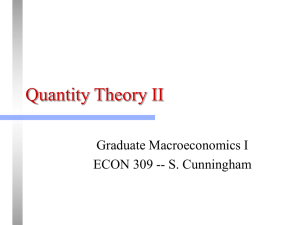

Friedman`s demand for money (Md) function1

advertisement

Friedman’s demand for money (Md) function1 Friedmans’ Md function is the single most important element of the new and improved version of the Quantity theory (also called “Monetarism,” and the “New Classcial economics, Part I). 1Milton Friedman. “The Quantity Theory of Money: A Restatement,” in Studies in the Quantity Theory of Money. Chicago: University of Chicago Press, 1956 Definitions •Md is the demand for nominal money balances (M2 assets); •YP is permanent income; • is the ratio of nonhuman to human wealth; •rb is the rate of return on bonds; •re is the rate of return on equities; •p is the general price level; •p is the expected change in the price level;and •U is tates and preferences of the wealth-holding agent Basic points Friedman argues that the demand for nominal liquid balances by economic agents depends on: 1. 2. income and wealth; the opportunity cost of holding wealth in liquid form; 3. the purchasing power of money; 4. expected changes in the value of money arising from future price level movements; and 5. tastes & preferences. Formally, it is expressed by + - - - + Md = f(YP, , rb, re, p, p; U) The signs of the partial derivatives are superimposed on the function. For example, the “positive” sign above the YP means that: Md/YP>0. For the uninitiated, this can be read as follows: other things being equal, the demand for money is positively related to permanent income Friedman’s Md as a methodological framework for empirical study •Friedman claims the demand for nominal money balances is a “stable”function of the variables delineated above. •The research program of the New Quantity theorists has accordingly been directed toward marshaling empirical (or econometric) evidence in support of the thesis that the demand for money is stable. • Having (ostensibly) “proved” the foregoing supposition, one can draw the conclusion that the income velocity of money (v) is also stable. Liquidity Trap rb 0 M M’ As the money supply expands in this range, v falls L or Md If v fluctuates wildly, then there is no determinate relationship between money and nominal GDP—hence the importance or “proving” that there is no liquidity trap The transmission mechanism The issue is this: What is the precise nature of the causal chain linking Federal Reserve policy initiatives (such as open market operations) to the time path of real sector variables--i.e., GDP, and employment? Increase in the Money supply Change in M causes divergence between “actual” and “desired” nominal balances Agents draw down money balances to “desired” level by purchasing financial assets but also new goods and services—this is a “portfolio adjustment” process. Increase in spending affects both prices and real ouput in the short run. In the long run, only prices are affected.