Chapter 7: Budgeting 101 Overview

advertisement

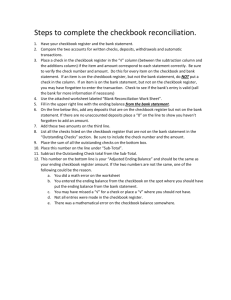

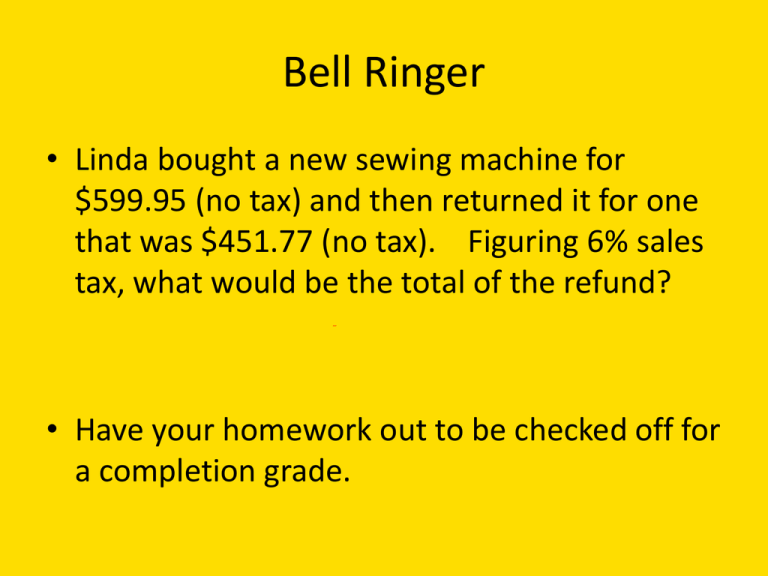

Bell Ringer • Linda bought a new sewing machine for $599.95 (no tax) and then returned it for one that was $451.77 (no tax). Figuring 6% sales tax, what would be the total of the refund? • Have your homework out to be checked off for a completion grade. Bell Ringer Answer • $599.95 * 6% = $36.00 in tax. • $599.95 + $36.00 = $635.95 • $451.77 * 6% = $27.11 • $451.77 + $27.11 = $478.88 • $635.95 - $478.88 = $157.07 Agenda • Bell Ringer / Announcements/College Survey Results – 5 mins. • How To Do Your Banking ANSWERS– 5 minutes • Dave Ramsey – Parts 5 & 6– 20 minutes – NO NOTES • Personal Budget Activity Description – 30 minutes How To Do Your Banking • Read Chapter 5 – Pages 16 & 17 • Complete Situation A (pages 18 - 20) and Situation B (pages 20 – 21). How To Do Your Banking Answers 1. 2. 3. 4. 5. $312.96 (Balanced Checkbook) $343.31 (Ending Balance on Statement) $0.00 (Outstanding deposits) $30.35 (Outstanding checks) $312.96 (Balanced checkbook) Before You Begin – Chapter 6 1. 2. 3. 4. 5. True True False False True 6. False 7. True 8. False 9. True 10. False Money Facts 1. 93% of teens agree that it is important to live within their means and have good money habits in order to be successful. 2. 86% of teens expect their parents to stop supporting them before age 25. 3. 63% of teens say they are knowledgeable about money management, including budgeting and saving. 4. 62% of teens believe they are prepared to deal with the finances after high school. 5. 41% of teens say they are very or somewhat knowledgeable about how to budget money. 6. 34% of teens say they are very or somewhat knowledgeable about how to balance a checkbook and reconcile an account register to a bank statement. 7. 51% of teens say they are very or somewhat knowledgeable about how to write a check. 8. 58% of teens have more than $100 in savings. 9. Teens report spending an average of $19 per week. 10. The top four things teens spend money on (according to our survey of 1,000 students around the country) are food, clothes, gas and entertainment. Chapter 7: Budgeting 101 Overview This chapter explains the benefits of a budget and demonstrates how to complete a zerobased budget. An in-depth explanation of balancing a checkbook is included. Vocabulary Words for Chapter 7 Page 116 • • • • • • • • Active ATM Card Budget Carbon Checks* Currency Debit Card Discipline Envelope System • • • • • • • Hoarding* Impulse Purchase Persistent* Pro-active Procrastinate Reconcile Zero-based Budget Chapter 7 Vocabulary NOT IN BOOK! • Carbon Checks - a duplicate check that is included behind the original check on carbon paper. These are beneficial for people who often forget to write their checks down in their check register. • Hoarding - the excessive collection of items, with the inability to discard them. • Persistent - to have strong initiative; when one happens ‘to’ things. Learning Outcomes • You will be able to explain how money is active. • You will be able to analyze the reasons why people do not budget • You will be able to examine common problems associated with budget failures • You will be able to explain the benefits of a budget Chapter 7 Lesson Plans Monday: Introduce Chapter 7 Parts 1 and 2 of Dave Ramsey Tuesday: Parts 3 and 4 of Dave Ramsey How to Write Checks Wednesday: Parts 5 and 6 of Dave Ramsey Consumer Equity Activity Thursday: Family Budget Activity Friday: Family Budget Activity Tuesday Chapter 7 Review Wednesday Chapter 7 Test Consumer Equity Activity • Use the information on the Consumer Equity sheet to fill out a Consumer Equity Form for each family. (There are 2 families) • Answer the two questions at the bottom of the Consumer Equity sheet. • Staple your Consumer Equity sheet and Consumer Equity forms together and turn in to the tray. How to Write a Check Activity 40 points. Turn in to tray when finished! Step 1: Read ‘How to Write a Check’ on page 1 – CHECK THE BOARD FOR AN EXAMPLE. Step 2: On page 2, write the following three checks: Check #1 – You bought groceries at Kroger for $123.96 Check #2 – You paid your cell phone bill to AT&T for $96.25 Check #3 – You paid your senior/junior dues to Moore for $50.00 Step 3: Read ‘Part 2’ on page 3, regarding filling out a check register properly AND page 97 in your workbook. Step 4: Complete the check register, using the three checks you just wrote. Step 5: You made a deposit of $63.25 to your account. Add this to your check register. Step 6: In the white space on page 3, answer the following question: ‘Why is it important to fill out a checkbook register and balance your checkbook each month, even though my bank has online banking?