Why do manufacturers issue coupons? An empirical analysis of

advertisement

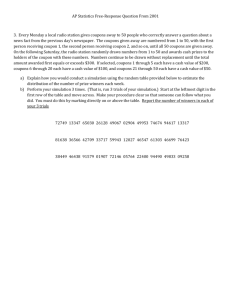

Why do manufacturers issue coupons? An empirical analysis of breakfast cereals Nevo and Wolfram Presented by Huanren (Warren) Zhang 2/22/2012 Static Monopoly Price Discrimination • Couponing is a tool for price discrimination • Only more price-sensitive customers bother to clip, save and use coupons • Manufacturers can use coupons to sort customers into groups with distinct price elasticities. However… • Procter & Gamble’s senior vice president of advertising once said “I don’t like couponing. Period.” Static Monopoly Price Discrimination • 𝜋 𝑝1 , 𝑝2 : profit when the consumers are faced with full price 𝑝1 and price with coupons 𝑝2 • 𝜋 𝑝1 , 𝑝2 is continuous and twice differentiable with a unique optimum at ∗ ∗ (𝑝1 , 𝑝2 ) • 𝜋 𝑢 𝑝 = 𝜋 𝑝, 𝑝 : profit with uniform price, peaked with optimum at 𝑝𝑢∗ • Proposition: 𝑝1∗ ≤ 𝑝𝑢∗ ≤ 𝑝2∗ Price Differentiation A direct implication of the proposition is that coupons and shelf prices are positively correlated Relevant Liturature • Existing work uncovered patterns consistent with the price-discrimination interpretation of coupons: – Coupon users have more elastic demand than nonusers (Narasimhan 1984) – Low-priced generic products have lower market shares if the brand-name manufacturers coupon heavily (Sethuraman and Mittelstaedt, 1992) – Larger percentage of consumers use coupons for brands with higher shelf prices (Vilcassim and Wittink, 1987) • Few work is done on the relationship between shelf prices and coupons Static Monopoly Price Discrimination • Unrealistic for cereal markets – Not monopoly – Ignores the changes in demand over time – Manufacturers do not sell the shelf price to retail consumers – Managers set coupon policies that may not fully internalize profit-maximizing incentives Other models • • • • Oligopoly Price Discrimination Dynamic Demand Effects Retailers’ Objectives Retailer or manufacturer costs Oligopoly Price Discrimination • Under symmetry assumptions, the conclusion of monopoly price discrimination can be carried onto oligopolistic industries (Holmes 1989) • BUT, under certain conditions, price discrimination may lead to lower prices and profits (Corts 1998) Oligopoly Price Discrimination • Professors Prefer Raisin Bran • Students prefer Cheerios Oligopoly Price Discrimination P↓ P↓ To To compete increase with Cheerios, Raisin profit, Raisin Bran may offersalso reduce couponsitstoshelf price students To keep the market share and profit, Cheerios may reduce the shelf price Oligopoly Price Discrimination • Prices fall for all consumers if the coupon users and nonusers have different brand preferences (“best-response asymmetry”) • Assess the influence of strategic interaction by investigating the effect of the presence of coupons for competing brands Dynamic Demand Effects • Low-valuation consumers are willing to postpone purchases • Sellers periodically lower prices to clear out low-valuation consumers • Coupons are issued in response to intertemporal patterns in demand (accumulation of low-valuation consumers) Dynamic Demand Effects • Coupons tend to follow periods of low-volume sales • The quantity demanded would be lower following a period when coupons were issues Dynamic Demand Effects • Coupons tend to follow periods of low-volume sales • The quantity demanded would be lower following a period when coupons were issues • Coupons can also be used to induce repeated purchase Retailers’ Objective Functions • When they have market power, the retailers (e.g. supermarkets) may not change the shelf prices according to the whole sale prices set by the manufacturers • Can use wholesale prices to examine whether the changes on shelf prices are driven by retailer or manufacturer behavior Retailer or Manufacturer Costs • In periods when demand is expected to be low, manufacturers may simultaneously issue coupons and reduce prices to generate more sales • Managers may reduce price and issue coupon to achieve market share goals by the end of the company fiscal year Data • Cereal Price Data: IRI Infoscan Data Base collected by a marketing firm in Chicago • Coupon Data: research company, Promotion Information Management (PIM) The Model • 𝑆𝐻𝐸𝐿𝐹 𝑃𝑅𝐼𝐶𝐸𝑏𝑐𝑡 = 𝛾𝑏(𝑐) + 𝜙𝑐(𝑡) + 𝛿𝑡(𝑏) + 𝜃 𝐷𝑂𝐿𝐿𝐴𝑅𝑆 𝑂𝐹𝐹𝑏𝑐𝑡 + 𝜖𝑏𝑐𝑡 • 𝑆𝐻𝐸𝐿𝐹 𝑃𝑅𝐼𝐶𝐸𝑏𝑐𝑡 = 𝛾𝑏(𝑐) + 𝜙𝑐(𝑡) + 𝛿𝑡(𝑏) + 𝜃 𝑃𝑅𝑂𝐵 𝑂𝐹 𝐶𝑂𝑈𝑃𝑂𝑁𝑏𝑐𝑡 + 𝜖𝑏𝑐𝑡 • • • • • • 𝛾𝑏 : brand fixed effects 𝜙𝑐 : city fixed effects 𝛿𝑡 : time trend of in prices 𝛾𝑏𝑐 : brand-fixed effects to vary by city 𝜙𝑐𝑡 : city-fixed effects to vary across quarters 𝛿𝑡𝑏 : the quarter effects to vary by brand We need to understand the negative correlations between prices and coupons Cross-Brand Effects The negative coefficients are driven by the interaction between manufacturers’ and their competitors’ couponing Dynamic Effects • Reduced-form Vector Autoregressive (VAR) model Dynamic Effects Dynamic Effects Coupons and prices Granger-cause volume but not vice versa Dynamic Effects • Coupons and prices Granger-cause volume but no vice versa • Manufacturers’ decisions to coupon are not a function of previous quantities sold • Coupons may induce consumers to try new brands Conclusion: Why Coupons? • Strategic interactions between manufacturers • Incentives given to the people within firms who make decisions about coupons • The effects of coupons on repeat purchases