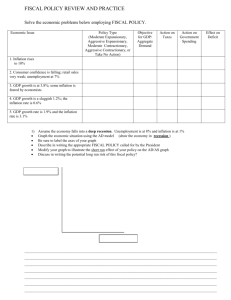

Fiscal Policy yr 13

advertisement

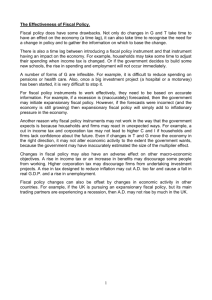

Fiscal Policy Fiscal Policy Fiscal Policy : Taxing and spending by the government to influence the level of economic activity Taxation Spending These taxing and spending decisions by the government are set out in the Budget. Government Income Comes mainly from Taxation (T) also some profit from State Owned Enterprises (SOE) Taxation is both Direct ( Income tax, PAYE) Indirect ( Goods and services tax, GST) When designing a tax system to raise revenue the government must take into account The DWL cost of the tax ( When it can cost more to raise the tax than it gains) Compliance costs ( Cost of filling in GST returns in time and wages) Tax systems in nearby countries. If tax is less un Australia then people will move and Governments tax take will fall. Government Expenditure Government expenditure (G) is an injection into the circular flow. It includes spending on Wages and salaries of government employees Capital e.g. Hospitals Transfers e.g. Welfare payments Government Spending in the Budget is always bigger than the figure in GDP calculations because the budget include transfers where the GDP calculation takes the Net effect of Tax – Transfers ( T- TR) Government spending has generally decreased as a percentage of GDP over the last few years to around 30% The Budget 2003 – 2004 Make three statements about the governments budget in 2003 – 2004 in 3mins. Governments Operating Balance Tax- leakage from circular flow Spending- injection into circular flow When tax=spending there is no increase in GDP (Balanced Budget). Operating Balance is zero Contractionary Fiscal Policy When tax > spending Govt. is running a budget surplus… called contractionary fiscal policy. This Causes a primary contraction of the money supply that leads to a secondary contraction Expansionary Fiscal Policy When tax < spending… Govt. is running a budget deficit… called expansionary fiscal policy. Govt. uses expansionary fiscal policy when spending is down (usually in times of recession)to keep growth in positives. Fiscal Policy History of fiscal policies Often used expansionary policies 1930s govt acted to drag the economy out of depression Think big projects of 1970s and 1980s meant to reduce NZ dependence on overseas oil and create 400,000 jobs. Pushed up govt spending and did not create as many jobs as hoped. Fiscal Responsibility Act 1994: aimed at running budget surpluses therefore CONTRACTIONARY in nature (enables debt to be paid off) Expansionary Fiscal Policy If the government does decide to increase its spending the money needs to come from somewhere If the money comes from the RBNZ then it can be inflationary, as it increases deposits with banks and causes a secondary expansion of credit. This increases the money supply and the deficit is said to be monetised Borrow from the public or overseas. Done by selling government bonds. Money demand will increase This will mean interest rates will rise.