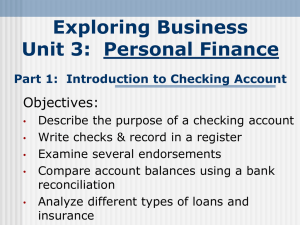

SACU Checking Presentation

advertisement

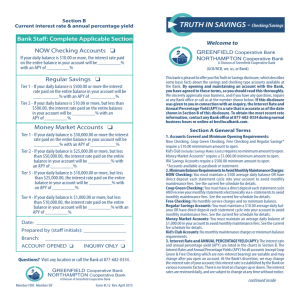

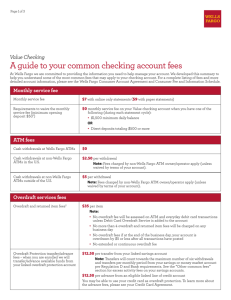

CHECKING ACCOUNTS WHAT YOU NEED TO KNOW? Presented by: Kellie Crawford June 20, 2013 BASIC DEPOSIT ACCOUNTS • • • • • • • Free checking Non interest bearing checking Fee driven checking Interest bearing checking Interest bearing checking with requirements Minor savings Regular savings WHAT IS A CHECKING ACCOUNT? The term checking account refers to a deposit account at a financial institution which allows the owner of the account the ability to withdraw funds and write checks against their deposits. While most Checking Accounts do not pay interest on Deposits, some Checking Accounts do pay interest. REASONS TO OPEN A CHECKING ACCOUNT? • • • • • • Safekeeping Budget Save money Earn interest (where applicable) Convenience Build a financial history CHECKING ACCOUNT FEATURES • • • • • • • Debit card Electronic banking Remote deposit capture Bill pay Direct deposit ACH/EFT (electronic funds transfer) 24/7 access to funds 24/7 ACCESS Online Banking Mobile Banking Retail ATM SACU’s mobile app features • View account history from any of your SACU accounts • Deposit checks to your account by taking a picture (Remote Deposit Capture) • Locate the nearest SACU branch or ATM • Manage bill payments, both one time and recurring payments • Manage transfers, both one time and recurring transfers • PayPal Reasons To Balance Your Account • • • • • • • Avoid return items Avoid account closure Identify unauthorized transactions Increase savings Avoid retailer fees Avoid financial institution fees Avoid the myths Checking Account Myths • • • • • • As long as I have checks I have money If the transaction goes through I have money All deposits are created equal When I performed a balance inquiry I had money Checks take days to clear I am not responsible for fees if the financial institution pays items on my behalf using overdraft services STANDARD FEES • • • • • Non Sufficient Funds (NSF) Return Deposit Items (RDI) Overdraft/Courtesy Pay Excessive Withdrawal ATM HOW TO AVOID FEES? • • • • • • • Balance account regularly Monitor account for unauthorized transactions Only use overdraft for emergencies Use ATM’s in financial institution network Use checking account for withdrawals Cash checks from others at their institution Don not share account information Protect your identity • Do not share your account information unless you initiated contact and know who you’re dealing with • Do not respond to phone or e-mail requests for your account information • Review your statement regularly and report suspicious transactions • Do not share your passwords • Shred sensitive mail and documents Visit www.balancepro.net/partners/sacu/for more information AVOIDING UNECCESSARY FEES Checking Activity Birthday Money (deposit) Pay cell phone bill (debit card) Balance Mc Donald’s (debit card) Overdraft fee (withdrawal) Balance Movies (debit card) Overdraft fee (withdrawal) Balance Nike Air Max Lebron (check) Overdraft fee (withdrawal) Balance Payroll Check (deposit) Balance $ 75 ($ 75) $ 0 ($ 5) ($ 25) ($ 30) ($ 20) ($ 25) ($ 75) ($165) ($ 25) ($265) $200 ($ 65) IMPACT FEES HAVE ON YOUR ACCOUNT Fees Paid/Owed Overdraft Foot locker return check Negative checking balance Actual Cost of Merchandise Mc Donald’s Burger ($5) Movies ($20) Nike athletic wear($165) $75 $35 $65 $175 $ 30 $ 45 $225 SACU PRODUCTS & SERVICES Credit & Debit Cards Free Checking Free Online Anytime Savings Free Mobile App Investments Loans Thank You For questions www.sacu.com SACU Toll Free # 1-800-234-SACU Bexar County Local # 210-258-1414