Payroll Expense Transfers

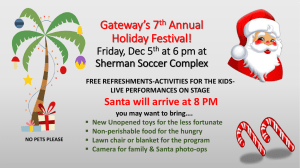

advertisement

PETs Payroll Expense Transfers Prior to Processing the PET ► EDB must be updated to reflect the funding changes PRIOR to processing PETs. ► Send an email or a SPAR to your personnel coordinator and/or MSO indicating: Employee name Effective date of change New FAU distribution REMINDER: Send requests as soon as you know of funding change to prevent more PETs ► Check the PETS online PET system to determine if PET have already been processed. Double PETs have been an issue! Prior to Processing the PET ► PETs from an uncapped fund TO a capped fund (i.e. from an unrestricted fund to an NIH grant), where the Pay Rate is over the current NIH Salary Cap rate. The PETs/EDB system will NOT allow you to process a UPAY to a capped fund if the Pay Rate is over the NIH Cap. You must have an Rx/Lx processed first to change the rate on the uncapped fund to the capped rate. ► Rx/Lx’s are usually processed by someone in the Academic Payroll Office. For DOM that would be Ernie and/or Isabel. Once the Rx/Lx has hit the PPP5302 ledger, you can PET the corrected line to the capped fund. Prior to Processing the PET ► Before posting the PET, double check the TO and FROM FAU are correct. Common Error: the TO and FROM FAU are exactly the same. ► Process PETs in a timely manner i.e. < 120 days PETs Hints & Tips Create a simple system for tracking PETs that need to be processed. ► For Faculty, use the tool in FPM to double check for required PETs. ► If the payroll details are confusing, run the QDB report one month at a time. ► Get a Request Authorization to Spend (RAS) fund established to prevent having to process PETs. ► Think about how the PET may affect certified ERS reports! ► Will the PET reopen and change the Original Payroll % column in ERS, and/or cause the report to be in Certified/Adjustment Required status? How will you justify changing the ERS report AFTER certification? Considerations for PETs System ALL PETs must address the following questions in the justification section: ► 1) Why is the transfer being made? 2) Why was the original in error? 3) Who approved the transfer? 4) How does the expense benefit new fund charged? AND for PETs greater than 120 days, the additional 2 questions must be addressed: 5) Explain delay in transfer > 120 days after original transaction date 6) What steps have been taken to prevent reoccurrence? For PETs involving Contract & Grant funds: ► PI must approve the transaction PETs > 120 days: ► ► Require EFM approval Require more time for processing so refer to the Payroll Calendar Use the “Process Web Expense Transfer for Review” date Reminder: PETs are ALWAYS a red flag to auditors