Pavel Kochanov Presentation

advertisement

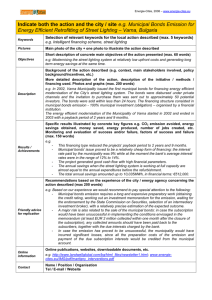

Why Pooled Financing of Municipal Infrastructure? Pavel Kochanov Municipal Finance Specialist Medium and small municipal borrowers face challenges and higher costs when accessing capital markets Developed countries Developing countries • Expensive credit ratings, due diligence, documentation • Relatively small financing needs • Low debt management sophistication • Same as for developed countries plus • Low fiscal autonomy and credit quality • Weak local capital markets • Lack of investment management capacity However, • Strong capital markets • Adequate or strong credit quality of municipalities • Stable subnational framework • Fiscal autonomy • Investment management capacity • Reliance on financing from the higher level government or donors Municipal pooled financing ??? 2 Examples of municipal pooled financing institutions National financing authority for local government – Options assessment / Ernst & Young, 2013 If municipal pooled financing is pursued in developing countries additional challenges should be addressed Challenges Possible solutions Low credit quality Possible Credit Enhancements: - 3rd party and pooled entities guarantee - Escrow account - Debt service fund - Intercept (claim on transfers) Weak local capital markets - Partial funding by IFIs, central government and local development institutions Lack of investment management capacity - Donors’ support is needed for preparation and execution of investment projects Lack of tradition of inter-municipal cooperation - Central government (with support from development agencies) may need to play a core role in establishing municipal pooled financing Inadequate subnational borrowing regulations - IFIs (such as WB) may play a role in advocating and establishing good practice for medium and small municipal borrowers to access capital markets 4 Average weight of criteria factors in a credit rating of local governments 5 Relative Importance of local (including cities) governments varies greatly measured by share of LG expenditures in consolidated general government expenditures Note: Color of a country corresponds to its percentile in the world’s distribution: red – 0-25th, yellow – 25-50th, blue – 50-75th, green – 75100th. - LG expenditures shares vary greatly - from virtually zero percent in a number of countries (Guyana, Mozambique, Haiti, etc.) to 59 percent in Denmark, A large majority of countries (63 percent) have local government expenditure shares less than the sample average of 13 percent, and only 11 percent of the countries have LG expenditures shares higher than 30 percent. Source: Maksym Ivanyna and Anwar Shah (2012). How Close Is Your Government to Its People? Worldwide Indicators on Localization and Decentralization. Policy Research Working Paper 6138, WB 6