The Budget: Congress and the President

advertisement

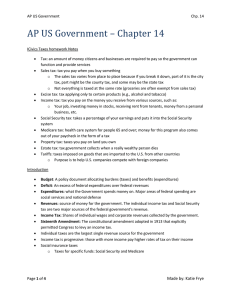

The Budget: Congress and the President Incrementalism Incrementalism: Budget predictor of this years budget by looking at what an agency received last year plus a little more. Usually receive at least their previous budget Debates usually occur over the increment (increase) The budget for most industries increases. Why is it difficult to control this? Uncontrollable expenditures! Uncontrollable expenditure: an expenditure determined by how many individuals are eligible for program benefits: Ex: Social Security Entitlements: Policies Congress has obligated itself to pay a certain amount of benefits to recipients. Farm subsidies. Congress could limit, but would face opposition. Politicking Budgets Agencies attempt to link their institutions benefits to a Congressman’s to gain favor. Pgs 420-421 list of all the big players in this process. Agencies: Push for higher budgets. Send request to OMB Office of Management and Budget(OMB): make decisions about how to distribute the budget President: Makes the final decision on what to propose. Budget Committees and Congressional Budget Office(CBO): Set the rules of the budget process in Congress. House Ways and Means Set the tax codes for the Congress alongside the Senate Finance Committee The government runs on taxes As a result, no taxes, no government. The House Ways and Means Com. And Senate Finance Com give the gov’t what it needs to run Essential function to the United States. The Presidential Budget OMB created in order to help the President craft a budget. President by law, submits budget for the year by the first Monday of February. Spring: Budget policy developed Summer: Budget decisions conveyed to agencies Fall: Estimates reviewed Winter: President’s budget determined and submitted. Congress and the Budget: Congressional Budget and Impoundment Control Act (1974) A fixed budget calendar: timetable for budgets A budget committee in each house: recommend target features for the budget by April 1 each year. Agreement needed by April 15 Congressional Budget Office: advises Congress on consequences of budget decisions. Budget Resolution Budget Res: binds Congress to a total expenditure level. 1. Reconciliation: program authorizations are revised to meet required savings. 2. Authorization bill: Specifies a programs goals and maximum expenditure for discretionary programs. 1. Sets eligibility standards from a program 3. Appropriations bill: An act that funds a program for a period of usually a year. FRQ 1.) Since the 1970s, the national debt has grown from $1 trillion to over $9 trillion. Two factors that have contributed to this growth are incrementalism and “uncontrollable” expenditures. (5 points) a) Define incrementalism and “uncontrollable” expenditures. b) Explain how each contribute to the increasing national debt of the past 40 years. c) Describe one other factor that has contributed to the growing national debt of the past 40 years _____9.) The federal government receives most of its revenues from A.) excise taxes. B.) social income taxes. C.) personal income taxes. D.) public bonds. E.) sales taxes. _____7.) An appropriations bill A.) allocates funding for particular programs. B.) revises spending proposals in order to achieve required savings. C.) allows agencies to spend at the level of the previous year. D.) establishes, continues, or changes a discretionary government program or an entitlement. E.) establishes new taxes, or sources of borrowed revenue, to pay for programs.