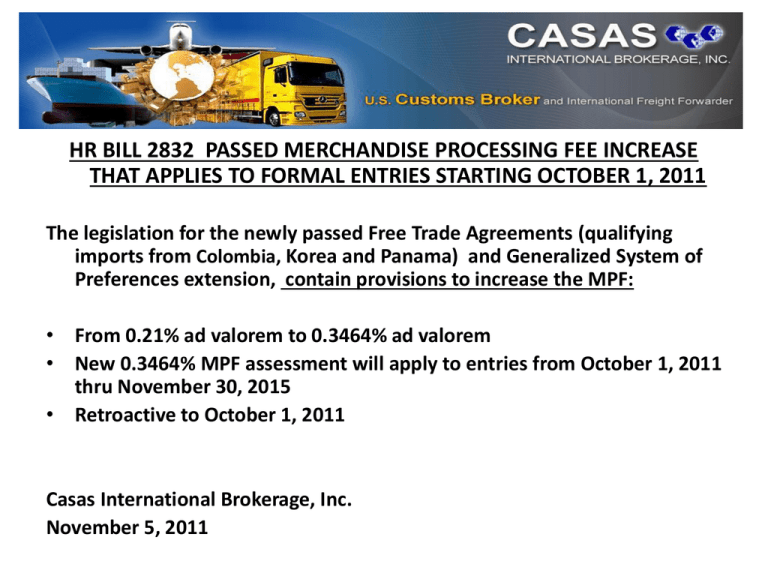

HR BILL 2832 PASSED MERCHANDISE PROCESSING FEE

advertisement

HR BILL 2832 PASSED MERCHANDISE PROCESSING FEE INCREASE THAT APPLIES TO FORMAL ENTRIES STARTING OCTOBER 1, 2011 The legislation for the newly passed Free Trade Agreements (qualifying imports from Colombia, Korea and Panama) and Generalized System of Preferences extension, contain provisions to increase the MPF: • From 0.21% ad valorem to 0.3464% ad valorem • New 0.3464% MPF assessment will apply to entries from October 1, 2011 thru November 30, 2015 • Retroactive to October 1, 2011 Casas International Brokerage, Inc. November 5, 2011 • EXISTING MPF EXEMPTIONS WERE NOT CHANGED. FOR EXAMPLE: NAFTA QUALIFIED GOODS ARE EXEMPT FROM MERCHANDISE PROCESSING FEES. • Importers with goods entering under an UNCONDITIONALLY DUTY FREE CLASSIFICATION from a NAFTA Country, Mexico or Canada, should evaluate the opportunity cost of qualifying their goods for NAFTA to save the Merchandise Processing Fees. •The maximum/cap on formal entry will remain the same at $485. •The 0.3464% mpf for importers means that previously the cap was reached when the entry was worth $230,952.00, now it will be reached for entries of $140,011.00 and higher. This is a significant cost increases to many importers, particularly companies shipping lower value articles. •Importers should make sure to account for the increased MPF for their formal entries on or after October 1, 2011 CBP WILL BE READY TO ACCEPT THE NEW MPF RATE OF 0.003464 ON SATURDAY, NOVEMBER 5, 2011 AT APPROXIMATELY 7:30 AM. What is the process for importers to pay the increased MPF retroactive back to October 1, 2011? • U.S. Customs and Border Protection (CBP) will generate bills for the period between October 1 and November 5, 2011 in order to collect the difference between the old and new rates for that time period. Any difference less than $20 will be disregarded. For questions: please contact Casas International Brokerage Department: • Myrna Aguilar at (619) 710-4628 • Sylvia Casas at (619) 710-4619 • Hector Casas at (760) 427-0441 Or email us at • s.casas@casasinternational.com • m.aguilar@casasinternational.com • h.casas@casasinternational.com PROPOSED MODIFICATIONS TO THE HARMONIZED TARIFF SCHEDULE OF THE UNITED STATES EFFECTIVE JANUARY 1, 2012 •Every 5 years, World Customs Organization undertakes revision and update to Harmonized Tariff Schedule •Last revision was in 2007 •Upcoming 2012 revisions focus primarily, but not exclusively, on environmental and social issues •In United States, US International Trade Commission charged with updating HTSUS •World Customs Organization (WCO) maintains the official HS at the international level through its HSC or Harmonized System Committee (HSC) • Changes are primarily in agriculture chapters 1-27 • Non-agricultural changes include new subheadings for specific chemicals controlled under the Rotterdam Convention and ozone-depleting-chemicals (ODC) controlled under the Montreal Protocol • Other amendments result from changing trade patterns • More than 40 subheadings deleted due to low use • New subheadings to specifically identify other products and new technology Specific Changes 220 sets of amendments divided as follows: • 98 relate to the agricultural sector • 27 to the chemical sector • 9 to the paper sector • 14 to the textile sector • 5 to the base metal sector • 30 to the machinery sector • 37 to the remaining sectors of the HS Specific Changes (cont’d) 204 amendments in • 53 different HS chapters • 95 different subheadings removed • 421 subheadings added • 34 subheadings changed • 39 legal notes • 108 different headings Examples of Changes Diapers, tampons, sanitary napkins and similar items • Current classification is in headings 3926, 4818, 5601, 6111, 6114, 6209, 6211 or 6307 (based on the essential character) 2012 change: classify in the new heading 9619 Examples of Changes (cont’d) Current subheading 8528.73 covers black & white TVs • 2012 version of 8528.73 will cover monochrome TVs Examples of Changes (cont’d) Changes in technology • Current battery heading 8507 doesn’t have lithium ion and refers to nickel –iron storage batteries in 8507.40 and “other” in 8507.80 2012 version: • 8507.50 - Nickel-metal hydride • 8507.60 - Lithium-ion Resources See WCO and ITC websites for specific changes WCO: • http://www.wcoomd.org/files/1.%20Public%20fil es/PDFandDocuments/HarmonizedSystem/HS%2 0Overview/NG0163B1.pdf • http://www.wcoomd.org/files/1.%20Public%20fil es/PDFandDocuments/HarmonizedSystem/tools_ instruments/HS_Correlation_Tables_Introduction .pdf Resources (cont’d) ITC • http://www.usitc.gov/tariff_affairs/modificati ons_hts.htm • http://www.usitc.gov/tariff_affairs/hts_docu ments/1205-7FinalReport.pdf • See Exhibits C and D for correlation tables 2012 Explanatory Notes Available at www.wcoomd.org . • Other Countries Canada • http://www.cbsa-asfc.gc.ca/trade-commerce/tariff-tarif/menueng.html Mexico EU Australia • http://www.customs.gov.au/tariff/hs2012.asp 2012 HTSUS and Correlation Tables • 2012 HTSUS • 10-digit Correlation Tables • Grace period • Certificates of Origin • Training QUESTIONS: Customs Rulings • I have binding rulings for products whose tariff item has changed. Do I need to file new ruling requests? Tariff Shift Rules • How will the 2012 HS amendments affect FTA tariff shift rules covering my products? Questions (continued) Certificates of Origin •Our practice is to update blanket certificates of origin at the end of each year for the coming year. If we update our blanket certificates by the end of 2011, will we be required to conduct another update in January 2012? CASAS customer exclusive webinar training: Participate in this special CASAS EXCLUSIVE event! • Mark your calendar and join us on December 14, 2011 (Wednesday) from 10:00-11:30 am PT. For questions: please contact Casas International Brokerage Department: • Myrna Aguilar at (619) 710-4628 • Sylvia Casas at (619) 710-4619 • Hector Casas at (760) 427-0441 Or email us at • s.casas@casasinternational.com • m.aguilar@casasinternational.com • h.casas@casasinternational.com