of a new global standard for the automatic

advertisement

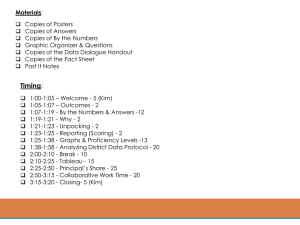

1 Haydon Perryman FATCA vs GATCA The Background of the Automatic Exchange of Information 2 On Monday 21st July the OECD released the full version of a new global standard for the automatic exchange of information between jurisdictions. [311 pages.] G20 Leaders at their meeting in September 2013 fully endorsed the OECD proposal for a truly global model for automatic exchange of information and invited the OECD, working with G20 countries, to develop such a new single standard for automatic exchange of information, including the technical modalities, to better fight tax evasion and ensure tax compliance. The Standard, developed in response to the G20 request and approved by the OECD Council on 15 July 2014, calls on jurisdictions to obtain information from their financial institutions and automatically exchange that information with other jurisdictions on an annual basis. It sets out the financial account information to be exchanged, the financial institutions required to report, the different types of accounts and taxpayers covered, as well as common due diligence procedures to be followed by financial institutions. The Background of the Automatic Exchange of Information 3 Part I gives an overview of the Standard. Part II contains the text of the Model Competent Authority Agreement (Model CAA) and the Common Reporting and Due Diligence Standard (CRS). Part III contains the Commentaries on the Model CAA and the CRS as well as a number of Annexes. Collectively these form the Automatic Exchange of Information (AEOI) informally known as “GATCA”. The Standard draws extensively on earlier work of the OECD in the area of automatic exchange of information. It incorporates progress made within the European Union, as well as global anti-money laundering standards, with the intergovernmental implementation of the Foreign Account Tax Compliance Act (FATCA) having acted as a catalyst for the move towards automatic exchange of information in a multilateral context. The Background of the Automatic Exchange of Information 4 Presenting the new standard, OECD Secretary-General Angel Gurría said: "This is a real game changer. Globalization of the world's financial system has made it increasingly simple for people to make, hold and manage investments outside their country of residence. This new standard on automatic exchange of information will ramp up international tax co-operation, putting governments back on a more even footing as they seek to protect the integrity of their tax systems and fight tax evasion." Gurria said, “The G20 mandated the OECD to work with G20 and OECD countries and stakeholders toward the development of an ambitious information exchange model that would help governments fight tax fraud and tax evasion; today’s launch moves us closer to a world in which tax cheats have nowhere left to hide.” Legal and operational basis for exchange of information 5 Different legal basis for automatic exchange of information already exist. Whilst bilateral treaties such as those based on Article 26 of the OECD Model Tax Convention permit such exchanges, it may be more efficient to establish automatic exchange relationships on the basis of a multilateral exchange instrument. The Multilateral Convention on Mutual Administrative Assistance in Tax Matters (the “Convention”), as amended in 2011, is such an instrument. It provides for all forms of administrative co-operation, contains strict rules on confidentiality and proper use of information, and permits automatic exchange of information. 67 Countries have signed by the convention but not all have signed the amending protocol. http://www.oecd.org/ctp/exchange-of-tax-information/Status_of_convention.pdf Potential Obstacles to the USA signing the amended protocol 6 These are similar to the challenges for by the US Treasury in getting the FATCA IGAs into US law, namely, • 4th Amendment (data protection) • 8th Amendment (excessive fines or cruel and unusual punishments including torture) • Circumventing the Senate’s role in ratifying the Agreements Of these obstacles, perhaps the third is the most credible. Impact on the USD 7 Impact on the USD and the link to reciprocity. Without reciprocity from the US will the US remain one of the largest secrecy jurisdictions in the world and if so would the money flow into the US or out of the US? How we know GATCA/FATCA will not damage the USD. The UK implemented FATCA without transition from July 1, 2014 with no discernable impact on GBP. Rapid evolution of GATCA 8 • With a mandate from the G20 the OECD developed the standard. In February 2014 the standard was endorsed by the OECD Council and the Finance Ministers of the G20. • On September 20th and 21st the standard will be formally presented to the G20 in Australia for ratification. • On November 21st there will be a Convention which brings together than 120 Countries and Jurisdictions where there will be a signing ceremony. Differences between FATCA the IGAs and GATCA 9 Quoting from the OECD’s Brief on AEOI of July 21, 2014: “Question: What are the main differences between the Standard and FATCA? “Answer: The Standard consists of a fully reciprocal automatic exchange system from which US specificities have been