What is the difference between the Bond and the Mill?

advertisement

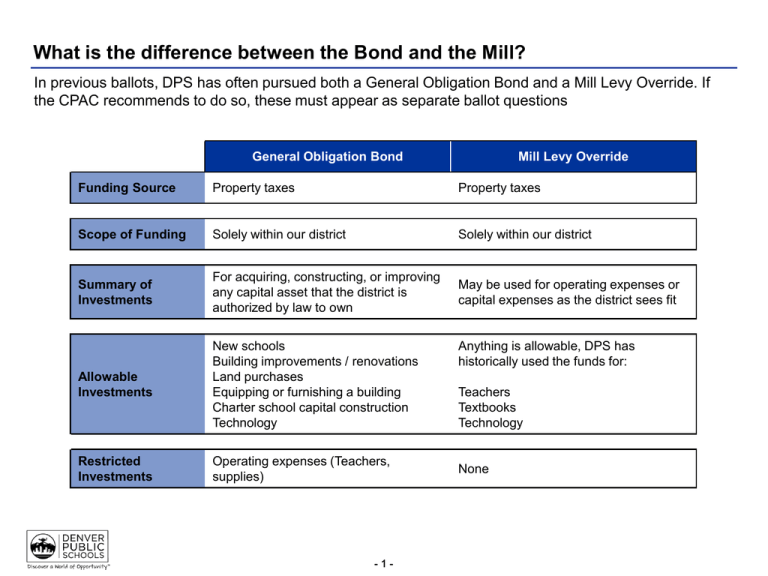

What is the difference between the Bond and the Mill? In previous ballots, DPS has often pursued both a General Obligation Bond and a Mill Levy Override. If the CPAC recommends to do so, these must appear as separate ballot questions General Obligation Bond Mill Levy Override Funding Source Property taxes Property taxes Scope of Funding Solely within our district Solely within our district Summary of Investments For acquiring, constructing, or improving any capital asset that the district is authorized by law to own May be used for operating expenses or capital expenses as the district sees fit Allowable Investments New schools Building improvements / renovations Land purchases Equipping or furnishing a building Charter school capital construction Technology Restricted Investments Operating expenses (Teachers, supplies) -1- Anything is allowable, DPS has historically used the funds for: Teachers Textbooks Technology None What is the statute and history of DPS initiatives? Bond Statute Districts are limited in the amount of bonds they can raise through local district bonds based on the latest assessment valuation. For Denver, the bonded debt limit is roughly $4 billion. Currently, DPS has roughly $1 billion in debt outstanding, leaving up to $3 billion available for additional authorization. Previous Bond Issuances In 2008, Denver citizens voted 2-to-1 to authorize $454 Million in general bond obligations, the largest issuance in the history of the district. In addition to 2008, there have been three other recent authorizations: - 2003: $311M authorization - 1998: $305M authorization - 1990: $200M authorization Previous Mill Levy Override Issuances In 2003, Denver citizens approved a $20 Million mill levy override with 60.0% of the vote In addition to 2003, there have been three other authorizations: - 2005: $25 Million (ProComp) - 1998: $17 Million - 1988: $12.1 Million -2-