HTC Affiliate Presentation 2013

advertisement

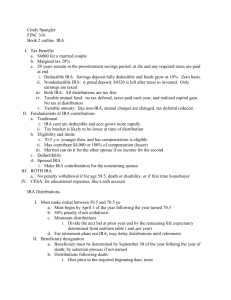

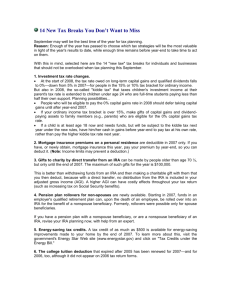

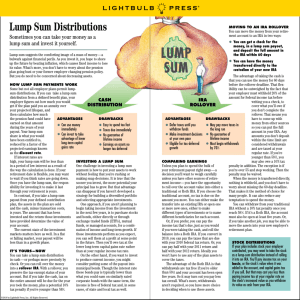

You are about to discover… 1. Why 95% of Americans FAIL to become financially free. 2. The simple solution that will allow you to create financial security and rewrite your family legacy. 3. How to get started. “According to a recent study conducted by the Social Security Administration, only 5 in 100 people are financially secure at age 65.” Why? The three forces working against people today 1. Uncertainty and Unpredictability 2. Expensive Loads & Commissions 3. Taxes With a $100,000 IRA you could pay $5,300 in commissions plus ongoing fees of $1,500 per year according to the ICI. That’s $6,800 your first year! The Trouble with Taxes Federal Income tax………..25% to 39.6% State income tax…………….4% to 10% Local income tax…………..1/2% to 3% Medicare Tax……………..1.45% to 2.9% Social Security Tax…………6.2% to 12.4% If you make $100,000…. you could pay in taxes …$42,200. Is it no wonder families today can’t seem to get ahead? If this has happened to you or someone you love… …it’s not your fault What’s the Solution? 1. Eliminate taxes using a Self Directed IRA. 2. Stop paying expensive commissions and fees -keep all your profits. 3. Eliminate Uncertainty …Invest in things you believe can be more predictable, certain and secure like real estate and notes. Is it really legal to buy real estate in an IRA? What’s the Secret Tip? The Secret isn’t Magic The Secret is a Self Directed IRA Harvard’s Endowment Fund has leveraged these principles for decades and you can too The Headline from July 18, 1917 The Headline from 2009 – $36.9 Billion How did Harvard do it? The 3 Things Harvard does (that you can too) 1. Harvard Self Directs 2. Harvard’s Endowment Fund makes Tax Protected Profits 3. Harvard invests in Alternative Assets like Real Estate Warren Buffet Endorses this Strategy Your Current Plan 1. A commission based salesman gives “advice” 2. Fee and commission based investments 3. Stocks 4. Bonds 5. Mutual Funds 6. CD’s What does Self Directed mean? 1. 2. 3. 4. 5. 6. 7. You get control… You keep all your income and profits. Yes, stocks, bonds mutual funds…PLUS Real estate FOREX /Futures Notes Virtually anything you can imagine! WHY HORIZON TRUST? Trust | Knowledge | Dependability With a Horizon Trust SDIRA… It’s your choice… You can pay less taxes or You can pay less taxes At Horizon Trust You can self direct a Traditional IRA, a Roth IRA, a 401(k) and many other accounts. Using a Roth Self Directed IRA you can make money and spend it 100% Tax Free! Is it really possible to keep all the money you make and spend it 100% tax free? Is making money (truly tax free) really possible? Meaning …No federal income tax …No state income tax …No local income tax …No capital gains tax …No social security tax …No Medicare tax …No AMT tax NO TAX AT ALL? Is making money (truly tax free) really possible? Is making money (truly tax free) really possible? Is making money (truly tax free) really possible? Tax Free Income is truly possible and the IRS put it in writing! Getting started is easier than you think • Contribute from you current income • Rollover over money from your old 401(k), 403(b) or other TSP. • Transfer money from your current IRA at your bank or brokerage. What kinds of results can you expect? Consistency Predictability Security What does it take to generate $100,000 per year for the rest of your life? Contribute $5,000 per year For 30 years Invested at 10% = $991,964 Annual Income at 10% = $99,000 What’s the best way to get started? Get Started for FREE! FREE Guide FREE Video FREE Consultation www.horizontrust.com