Presentation - AFSCME 41st International Convention

advertisement

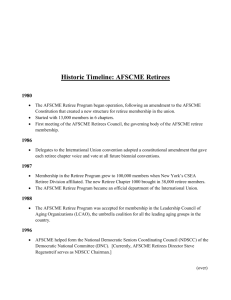

AFSCME 41st INTERNATIONAL CONVENTION CHICAGO, ILLINOIS FINANCIAL STANDARDS CODE JULY 13, 2014 TODAY’S HOST Laura Reyes, Secretary-Treasurer, AFSCME International Additional Hosts Charles Jurgonis, Director, Financial Services Jeff Taggart, Associate Director, Auditing & Accounting Karen Tyler, Assistant Director, Auditing PRESENTERS William Del Pino Cathy German AFSCME AUDITORS PRESENTERS CONTACT INFORMATION William Del Pino wdelpino@afscme.org Cathy German cgerman@afscme.org Today’s Topic THE AFSCME FINANCIAL STANDARDS CODE - 2013 REVISED Financial Standards Code AFSCME FINANCIAL STANDARDS CODE Adopted by International Executive Board Part of AFSCME IU Constitution 2013 AFSCME FINANCIAL STANDARDS CODE Article I - Article XI Appendices Glossary of Terms Trustees Audit Guide Trustee Audit Checklist Article I - Purpose and Scope Establish Minimum Standards for the Handling of Funds and Records Maintenance Article II - Custody of Funds Bank Accounts Should Be: In Federally Insured Institutions In Name of Union Contain Union Funds Only Investments Union Officers Have a Fiduciary Responsibility to Manage and Invest Union Funds Prudently in Accordance with Union Policies Investments Approved Investments: Insured Bank Accounts Insured Government Investments Other Investments Approved by Executive Board The Following Investments Are Not Allowed : Purchase of Lottery Tickets or Other Gaming Activities Investment in Any Illegal Activities Investments Safest Investments Available: Treasury Bills Certificates of Deposit Government Notes and Bonds Petty Cash Fund Executive Board Sets Fund Amount, Selects Custodian and writes Check to the Custodian To Initiate Fund Petty Cash Receipts Maintained to Document Expenditures From Fund Record Expenses in Petty Cash Journal Maximum Petty Cash Fund $100.00 Article III Maintaining Records Transaction Records Cashbook or Journals Are Required Manual Cash Book Receipts & Disbursements Journal Computerized Cash Book Income Documentation Copies of Transmittal, Remittance Advice or Membership Documents Make a Copy of all Checks Received Keep a Copy of the Deposit Slips Deposit Funds Promptly in full Bank Records Bank Statements & Canceled Checks: Keep Checks With Bank Statements Reconcile Bank Statements Monthly Request Missing Checks or Bank Statements Verify Deposits to Deposit Slips Bank Records Check Stubs & Voided Checks: Before Storing a Voided Check, Write “Void” Across the Check in Ink and Tear Off the Signature Portion Retain All Void Checks VOID Paid Bill Records Paid Bills or Invoices - When Signing Checks, Write the Date Paid, Amount Paid, and Check Number on Your Copy of Bill or Invoice Dues Payment Records International & Council Per Capita Tax Reports Dues Deduction Rosters Council Rebate Transmittal Reimbursement Records All Officer and Employee Expense Reports and All Receipts for Expenses Reimbursed Petty Cash Records Records of Petty Cash Expenditures - Petty Cash Slips - Receipts - Petty Cash Journal Payroll Records IRS Form 941s IRS Form 940s IRS Form W-2s Required State & Local Payroll Reporting Financial Records Financial Reports Prepared for the Membership or Executive Board Federal Reports Filed With the IRS (including Payroll) or U.S. Department of Labor Financial Records Copies of Financial Reports Filed with the International Union: - Surety Bond Report - Local Union Annual Financial Report (LUAFR) Surety Bond Certificate of Coverage Financial Records Mortgages, Loan Agreements, Lease Agreements, Lease-Purchase or TimePayment Contracts, and anything Which Involves a Financial Obligation on the Part of the Affiliate. Financial Records All Documents Constituting Evidence of Ownership by the Local Union of Any Property or Equipment Financial Records Minutes of any Executive Board, Membership, or Committee Meetings at which any Financial Decisions were Made, Approved or Rejected. Personnel Records - Collective Bargaining Agreements & Personnel Policies Key Point Financial Records, including Minutes of Executive Board and Membership Meetings, must be kept for a minimum of Seven Years. Article V Expenditures - Authorization There Are Four Types of Authorization: