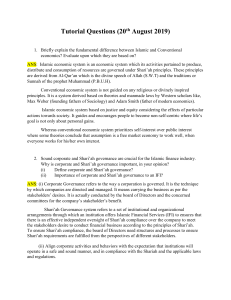

PowerPoint Presentation - British Institute of International and

advertisement

The conflict between the Shari’a and conventional business and finance laws – a practitioner’s perspective Richard T de Belder Partner Denton Wilde Sapte LLP London 1 Agenda 1. 2. 3. 4. 5. 6. 7. 8. 9. Introduction Choice of law Riba Islamic finance calculation of returns Default rate interest Taxation issues Doing business issues Regulatory issues with Sukuk Registration requirements 2 2 Choice of law • A conventional choice of law • Shari’a Supervisory Boards • Contractual variations: • This Agreement shall be governed by and construed in accordance with the laws of *, except where their laws conflict with the Shari’a, where the latter shall prevail. • Recent Variation • This Agreement shall be governed by the provisions of the laws of * to the extent their laws do not conflict with the Shari’a, where the Sharia shall apply. The interpretation of the Shari’a shall be conclusively decided by the Shari’a Supervisory Board of *. 3 3 Choice of law C’td… • Problems with these clauses • Some English decisions – the Symphony Gems and Beximco judgments • An Abu Dhabi judgment 4 4 Riba • Definition • References to interest in many Middle Eastern jurisdictions • Grounds used to justify • UAE Constitutional Bench decision 5 5 Islamic Finance calculation of returns • How calculated – by reference to a conventional benchmark • No current Shari’a compliant alternative • Justifications used 6 6 Default rate interest • Laws and practice only refer to conventional interest • Initial exclusions of such provisions in Islamic Finance transactions – the results • Current practice – compensation/late payment amounts; donated to charity. 7 7 Taxation issues • Tax laws not enacted to take into account Islamic Finance structures which are dictated by the need to be Shari’a compliant • Relevant taxes: • • • • Documentary taxes; Taxation of returns and taxation of Sukuk; Taxes on transfer of assets; Value added taxes and sales taxes • Documentary taxes • Shari’a requirements regarding an asset transfer • Ijara and Murabaha structures – two transfers of title – impact of documentary taxes such as stamp duty land tax • UK changes 8 8 Taxation issues C’td… • Taxation of returns and of Sukuk • Interest can be deducted in calculating taxable profits • Islamic Finance returns such as profit/variable returns not deductible • Effect – Islamic financial institutions could be taxable on entire profit/variable return • UK tax law changes to deal with murabaha, diminishing musharika and sukuk 9 9 Taxation issues C’td… • Taxation of transfers of assets • Issues arise due to requirement for Islamic financers or investors to have an ownership interest – assets being transferred at beginning and end of a transaction • Issues also if the customer transfers an asset as its contribution to a Musharaka • Transfers can trigger capital gains tax • UK Government has amended legislation, although there are still issues. 10 10 Taxation issues C’td… • VAT and sales taxes • Due to Shari’a requirement for ownership interests, transfers of assets can lead to a VAT charge • Conventional financial services are basically VAT exempt 11 11 Regulatory issues with Sukuk • What is a Sukuk? • Treated as “collective investment schemes” • Adverse impact when compared with conventional bonds – i.e., requirements surrounding “establishing, operating and winding up” a collective investment scheme 12 12 Registration requirements • Shari’a position on a sale/transfer of an asset • Statutory requirements to register • Impact on non-registration: • Third parties • Void • Bankruptcy issues 13 13 Doing business issues • Nature of Islamic finance products leads to creation of particular entities • Do these entities need to be licences and comply with other “doing business” requirements? • Problem areas: • Nationality limits • Annual accounts and filings • Approval of Central Bank and other regulatory bodies • Need to have physical offices, employees etc… 14 14 An example of conventional laws being used to accommodate Shari’a requirements • Differences relating to Sukuk compared with conventional bonds • Ownership issues • Current solution – common law trust; legal and beneficial ownership interests. 15 15 Laws relating to financial institutions • Banking laws usually geared for conventional banks • Prohibited activities often those that an Islamic finance institution needs to engage in: • Partnerships • Joint ventures • Owning real estate not directly connected to its business • Trading activities • The UAE example 16 16 The conflict between the Shari’a and conventional business and finance laws – a practitioner’s perspective Richard T de Belder Partner Denton Wilde Sapte LLP London 7994351 17