LTWP_Revaluation_Pre..

advertisement

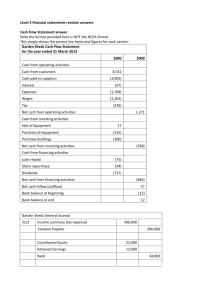

Lawrence Township Lawrence Township Mayor Jim Kownacki Councilmembers Stephen Brame Cathleen Lewis Dr. David Maffei Michael Powers What is a Revaluation? A revaluation is a program undertaken by a municipality to appraise all real property within the taxing district according to its full and fair value. Why is there a need for a Revaluation? A revaluation program seeks to spread the tax burden equitably within a municipality. For example, two properties having essentially the same market value should be paying essentially the same amount in property taxes. Inequitable assessments result from the following situations: A.) changes in characteristics in areas or neighborhoods within the municipality and within individual properties; B.) fluctuations in the economy (inflation, recession); C.) changes in style and custom (desirability of architecture, size of house; D.) changes in zoning which can either enhance or adversely effect value; E.) delays in processing building permits, which delay tax assessments on new construction Why is Lawrence Township doing a Revaluation? • On February 15, 2011 the Mercer County Board of Taxation ordered Lawrence Township to complete a revaluation for tax year 2014. • Out of the 13 towns in Mercer County only 4 have not revalued within the last 5 years, they are as follows: City of Trenton, Ewing, Hamilton and Lawrence Townships. • All 4 have been ordered to complete a revaluation by the Mercer County Board of Taxation. Effect of Revaluation on Taxes? Although revaluation will result in an increase of nearly each individual assessment, it does not mean that all property taxes will increase. You might now be thinking, “How can my assessment increase and my taxes not go up?” Remember, assessments are merely a base used to apportion the tax burden. The tax burden is the amount that your municipality must raise for the operation of county, local government and schools. Example of Revaluation Need and Impact? Pre-Revaluation Assessment Post-Revaluation Taxes Assessment Taxes Property 1 125,000.00 5,611.25 Property 1 200,000.00 4,489.00 Property 2 100,000.00 4,489.00 Property 2 200,000.00 4,489.00 Property 3 75,000.00 3,366.75 Property 3 200,000.00 4,489.00 Tax Levy Notes: 13,467.00 Tax Levy 13,467.00 1) Three identical Township Properties and pre-revaluation assessment ratio at 50% 2) All three Properties have the same market value 3) For reasons previously discussed, there are disparities in the pre-revaluation assessments 4) Post-revaluation assessments reflect fair market value 5) Property 1 has a pre-revaluation over assessment while Property 3 has a pre-revaluation under assessment Ask yourself…”How is this Revaluation going to effect me?” 1. Double your 2013 assessment 2. Does the result from Step 1 reflect the current Fair Market Value (i.e. Potential Selling Price) of your property? 3. If answer to Step 2 is YES, then your taxes after the revaluation most likely will not change considerably. Township/County Contacts Geoffrey Acolia, Tax Assessor 844-7040 Ken Pacera, Deputy Assessor 844-7038 Dave Levy, Deputy Assessor 844-7039 Website: www.Lawrencetwp.com Marty Guhl, Mercer County Tax Administrator 989-6704 Website: http://nj.gov/counties/mercer/commissions/tax/ Questions and Answers will follow Revaluation Company Presentation