Law Constitution Contract Vote Unauthorized Checks Required By Law Payroll Tax Deposits and Related Payments (FICA, Unemployment Taxes, etc.) Possible Fines Imposed by IRS for Late Filing of Form 990 Required by Union Constitution International and Council Per Capita Taxes Payment of Surety Bond Premium to International Required by Contract Prior Authorization Required: Equipment Rental Meeting Hall Rental Authorized By Vote Membership Executive Board Delegate Assembly Key Points Expenditures Must Be Authorized and Documented in the Minutes Article VI – Expenditures Procedures Before You Write a Check, You Need: Authorization Documentation Explanation No Cash Payments Exception: Petty Cash Never Write a Check Payable to Cash Writing Checks/Making Disbursements Never Pre-Sign Checks: Do not Sign any Check before the Date, the Name of the Payee and the Amount have been entered on the Check Never use a Rubber Stamp for Check Signing Purposes No ATM Cards Bank Debit Cards or ATM Cards May Not Be Used Under Any Circumstances Check Signers Checks and Withdrawal Slips Must Be Signed by Two Officers It is Recommended That at Least Three (3) Signatories Be Registered with the Bank for Each Affiliate Account Article VII Expenditures - Documentation Receipts and Invoices Must Be Maintained to Support all Expenditures Non-Taxable Payments Accountable Plan = Expense Report Reimburse Actual Expenses Non-Taxable to Recipient Expense Reports Required to Document Reimbursements : Officers Members Employees Expense Reports Each Expense Item Reimbursed Must Have Receipt Attached and Show: (1) Date (2) Amount (3) Union Purpose Expense Reports Original Receipts Must Be Attached Expense Reports Should Be Filed Timely The IRS Considers Filing within 30 Days to be Timely Expense Reports Meal or Entertainment Items List: Name(s) and Union Relationship of Person(s) Entertained Explanation of Union Business Discussed Expense Reports Required Account For All Costs Paid Directly by Affiliate: Direct Hotel Billings Charges on Union-Owned Credit Cards Payments to Travel Agency Expense Reports All Expense Reports Must Be Approved By Someone Other than the Preparer Union-Owned Credit Cards AFSCME Strongly Recommends against the use of union-owned Credit Cards. Circumvents the Requirement that Two (2) Officers Sign all Disbursement Checks. Article VIII - Minutes Meeting Minutes Record of Proceedings Permanent Record of Actions and Decisions Document whether a Quorum was present Minutes note Financial Authorization for Expenditures. Financial Reports The Following Must Be Attached to the Minutes: Monthly Financial Report Budget Audit Report Article IX - Reporting Financial Statements Prepared Monthly Reported to the Executive Board and Membership Attached as a Permanent Part of the Local’s Minutes Large Affiliate Reporting All Councils and any Local Union with 2,000 or More Members Must Prepare a Monthly Report Showing Actual Income and Expenses Versus Budgeted Income and Expenses for the Month and the Year-to-Date Large Affiliate Reporting All Councils and Local Unions with 2,000 or More Members Must: Prepare Quarterly Financial Statements Submit Copy to the International Secretary-Treasurer Have an Annual CPA Audit Government Reporting You May Be Required to File One (or More) of the Following: * Due Date IRS Form 990, 990 EZ or 990 N May 15th IRS Form 1120-POL March 15th DOL Form LM-2/3/4 March 31st * Calendar-Year Filers AFSCME Reporting Every Affiliates Must File: Surety Bond Report Due by March 1st Each Year Local Union Annual Financial Report (LUAFR) - Due May 15 (or 4 1/2 Months After Fiscal Year End) Article XI - Audits Audits - How Often? Required At Least Once Each Year - Check Your Constitution Upon Change of Officers When Circumstances Warrant Audits - By Whom? Trustees Independent Auditors Not Otherwise Connected With the Union Trustee Audit Trustees May Follow Procedures Outlined in the Trustees Audit Guide Audit Results Report on Material Deviations from the Financial Standards Code Action Taken to Correct Audit Discrepancies Must be Reported to Executive Board and Membership Audit Findings Findings Reported to Executive Board and Membership Audit Report Attached to Minutes of Meeting at which it was Presented Questions & Answers