Income and Taxes Lawns R Us

advertisement

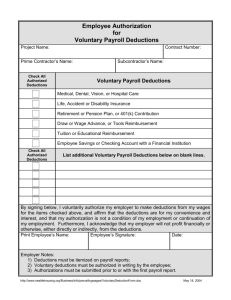

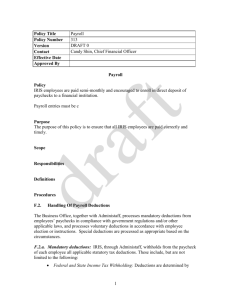

Income and Taxes Lawns R Us @2008 Oklahoma State Department of Education. Objectives Identify the different kinds of payroll deductions. Explain the difference between gross and net income. Find the net income. Income Gross Income: wages or salary before deductions for taxes and other purposes. Net Income: commonly called “take home pay”; it is your income after all deductions and exemptions. Paycheck Deductions Deduction: anything that is subtracted from the gross amount. Can either be voluntary or required. Taxes: state and federal (required) Insurance: health, life, or dental Stock purchases Meals or uniforms Retirement Other ideas? Paycheck Exemptions Exemption: Legal allowances that reduce the amount of income taxes subtracted from your gross income. You fill out a form when you are hired. You can have federal withholding allowances for yourself, your spouse, and your dependents. Payroll Taxes FICA (another name for Social Security) stands for Federal Insurance Contributions Act that covers both Social Security and Medicare. Federal programs providing benefits for people who are retired, disabled, or children or deceased workers. Any business with more than 1 employee must pay FICA (employer pays ½ and employee pays ½.) State & Federal Taxes Actual amount of income tax taken out each month depends on a person’s income. Employers use information called “tax tables.” State payroll taxes vary greatly from state to state, but federal tax rates are the same for everyone living in the United States. Why Taxes? Paying taxes is a part of the responsibility of earning an incomes. Taxes are used to support a variety of programs, such as schools, national defense, and public welfare. We all enjoy the benefits from taxes. Complete Wksht 1.2 and Activity 1.2.1 Answer all of the questions on the worksheet! Answers to Lesson 1.2 1. The difference between gross and net income is gross income is salary before deductions and net income is your income after all deductions and exemptions. Answers to Lesson 1.2 2. Some of the different kinds of deductions that an employer may deduct are: State Taxes (required) Federal Taxes (required) FICA (required) Retirement (optional) Uniforms, meals, stock purchases (optional) What else? Answers to Lesson 1.2 3. What is net pay? A. The amount of money left after all deductions have been taken. 4. What 2 taxes are included within the Federal Insurance Contribution Act (FICA)? B. Social Security & Medicare. Paycheck Deductions – Activity 1.2.1 1. The employer is Lawns R Us. 2. Zooma earned $294 before deductions. 3. Zooma’s hourly wage is $240/40hours, is $6 an hour. 4. Zooma’s deductions are: income tax, state tax, FICA, and meals. Paycheck Deductions – Activity 1.2.1 5. Divide Zooma’s net pay by her gross is pay $223.43/$294.00 = .76, which is 76%. 6. To find the percent divide the tax by her gross pay Federal Tax: $42.65/$294.00 = .145, which is 14.5%. State Tax: $8.67/$294.00 = .0295, which is 2.95%. FICA: $16.25/$294.00 = .055, which is 5.53% Paycheck Deductions – Activity 1.2.1 7. The pay period is between 8-6 to 8-12. 8. $372.01 is the income tax that has been taken out of Jennifer’s paycheck so far this year. 9. Jennifer contributed $5 to a retirement plan this paycheck. 10. Jennifer’s take-home pay was $296.26. Paycheck Deductions – Activity 1.2.1 11. To find the percent of Jennifer’s takehome pay divide her net pay by her gross pay, $296.26/$374.00, which is .792 or 79.2%. 12. To find the percent divide the tax by her gross pay Federal Tax: $30.75/$374.00 = .0822, which is 8.22%. State Tax: $9.50/$374.00 = .0254, which is 2.54%. FICA: $22.49/$374.00 = .0601, which is 6.01% Summary You should now know The difference between net and gross pay The difference between deductions and exemptions The different types of payroll deductions How to find the percent of net pay How to find the percent of federal tax, state tax, and FICA. Resources Entire http://sde.state.ok.us/curriculum/PFLP/Stud ent/Standard_1/module_1.2.pdf Basic Lesson plan: information on Payroll taxes: http://taxes.about.com/od/payroll/qt/payr oll_basics.htm Internal Revenue Service http://www.irs.gov/