Chapter 8

Purchasing/

Human Resources/

Payment Process:

Recording and

Evaluating

Expenditure

Process Activities

McGraw-Hill/Irwin

Copyright © 2009 by The McGraw-Hill Companies, Inc. All rights reserved.

What is the Difference between Merchandising

and Manufacturing Inventories?

• Merchandising

Inventory purchased to be resold

Merchandise Inventory account

• Manufacturing

Inventory purchased to be used to make

products

Raw Materials Inventory account

8-2

What is the Difference between Periodic

and Perpetual Inventory Systems?

• Periodic

Determine ending inventory and cost of goods

sold at the end of the period

• Perpetual

Determine cost of goods sold and ending

inventory on a continuous basis

8-3

How are Inventory Activities Recorded in

a Periodic System?

• Purchase

Debit Purchases

Credit Accounts Payable

• Return or allowance

Debit Accounts Payable

Credit Purchase Returns and Allowances

• Freight or insurance on purchases

Debit Freight-in (Insurance-in)

Credit Accounts Payable (Cash)

8-4

How are Inventory Activities Recorded in

a Perpetual System?

• Purchase

Debit Inventory

Credit Accounts Payable

• Return or allowance

Debit Accounts Payable

Credit Inventory

• Freight or insurance on purchases

Debit Inventory

Credit Accounts Payable (Cash)

8-5

What is the Difference between the Net

Price and Gross Price Methods?

• Net price

Purchases and purchase returns/allowances

are recorded net of the available discount

Discounts lost are recorded separately

• Gross price

Purchases and purchase returns/allowances

are recorded at the gross price

Discounts taken are recorded separately

8-6

Example

• A company purchases $1,000 (gross) of

inventory (terms: 2/10, n/30), subsequently

returns $200 (gross) of the inventory, and

pays for the inventory within the discount

period.

8-7

Net Price Method/Perpetual

• Purchase

Increase (debit) inventory by $980 ($1,000 * 0.98)

Increase (credit) accounts payable by $980

• Return

Decrease (debit) accounts payable by $196 ($200 *

0.98)

Decrease (credit) inventory by $196

• Payment within discount period

Decrease (debit) accounts payable by $784 ($980 - $196)

Decrease (credit) cash by $784

8-8

Gross Price/Perpetual

• Purchase

Increase (debit) inventory by $1,000

Increase (credit) accounts payable by $1,000

• Return

Decrease (debit) accounts payable by $200

Decrease (credit) inventory by $200

• Payment within discount period

Decrease (debit) accounts payable by $800 ($1,000 - $200)

Decrease (credit) cash by $784 ($800 * 0.98)

Recognize discount taken (credit inventory) for $16

8-9

What is the Balance in Inventory

under Each Pricing Method?

• Net price

Inventory = $980 - $196 = $784

• Gross price

Inventory = $1,000 - $200 - $16 = $784

8-10

What if the Payment is Made After the

Discount Period has Expired?

• Net price

Decrease (debit) accounts payable by $784 ($980 - $196)

Recognize discount lost (debit Discounts Lost) for $16

Decrease (credit) cash by $800 ($784/0.98)

• Gross price

Decrease (debit) accounts payable by $800 ($1,000 - $200)

Decrease (credit) cash by $800

8-11

Now What is the Balance of Inventory

under Each Pricing Method?

• Net price

Inventory = $980 - $196 = $784

• Gross price

Inventory = $1,000 - $200 = $800

• Does this mean that the inventory under the gross

price method is worth more?

No, it simply reflects management’s beliefs concerning

discounts.

• Gross = cost reduction when taken

• Net = financing cost when lost

8-12

What is the Basic Flow of Information in

the Payroll Process?

• Employees record time worked on time cards and

factory records time worked on time tickets

• Timekeeping compares time cards and time

tickets

• Payroll records time worked, deductions, etc.

• Accounts payable approves payroll and notifies

cashier

• Cashier pays employees

8-13

What is the Difference between Gross Pay and Net

Pay from the Employer’s Point of View?

• Gross pay—salary and wage expense

(amount incurred in an attempt to generate

revenue)

• Net pay—cash outflow to employees

• Withholdings—liabilities to pay the entity to

which the funds belong

8-14

What is the Difference between Salary/Wage

Expense and Payroll Tax Expense?

• Salary/wage expense—expense incurred

from using employees in an attempt to

generate revenue

• Payroll tax expense—expense incurred due

to having employees (matching FICA and

unemployment taxes)

8-15

When are Expenses Recognized?

• When incurred, regardless of when cash is paid.

Assume December 31 year for examples that

follow.

Example #1—receive a utility bill in December, pay the

bill in January, expense is recognized in December

Example #2—pay insurance for 6 months in November,

recognize 2 months of insurance expense in December

Example #3—pay the local newspaper in December for

an ad to be run in December, recognize expense in

December

8-16

Inventory Example

• Inventory is an asset when purchased

• When inventory is sold, we recognize the

expense, called Cost of Goods Sold

8-17

How are Expenditure Process Activities

Communicated to Users?

• Income statement

Discounts lost, Loss on Inventory, other

expenses

Cost of goods sold

• Balance sheet

Ending balance of inventory, other assets, and

liabilities

• Statement of cash flows

8-18

Cash paid for inventory and other expenditure

process items

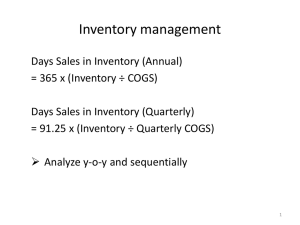

How can we Estimate the Cash Paid for

Inventory?

• Beginning inventory (balance sheet)

• + Net purchases (calculated)

• = Maximum inventory available

• Cost of goods sold (income statement)

• = Ending inventory (balance sheet)

• Then,

8-19

Estimating Cash Paid for Inventory,

Continued

• Beginning accounts payable (balance sheet)

• + Net purchases (from inventory account)

• = Maximum amount owed to suppliers

• Cash paid for inventory (calculated)

• = Ending accounts payable (balance sheet)

8-20