Hannah Mackinlay

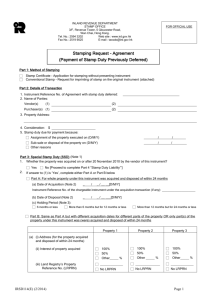

advertisement

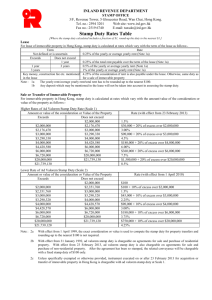

SDLT Hannah Mackinlay LLB MA Solicitor www.propertylaw.guru IT'S NOT STAMP DUTY There is no Stamp Duty • There is no Stamp Duty on deeds any more • But there is a new tax on land transactions • A Self-assessed tax not a voluntary duty • Just like all the other taxes with the same HMRC powers to investigate Not a duty on docs • A transfer for £255 k could be taxed at: • Market value if connected company • 0% if relief or exemption • 1% if averaged - multiple resi. purchases • 3% if standalone and up to .. • 5% or more if linked with another transaction Communication • Clients must know it is not Stamp Duty • And that it is like Income Tax • Call it SDLT on everything esp. statements • Make it clear that the figures stated can be reviewed by HMRC • And that it isn’t part of your fee to deal with queries raised The taxpayer is key • Dangers of automated systems • Need to ask questions of the clients • If there are other Linked Transactions • Connected Parties • Fixtures and other consideration • Other parts of the deal not revealed to you SDLT5 - not finality • Land Registration is not the aim of submitting an LTR • Long time to catch up • Warning bells being rung by HMRC • More investigations likely of ordinary conveyancing transactions – Orsman v HMRC ([2012] UKFTT 227 • You might end up paying the extra tax, penalties and for thecosts of the investigation! ITS NOT STAMP DUTY Risk management • Hurlingham Estates v Wilde & Partners 1997 • Enquiry window - up to 20 years • New penalties regime - 30% to 100% of tax Self Assessment • Just like all the other taxes • Voluntary Disclosures • Don’t get caught underwriting the amount of the tax • Or you will end up paying it! • Make it clear that it is subject to enquiry or variation Structure • ‘A land transaction’ • ‘Chargeable Interest’ • Exempt interest vs. Reliefs Effective Date • Effective Date • Substantial Performance • Examples Commercial or Residential? • Significance - Multiple property relief if Residential for example • Definition is an ‘exhaustive’ one • When do you apply the test? • Rates of tax and Enveloped Dwellings - ATED IT'S NOT STAMP DUTY Linked Transactions • Example - easy to miss or be misled • Linked transactions, enquiries and warnings • Linked even if no contractual linkage • Linked even on different months • Client has to self-assess if linkage • But Multiple Dwelling relief for Residential properties Connected Parties • Example - easy to miss or be misled • Care with close or extended families and nonnative speakers • Also businesses, companies, etc. • Can be very hard to work out • Don’t end up underwriting the risk Self assessment • What if the answer isn’t clear • You aren’t acting for the taxman • But you are a tax agent • Voluntary disclosures? • But don’t try to be too crafty Consideration • R v Orsman • Chattels, works, cash • Quantification and apportionment • Goodwill • Put the risk on the client, not you! Risk Management • ‘Arrangements’, deals, etc. • Intrusive questioning? • Are you the right one to make the decision • Accountants involved? Reliefs from SDLT • Long list of possible reliefs • Still notifiable if consideration exceeds threshold • Right to Buy relief • Shared ownership • Worked examples Exemptions from SDLT • Not notifiable • Self Assessed whether exempt • Penalties for not filing a return if you got it wrong • Examples Conclusion • Its not stamp duty! • Greater responsibilities on you • You end up paying the clients tax if you don’t ask the right questions • Communication is key • Use standard guides and checklists • www.propertylaw.guru for templates and examples www.propertylaw.guru www.propertylaw.guru www.propertylaw.guru IT’S NOT STAMP DUTY