removed. For instance, it is based on residence and unlike FATCA does not refer to citizenship. Terms, concepts and approaches have been standardized allowing countries to use the system without having to negotiate individual annexes. Unlike FATCA, the Standard does not provide for thresholds for pre-existing individual accounts, but it includes a residence address test building on the EU savings directive. It also provides for a simplified indicia search for such accounts. Finally, it has special rules dealing with certain investment entities where they are based in jurisdictions that do not participate in automatic exchange under the standard.” Differences between FATCA the IGAs and GATCA (Cont.) Topic Reportable Persons and Entities Basis of Tax Jurisdiction Legal Entity Classification US Treasury FATCA US Citizens Citizenship US Bespoke (31) Primary Keys GIIN/TIN/ITIN IGAs US Citizens US Citizens IGA Bespoke (e.g. UK does not recognize OD-FFIs) GIIN/TIN/ITIN De minimis rules Exempt product and entities Entities and Individuals As per US Treasury Exemptions Entities and Individuals IGA Annex II Exemptions Withholding Applies Account can be opened before self certification True (earlier of 90 days or withholdable event) Applies only in exceptional circumstances outside of local law True (earlier of 90 days or withholdable event) 10 AEOI Residency in all Reportable Countries Residency AEOI Bespoke (few) Registered Company #, GLEIs, GIIN/TIN/ITIN Pre-existing accounts for entities only Similar to US Treasury exemption but includes no IGA Annex II exemptions Does not apply False Basis of determination of reportable Beneficial Ownership at 10% Passive NFFEs Temporal basis for determining high End of year/period or low value account balances Competent authority to whom to One: US IRS report Controlling Persons based on local law %. End of year/period or average (e.g. Mexico) One: US IRS (Model 2) OR Local Competent Authority (Model 2) Controlling Persons based on local law %. End of year/period or average Single/plural tax jurisdictions 1: the IRS Reporting currency USD 1: the IRS (the exception being the UK) USD Basis of Self Certification Rules based Principles Based Principles Based Tax advice for customers (regarding completion of the Self Certification) No tax advice No tax advice Tax advice expected and OECD to facilitate Many: to the competent authority of every Jurisdictional Competent Authority Many Local Currency Timelines for implementation • Commences 2016 • Information Exchange September 2017 11 The following are recommendations for coping with FATCA, the IGAs and AEOI. 12 Multiple Tax Jurisdictions per natural person. Many customers fall under more than one tax jurisdiction. Institutions should build capacity to cope with a customer falling within the tax jurisdiction of 3 to 4 jurisdictions. Not all the IGAs have all the US Tax Code Chapter Four Classifications. The AEOI has substantially fewer. However, all 31 classifications are captured under Chapter Four so it makes sense to be able to map them to the IGAs and AEOI. For example, in the UK there is no concept of an Owner Documented FFI. Consider not applying the de-minimis rules to natural persons. Although FATCA and the IGAs allows for the application of de-minimis thresholds for natural persons, AEOI does not. No onboarding before self certification. While US Treasury FATCA and the IGAs do allow for it, AEOI does not. Retail Banks in particular will struggle to obtain self certifications before onboarding is completed but the weather vane appears to be pointing at prohibiting opening new accounts with prior self certification. Build a reporting solution that can report in both local currency and USD. AEOI requires reporting in local currency. Substitutes for the US centric W9 and W8 series. The requirements under the IGAs and AEOI Common Reporting Standard (CRS) appear to be far less onerous than those of US Treasury FATCA. It may be advisable to study the CRS develop a substitute that navigates a practical path between complying with these regulations and at the same time is not an overly burdensome customer experience. Substitutes for W-8/9 are already in advanced planning by both OECD and EU – ISDs (investor self-declarations). The following are recommendations for coping with FATCA, the IGAs and AEOI. 13 Having said that opinions vary on the use of substitutes, it appears that in the US the perception is that it is in W8 or W9 world. Outside the US the perception is the contrary. This poses a question “Will US Withholding Agents accept anything other that a W8 or a W9?” This is an important point to resolve because if the OECD and the EU is working on substitutes, will the US accept them? Further, some see a future where customers have to complete three self certifications: • • • W9/W8 series EU Savings Directive series OECD series Perhaps the regulators need to work together to establish one self certification that all the regulators will accept. What is particularly interesting is that the AEOI appears to offer a paradigm shift towards offering customers advice when completing their self certifications. More interesting still is the anticipation that the OECD will facilitate this. 14 Thank you Haydon Perryman Web: www.haydonperryman.com Email: haydon@haydonperryman.com