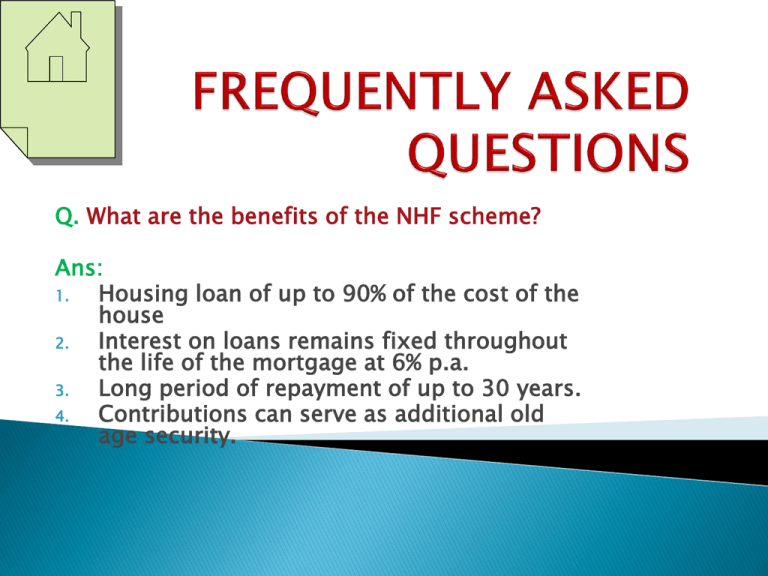

FREQUENTLY ASKED QUESTIONS

advertisement

Q. What are the benefits of the NHF scheme? Ans: 1. Housing loan of up to 90% of the cost of the house 2. Interest on loans remains fixed throughout the life of the mortgage at 6% p.a. 3. Long period of repayment of up to 30 years. 4. Contributions can serve as additional old age security. 4. Up to N15 million can be borrowed. 5. Refunds with 2% interest on retirement. 6. Loan repayment is about the same as a typical monthly rent. 7. Every contributor has: ◦ A lifetime registration number; ◦ A passbook for personal recording of contributions; and ◦ An account statement Ans: It is compulsory. Registration onto the scheme is by organizations and self employed Employers are not given the choice to make the scheme voluntary for some staff Ans: Yes, you still need to contribute to the scheme because just like a cooperative scheme it is not all members who may want to take a loan. Secondly, the person who is not taking the loan today may change his mind tomorrow. The compulsory savings is an additional security to a retiring staff. Ans: The act establishing the scheme provides that the contributing organization shall appoint a desk officer whose duty it shall be to send schedule of deductions to us and also update the passbooks on monthly basis. What we have today is that organizations load their desk officers with other assignments and this function is not done. On our part, we are already migrating to ecollection platform to totally remove this problem. Ans: A contributor to the scheme has a life time account number. On transfer we merge whatever he has contributed in the other organizations with his contribution now under that single account. People who have this problem should come to our office. Ans: No withdrawal is allowed from the savings until retirement and the attainment of 60 years old or after 35 years in service. A refund is paid to a retired officer upon the attainment of 60 years old or 35 years in service. Ans: The scheme is doing well in this state. The fund was used to finance the following estates: 1. Mandate III Estate, Yidi Road, Ilorin. 2. Royal Valley Phases I & II. Kulende, Ilorin 3. Harmony Estate, Sobi Road, Ilorin 4. Kam-Abioye Estate, Eiyenkorin, Ilorin Processed Estate Development Loan at the verge of disbursement 1. Legacy Estate, Tanke Ilorin 2. Tranquility Estate, Oke-Ose, adjacent UITH, Ilorin. Estate Development Loans still under MOU 1. NMA/ SAFEFORTE NIG LTD for Doctors Mega City 2. SSA/ QH Multi-Concepts Ltd for SSA estate Ans: No. The scheme is to promote the acquisition of houses by the contributors. Ans: The fund is pooled from monthly contributions The monthly repayments from loans also increase the fund Government housing intervention funds also increase the scheme. The scheme is a revolving fund. Ans: No relationship. That programme was a political program that went with the NPN government of the President Shehu Shagari regime. As the scheme was anchored by the Federal Housing Authority (FHA), all questions can be directed to that organization. Ans: The old FMBN which was mobilizing savings from the public, was deconsolidated and Federal Mortgage Finance Ltd (FMFL) took over the savings portfolio. At the moment the FMFL is under liquidation as FGN is divesting from retail mortgage operations. Anybody who has savings with this organization can reach them at their office at Abuja. Ans: Unlike Insurance Companies, we do not operate under risk. We manage a revolving fund and the loans we give are collateralized by the houses upon which we create mortgages. We are interested in social profitability and not commercial profitability. Our activities are therefore subsidized by the Federal Government of Nigeria. Ans: FMBN is the Manager of the fund and we give the fund to Primary Mortgage Banks who operate at the retail level. The act that established the fund recognizes that the retailers would have outlets nationwide to package retail loans and facilitate repayments of the loans granted. This arrangement accordingly ensures check and balances. Ans: On the presentation of letter of administration from a court or a notary person, the full refund is processed and paid to the next -ofkin of the deceased. Ans: The timing depends on the seriousness to provide the documents upon which a mortgage is to be created. The timing depends on the applicant, the PMI and very little on us. This is because all our loan requirements are disclosed even before a decision is taken to take a loan. Ans: We at Federal Mortgage Bank of Nigeria Complex, Adjacent Global Soaps & Industries, Asa-Dam Road, Ilorin. Our website is: www.fmbnigeria.org