Document

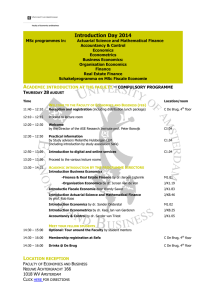

advertisement

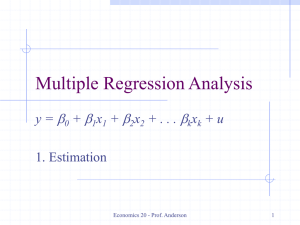

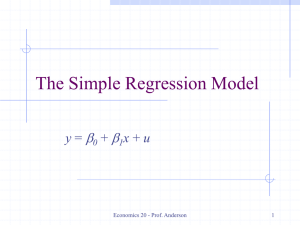

Welcome to Economics 20 What is Econometrics? Economics 20 - Prof. Anderson 1 Why study Econometrics? Rare in economics (and many other areas without labs!) to have experimental data Need to use nonexperimental, or observational, data to make inferences Important to be able to apply economic theory to real world data Economics 20 - Prof. Anderson 2 Why study Econometrics? An empirical analysis uses data to test a theory or to estimate a relationship A formal economic model can be tested Theory may be ambiguous as to the effect of some policy change – can use econometrics to evaluate the program Economics 20 - Prof. Anderson 3 Types of Data – Cross Sectional Cross-sectional data is a random sample Each observation is a new individual, firm, etc. with information at a point in time If the data is not a random sample, we have a sample-selection problem Economics 20 - Prof. Anderson 4 Types of Data – Panel Can pool random cross sections and treat similar to a normal cross section. Will just need to account for time differences. Can follow the same random individual observations over time – known as panel data or longitudinal data Economics 20 - Prof. Anderson 5 Types of Data – Time Series Time series data has a separate observation for each time period – e.g. stock prices Since not a random sample, different problems to consider Trends and seasonality will be important Economics 20 - Prof. Anderson 6 The Question of Causality Simply establishing a relationship between variables is rarely sufficient Want to the effect to be considered causal If we’ve truly controlled for enough other variables, then the estimated ceteris paribus effect can often be considered to be causal Can be difficult to establish causality Economics 20 - Prof. Anderson 7 Example: Returns to Education A model of human capital investment implies getting more education should lead to higher earnings In the simplest case, this implies an equation like Earnings 0 1education u Economics 20 - Prof. Anderson 8 Example: (continued) The estimate of 1, is the return to education, but can it be considered causal? While the error term, u, includes other factors affecting earnings, want to control for as much as possible Some things are still unobserved, which can be problematic Economics 20 - Prof. Anderson 9