Presentationby John Roberts

advertisement

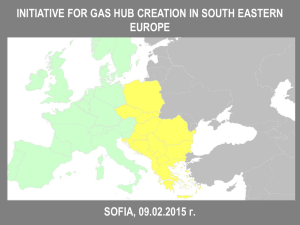

Turkey and Mediterranean Gas: What does it Mean for Europe and the World? A Post-Ukraine Prognosis John Roberts, Energy Security Specialist, Methinks Ltd EUCERS/ISD/KAS Energy Talks King’s College, London 10 March 2014 Turkey’s Need for Gas • Gas demand in 2020 • A gas shortfall: Sooner than we think? • Misjudging the European market: Supplier problems and the Southern Corridor Eastern Mediterranean: Too Early to Judge • No realistic figure for export availabilities in 2020. • Export destination: Probably Europe but what prospects for reaching Turkey? • Overall: IF Leviathan is approved for export, then perhaps 15-20 bcm/y by 2020. • IF Aphrodite’s reserves are augmented, then LNG scale deliveries in the 2020s. • NOTE: Good prospects for further discoveries but seismic not the same as drilling. East Med EEZs: Different Concepts Northern Iraq: Gas from Kurdistan • Stranded production, not just stranded resources. • November 2013: Government of Turkey signs a GSA with the KRG on gas exports to Turkey. • Volumes set at initial 4 bcm/y in 2017, 10 bcm/y by 2020 and an option to move to 20 bcm/y thereafter. • Principal resource base: Genel Enerji’s fields at Miran and Bina Bawi. Azerbaijan: Volumes to Turkey • Shah Deniz Phase II: 2-6 bcm 2019 -2012 • Shah Deniz Phase I: What happens post-2020? • Absheron and the ‘Next Wave’ of Azerbaijani gas exports Iran: The Unknown Factor How ready for export? The Rouhani Administration and old priorities The OIES view (David Ramin Jalilvand): • 20-30 bcm of exports in c. 2025 • No prospect of 50 bcm/y exports until the 2030s. The subsidy issue A truly reformist government? Iran: A Near-Term Major Exporter? • Iran Gas 2013-2016 • Production, Consumption and Export Availability (in bcm) 1981 2012 BP BP 2013 BK 2016 BK • 2016 Production 6.0 160.5 200.8 306.6 • 2016 Imports n/a 9.4 8.0 9.9 • 2016 Consumption 5.7 156.1 198.9 240.9 • Export Availability n/a 13.8 9.9 75.5 • Net Export Availability 0.3 4.4 18.3 65.7 • Sources: BP Statistical Review June 2013; Bijan Khajepour (Sept 2013) • NOTE: BK Figures appear to be gross production (a 37 cm difference in 2012). South Stream & Russia’s Southern Corridor (Gazprom 2011) How many strings? What destination? EU negotiations? Turkey: The residual market? Russia: South Stream & Turkey • How many strings? • What destination? • EU negotiations? • What cost? • Turkey: The residual market? Russia: Post-Ukraine • No such thing as ‘cheap gas’ • The use of force and energy security • The increased cost of bailing out Ukraine • The EU and South Stream’s onshore connections to both the EU and Turkey. South Stream: An Announcement • “South Stream Transport is honoured to announce that a Final Investment Decision (FID) has been taken for the South Stream Offshore Pipeline in accordance with the Shareholders Agreement. The FID was made today in a Shareholders’ meeting subsequent to the meeting of the Board of Directors of South Stream Transport. The minority Shareholders maintain the right to leave the Project in case certain conditions will not be satisfied in the future. South Stream Transport,14 November 2012, Amsterdam Conclusions • East Med: Don’t rule out Turkey market; indirect impact on Europe. • Iraq. 5-10 bcm/y to Turkey by 2020; indirect impact on Europe. • Shah Deniz/Caspian: 10 bcm/y (16 bcm/y) in 2020; subsequent – but delayed – throughput expansion. • South Stream: Pre-Ukraine: Two strings probable; four strings questionable. Post-Ukraine: Who knows? • Iran: The great unknown. Questions? • • • • • • • • John Roberts Energy Security Specialist Methinks Ltd New Mill House Jedburgh TD8 6TH Scotland UK Email: john.roberts@methinks.org.uk Tel: +44-1835-863725 (home) +44-7966-290354 (mobile) South Stream South Stream Gazprom Prices in IH 2012 - Izvestia, 2/04/2013