Chapter 1 & 2

advertisement

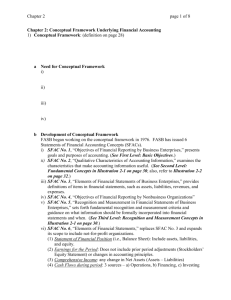

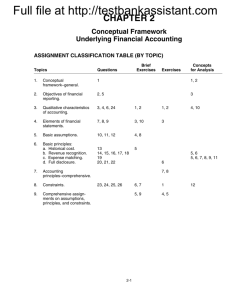

Chapters 1 & 2 Financial Accounting and Accounting Standards and Conceptual Framework for Financial Reporting ACCT-3030 1 1. Basic Definitions What is accounting? ◦ the identification, measurement, and communication of financial information ◦ about economic entities ◦ to interested parties What are objectives of financial reporting? ◦ To provide relevant and reliable information: useful for investor & creditor decisions that helps predict cash flows about economic resources, claims to resources, and changes in resources and claims ACCT-3030 2 1. Basic Definitions Who provides accounting information? Who uses accounting information? Should there be a primary user group identified? Financial statements v. financial reporting What are capital markets? ◦ Does accounting information help them? Financial accounting v. managerial accounting ACCT-3030 3 2. Financial Reporting What are the basic financial statements? What parties are involved in the financial reporting process? What level of knowledge is expected from users? What is the time orientation of financial statements? What are the limitations of accounting? ACCT-3030 4 3. Accounting Standards What are GAAP? Who sets accounting standards? Who should set accounting standards? Are there political considerations in accounting standard setting? Do accounting standards have economic consequences? Principles-based v. rules-based standards Is accounting governed by rules? ACCT-3030 5 4. History of Accounting Standard Setting CAP 1939-1959 ARBs Bulletins (51) APB 1959-1973 APBs Opinions (31) FASB 1973-now SFASs Standards (168) Accounting standards updates Role of the SEC Enforcement of standards EITF Conceptual framework Hierarchy Codification IASB ACCT-3030 6 The Conceptual Framework The Conceptual Framework is like a constitution—a coherent system of interrelated objectives and fundamentals that lead to consistent accounting standards. Why is a conceptual framework needed? ACCT-3030 7 The Conceptual Framework The FASB has issued seven Statements of Financial Accounting Concepts SFAC No.1 - Objectives of Financial Reporting (superseded by SFAC No. 8) SFAC No.2 - Qualitative Characteristics of Accounting Information. (superseded by SFAC No. 8) SFAC No.3 - Elements of Financial Statements. (superseded by SFAC No. 6) SFAC No.5 - Recognition and Measurement in Financial Statements. SFAC No.6 - Elements of Financial Statements (replaces SFAC No. 3). SFAC No.7 - Using Cash Flow Information and Present Value in Accounting Measurements. SFAC No.8 - The Objective of General Purpose Financial Reporting and Qualitative Characteristics of Useful Financial Information (replaces SFAC No. 1 and No. 2) ACCT-3030 8 The Conceptual Framework FASB and IASB Joint Conceptual Framework Project Eight Phases: A. Objective and Qualitative Characteristics B. Elements and Recognition C. Measurement D. Reporting Entity E. Presentation and Disclosure F. Framework for a GAAP Hierarchy G. Applicability to the Not-For-Profit Sector H. Remaining Issues ACCT-3030 9 The Conceptual Framework Objective To provide financial information that is useful to capital providers. Fundamental and Enhancing Qualitative Characteristics Constraints Elements Recognition and Measurement Concepts Financial Statements ACCT-3030 10 Illustration 2-7 Conceptual Framework for Financial Reporting LO 4 ACCT-3030 12 Practical Boundaries (Constraints) to Achieving Desired Qualitative Characteristics Cost Effectiveness Industry Practice Elements of Financial Statements ACCT-3030 14 Elements of Financial Statements ACCT-3030 15 Recognition and Measurement Concepts ACCT-3030 16 •The Asset/Liability Approach Measure assets and liabilities that exist at a balance sheet date. Recognize revenues, expenses, gains, and losses needed to account for the changes in assets and liabilities from the previous balance sheet date. The focus on assets and liabilities has lead to increased interest on fair value measurement •The Revenue/Expense Approach ACCT-3030 17 The Move Toward Fair Value Fair value is the price that would be received to sell assets or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Income Approaches Market Approaches Cost Approaches ACCT-3030 18 Fair Value Hierarchy SFAS No. 159 gives companies the option to report some or all of their financial assets and liabilities at fair value. ACCT-3030 19