VET Levy Framework Presentation_230114

LEVY IMPLEMENTATION

27 JANUARY TO 14 FEBRUARY 2014

Presentation Outline

• Background/Introduction

• Notice 35: Imposition of the VET Levy

• Regulations 47 (1) (d): Imposition and

Collection of the VET Levy

• Marketing and Stakeholder Engagement

Background/Introduction

• VET Act of 2008 makes provision for the imposition of a

VET Levy on employers

• VET Levy framework developed based on studies done

• Benchmarking of framework carried out

• Consultations on draft framework carried out

• Notice 36 (1) gazetted in April 2013 where stakeholders were invited to submitted proposals on the Levy

• Cabinet approved the implementation of the VET Levy in

November 2013

• As per the VET Act, a notice (S 35) must published in the

Gazette at least 30 days before commencement. Notice 35 and

Regulation 47 will be gazetted on the 27 th January ‘14

VET Training Levy - Government Notice

Section 35 (1)

• Payment of the levy will commence 01 st April 2014

• The Levy Rate is 1% of Employers Total Annual Payroll

• Payroll means the total annual remuneration paid or payable by an employer to its employees

• Remuneration means the total value of all payments in money or in kind made or owing to an employee arising from the employment of that employee as defined in

Chapter (1) of the Labour Act of 2007. (Act No. 11 of

2007)

• Employee means an employee as defined in Chapter (1) of the Labour Act of 2007. (Act No. 11 of 2007)

VET Training Levy - Government Notice

Section 35 (1)

• Levy must be paid on a monthly basis on or before the 20 th day of every month.

• 01 st Payment will then be on or before the 20 th May

2014 and each month thereafter

• Levy to be paid directly into the National Training

Fund Bank Account by EFT, Cheque, Cash.

• Every employer must submit a corresponding levy return form to the NTA on a monthly basis or before the 20 th day of every month.

VET Training Levy - Government Notice

Section 35 (1): Exemptions

• the state;

• regional councils as defined in section 1 of the

Regional Councils Act, 1992 (Act No. 22 of 1992);

• charitable organisations;

• public and not for gain educational institutions;

• faith based organisations; whether or not supported wholly or partly by grants from government

• Institutions and employers can apply to the Minister for consideration for exemption

VET Training Levy - Government Notice

Section 35 (1)

• Employers Must Register and submit the required information within 30 days of the Gazette of this

Notice

• NTA can estimate an employers liability if they fail to submit monthly return or incorrect information

• Must pay levy on or before the due dates.

• Non Payment and or Under Payment will be subject to Interest and Penalties.

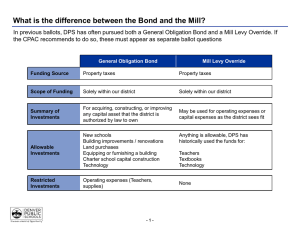

Regulations Relating to the Use of VET

Levies – Section 47 (1) (d): Levy Distribution

• Company Training 50%

• Key Priority Training 35%

• NTA Administration 15%

Company Training 50% Levy Allocation

Refund Up to 50% of levy paid based on

Evidence of Training Implementation and Actual

Costs

Key Priority 35% Allocation

To fund and Promote:

• Government/National Priorities (National HR

Plan)

• Sector Needs (Industry Skills Committee

Priorities)

• Strategic and Scarce Skills

Allocation of up to 15% of Collected Levy

To defray expenditure for NTA Collection and

Administration Costs.

Regulations Relating to the Use of VET

Levies – Section 47

Payment of Company Training Grants;

• Must be Up to Date with Levy Payments

• No Interest or Penalties Outstanding

• Submits to the NTA Evidence of the

Implementation of Training

• Submits Evidence of Actual Costs

Regulations Relating to the Use of VET

Levies – Section 47 (1) (d)

Definition of “Training” for Levy Refund

Purposes:

• “Training” means training which is related to vocational training provided by a private vocational training provider who is accredited by the Namibia Qualifications Authority or a state owned vocational training centre.

Regulations Relating to the Use of VET

Levies – Section 47

Eligible Programmes for Grants

• Must be Provided by State Owned VTC’s.

• Private VET Providers must be accredited by NQA.

• Programmes conducted within the company are

“vocational related.” (Refer to List)

• Companies conducting “in-company” training do not necessarily need to be accredited by NQA or registered with the NTA. They are however encouraged to do so.

Definition of Actual Costs

Internal Costs:

• Training Staff Salaries

• Training Materials used in the Training Process

• Cost of Training Equipment for the Training Period

• Assessment Costs for Training Conducted

• Certification Costs

• Overheads related to Training Venue

• Cost of Other External Supplementary Training

• Administration Costs Applicable to Training activities

Definition of Actual Costs

External Training Costs:

• Travel Costs to Training Venue

• Invoiced/Receipted Costs from Service

Providers

• Administration costs applicable to training activities

• Accommodation Costs related to training

Payment of Company Training Grants:

• Grants will be Paid on an Annual Basis

• Employers must make submissions in compliance with the above criteria

• Submissions to NTA within 30 days after the end of the Financial Year

• Unclaimed Grants will be transferred to the Key

Priority Fund for allocation

Training Evidence

Evidence That Training was implemented

• Training Records

• Attendance Sheets

• Invoices/Payments made

• Certification

Regulations Relating to the Use of VET

Levies – Section 47 (1) (d)

Key Priority Fund Sources:

• 35% of levies collected in each financial year.

• Unclaimed Training Grants.

• Funds Arising from Non Payment of Grants to

Employers who fail to comply with the eligibility criteria.

• Interest and Penalties

• Interest earned on levy funds

Regulations Relating to the Use of VET

Levies – Section 47

Application for Key Priority Funds.

Needs Identified within

• NDP4

• NHRDP

• ISC Sector Needs and Priorities

• Government Priorities

• Request for Submissions

• NTFC and NTA Board Approval

VET LEVY IMPLEMENTATION

LOGISTICS

• Location of Road shows

• Team Compositions

• Availability of Call Centre

• Planned Media Events

Stakeholder Workshop Locations

VET Levy Teams Composition

Consultation Schedule

Consultation Schedule

Consultation Workshop Windhoek 3rd

February

Formal Major Launch of Levy Implementation

• Government Ministers

• Regional Directors x 14

• Other Government Officials

• Employer Representative Bodies

• Social Partners

• Educationalists. UNAM, POLY: Private.

• Training Providers.