroprudential Liquidity Tools • Structural Restrictions (e.g. ring-fencing, “Volcker” Rule) • Recovery and Resolution Plans • Asset Encumbrance Other: • Shadow Banking • Solvency II Macro-prudential Policy Aim: To control liquidity-driven balance sheet expansion and curbing credit cycles Correct for potential procyclicality of microprudential tools Discourage over-reliance on particular funding sources Tools: Time-varying liquidity buffers, structural funding measures Challenges: Calibration, data availability, application “Ring-fencing” Aim: To make banks better able to absorb losses To make it easier and less costly to sort out banks that still get into trouble; and so To curb incentives for excessive risktaking. Tools: Higher prudential requirements and structural separation Challenges: Implementation (c.f. Volcker rule)