Chapter 8

advertisement

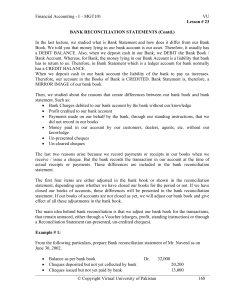

CHAPTER 7 INTERNAL CONTROL AND CASH Chapter 7 Quiz (Unit 3 Quiz#1) will occur on Thursday, Nov 13 USE OF A BANK The use of a bank minimizes the amount of cash that must be kept on hand and contributes significantly to good internal control over cash. A company can safeguard its cash by using a bank as a depository and clearing house for cheques received and cheques written. Bank Statement Each month the bank will provide you with a bank statement which shows all the activity in the client’s bank account. Bank statement has debit column and credit column. Debit column amounts are reduction of the bank account such as “cheque payment” activity. Credit column amounts are increase of the bank account such as “deposit” activity. BANK STATEMENTS A bank statement shows: 1. cheques paid and other debits charged against the account 2. deposits and other credits made to the account 3. account balance after each day’s transactions ACCOUNT STATEMENT W. A. LEE COMPANY 500 QUEEN STREET Statement Date/Credit Line Closing Date FREDERICTON, NB, E3B 5C2 April 30, 2003 457923 ACCOUNT NUMBER Balance Deposits and Credits Last Statement No. Total Amount 13,256.90 20 34,805.10 Balance Cheques and Debits Total Amount This Statement 32,154.55 15,907.45 26 DEPOSITS AND CHEQUES AND DEBITS CREDITS DAILY BALANCE Date No. Amount Date Amount Date Amount 4-2 435 644.95 4-5 436 3,260.00 4-4 437 1,185.79 4-3 438 776.65 4-8 439 1,781.70 4-7 440 1,487.90 4-8 441 2,420.00 4-11 442 1,585.60 4-12 443 1,226.00 ================= 4-29 NSF 425.60 4-29 459 1,080.30 4-30 DM 30.00 4-30 461 620.15 4-2 4,276.85 4-3 2,137.50 4-5 1,350.47 4-7 982.46 4-8 1,320.28 4-9 CM 1,036.00 4-11 2,720.00 4-12 757.41 4-13 1,218.56 ============== 4-27 1,545.57 4-29 2,929.45 4-30 2,128.60 Symbols: 4-2 16,888.80 4-3 18,249.65 4-4 17,063.86 4-5 15,154.33 4-7 14,648.89 4-8 11,767.47 4-9 12,802.47 4-11 13,936.87 4-12 13,468.28 ============= 4-27 13,005.45 4-29 14,429.00 4-30 15,907.45 CM Credit Memo EC Error Correction NSF Not Sufficient Funds DM Debit Memo INT Interest Earned SC Service Charge Reconcile Your Account Promptly Bank Reconciliation Accountant must perform bank reconciliation every month. Bank reconciliation is a worksheet, which explains any differences between the bank statement records and the accounting records. RECONCILING THE BANK ACCOUNT Bank Reconciliation is necessary because the balance per bank and balance per books are seldom in agreement due to time lags and errors. Basically you compare the bank statement with accounting record and make notes about why there is any discrepancy. A bank reconciliation should be prepared by an employee who has no other responsibilities pertaining to cash. (segregation of duty) Things that show in accounting records but they have not been recorded in bank statement… Deposits in transit (must be added to BS balance) Deposits which were deposited too late to the bank. For example, if an employee made the deposit at 7pm on March 30, then this deposit would not show up in March bank statement. (which covers from March 1 to March 30) Outstanding cheques (must be subtracted from BS balance) Accountant wrote a check and recorded the journal entry in accounting record on March 28, but the supplier’s employee did not deposit this check to the bank yet. This check will not show in the March bank statement. (It will show up in April bank statement) Things that show in bank statement but they do not show in accounting records… Service Charges: The monthly fees that banks charge to customers for using their bank. (should be subtracted from Accounting number) Charges for depositing NSF cheques: A check was issued by this company, but the company’s bank account did not contain enough money to pay out the check amount then it is called NSF check. Then bank would charge $35. (should be subtracted from Accounting number) Things that show in bank statement but they do not show in accounting records… Misc. Bank Charges and Credits: Banks charge the customer when they print more checks for customer or issue money order (or certified check) for their customer. (should be subtracted from Accounting number ) Credits for Interest Earned: The interest the business earned on the bank account in the month. (should be added to Accounting number) Steps in Preparing a Bank Reconciliation 1. 2. 3. Compare the desposits listed on the bank statement with the deposits shown in the company’s accounting records. Any desposits not yet recorded by the bank are deposits in transit and should be added to the bank ST balance. Compare the paid checks (indicated in bank statement) received with any outstanding checks in the accounting records. Any outstanding check amounts should be deducted from the bank ST balance. Add to the accounting records any collections made by the bank. (such as interest income) They will issue a credit memorandum stating the circumstances. Steps in Preparing a Bank Reconciliation 4. Deduct from the accounting records any debit memoranda issued by the bank such as bank service fee, NSF check charges etc…. 5. Make appropriate additions or deductions to correct any errors in the balance per the bank statement or the balance per the depositor’s records. 6. Make sure that the adjusted balance of the bank statement is equal to the adjusted balance in the accounting records. 7. Prepare journal entries to record any items in the reconciliation listed as adjustment. Terms Debit memoranda Credit memoranda Charges against depositor’s account (e.g. service charges, Returned Check/NSF (insufficient funds) cheques) Amounts that increase depositor’s account (e.g., interest earned and daily deposits of cash and check from branch) Adjusted balance Reconciled or correct bank account balance Bank Reconciliation Procedures Balance Per Bank Statement -outstanding cheques +deposits in transit +/- bank errors = correct cash amount Balance Per Books -NSF cheques -cheque printing or other service charges +notes collected by bank +/- book errors = correct cash amount Illustration 8-11 Summary Bank Statement Balance You add or subtract items which must appear in the Bank Statement, but they did not appear on Bank Statement of this month. If the item increased Book Balance, then you add this item to BSB. Book Balance You add or subtract items which must appear in the Bank Ledger Account, but they did not appear on BLA. If the item decreased BSB, then you subtract this item from Book Balance. Reconciling Journal Entries Accounting Books Each reconciling item in determining the adjusted balance per books MUST be journalized and posted Bank Statement Do NOT journalize any entries on bank side (because they are already mentioned in accounting records) Classwork / Homework Homework: P377 BE 7-8, BE7-9, BE7-10, BE7-11, BE7-12 P380 E7-7, E7-8

![[Sample] First Nation Cash Management and Banking Policy](http://s3.studylib.net/store/data/008537083_1-2984909933b7210a238ea8f483ded321-300x300.png)